The Metals Company (TMC +2.25%) is a deep-sea mining exploration firm that wants to vacuum polymetallic nodules from the Pacific seafloor and turn them into battery-grade metals.

The company believes that if it can secure permits soon, it could begin commercial production in the fourth quarter of 2027. It also believes it can generate some attractive margins on the nodules in its possession. Indeed, a recent feasibility study pegged its combined project value at about $23.6 billion.

Taken together, those numbers sound impressive, but they also raise the blunt question: Is TMC for real, or is this story more of a mirage than a sure thing?

Let's take a quick look at the facts.

NASDAQ: TMC

Key Data Points

TMC: A moonshot, or a deep-sea mirage?

Let's start with the hard truth.

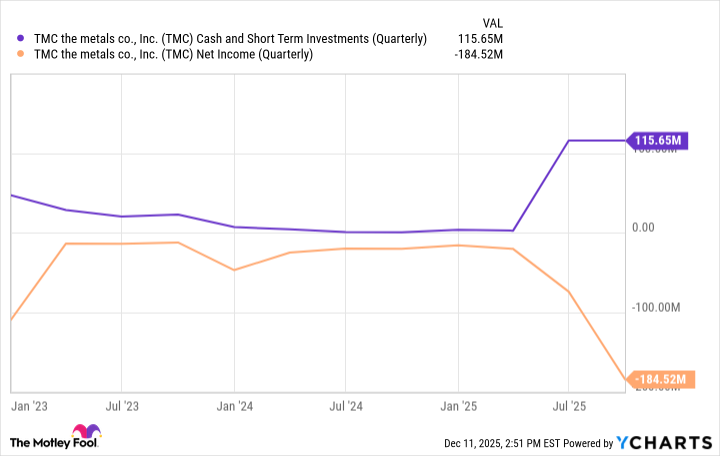

TMC is still pre-revenue, meaning it's not bringing in money, and it's burning significant cash. It reported roughly $165 million in total liquidity for the third quarter and a net loss of about $185 million.

TMC Cash and Short Term Investments (Quarterly) data by YCharts

On top of that, no company has ever operated a commercial deep-sea project before, and regulators are still arguing over the rules. Meanwhile, scientists and oceanographers are worried that deep-sea mining could cause irreversible damage to ocean life.

True, TMC has demonstrated in tests that its nodule collector can bring nodules up from the seafloor. But scaling that into a commercially viable operation is a much harder leap.

Image source: The Metals Company.

Other factors could derail TMC's long-term potential, too, such as a change in battery technology or a slide in nickel and cobalt prices.

None of this means TMC won't last as a business, only that it isn't a straight shot to riches. If the stock does set you up for life, the ride will likely be long and bumpy, especially in these early pre-revenue days.

For most investors, that makes TMC a tiny position at most, sized as money you can afford to lose. More conservative investors will likely want to look elsewhere for their next investment.