The universe of sin stocks is expansive, so it's understandable if investors overlook a few names here and there. That's likely what's happening with Codere Online Luxembourg (CDRO +1.14%).

Haven't heard of this $353 million sports betting stock? You're not alone, and the anonymity in which this gaming equity toils isn't so much about its market capitalization. Instead, it's likely the result of this company not booking bets in North America.

No U.S. exposure, no problem for this betting stock. Image source: Getty Images.

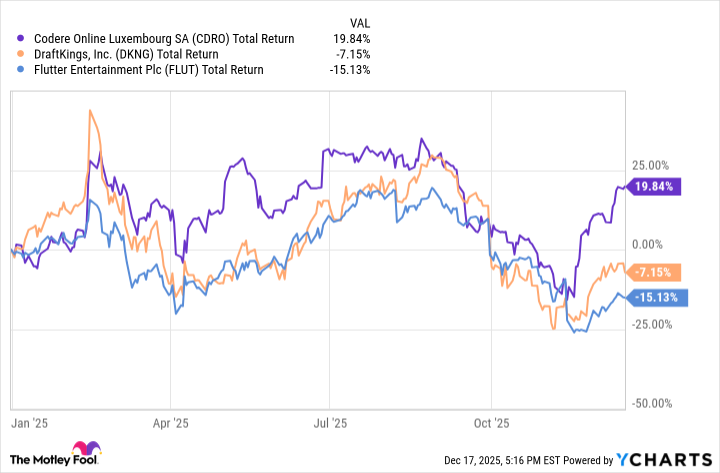

That's actually one of the most interesting facts about Codere Online. It doesn't operate in the fastest-growing sports wagering market in the world , but the shares are up nearly 20% year to date.

Why this sports betting stock can keep soaring

Codere's lack of exposure to the U.S. is proving beneficial at a time when shares of rivals with heavy domestic footprints are sagging. Some of the 2025 weaknesses displayed by stocks such as DraftKings and FanDuel owner Flutter Entertainment are attributable to the emergence of prediction markets as a competitive threat.

CDRO Total Return Level data by YCharts

That's not an issue for Codere, which went public about four years ago, via a reverse merger with a SPAC. Likewise, Codere is avoiding some of the regulatory risk associated with prediction markets in this country, as some states are warning sportsbook operators that their licenses could be at risk if those companies venture into the event contracts space.

NASDAQ: CDRO

Key Data Points

Alright, so Codere Online doesn't do business in the U.S., but where it does offer internet casinos and online sports betting is important, too. It has exposure to Italy, South Africa, and the U.K., but its most lucrative markets are Spanish-speaking nations, including Argentina, Colombia, Mexico, and Spain. Those soccer-rabid countries indicate this stock is arguably a better way to tap into 2026 World Cup betting trends than its U.S.-focused rivals.

For investors demanding more than the one-off catalyst of the World Cup, Codere stock is viewed as inexpensive while providing exposure to the high-growth Latin America internet wagering market. As that growth story gains more appreciation, it's possible that Codere could draw takeover offers from suitors looking to enter the region via acquisition rather than building it from the ground up.