Although the stock of Meta Platforms (META 0.58%) is up around 11% for the year, it's still down around 20% from its all-time high. In normal years, that 11% return would be enough to just barely edge out the average long-term return of the broader market, as measured by the S&P 500. However, the S&P 500 has also had a strong year, rising 17% so far.

With Meta underperforming the market, many investors are wondering if it could be due for a comeback in 2026. The company's latest quarterly results were incredible, and I think it is in great shape for 2026 and could stage a comeback next year.

Image source: Getty Images.

Meta's Q3 wasn't as bad as the market made it seem

Meta is the parent company of many social media sites, including Facebook, Instagram, and Threads, among a few others. These platforms are free to use, and the company profits from the ads they show, which is a lucrative business.

In the third quarter (ended Sept. 30), revenue rose 26% year over year to $51.2 billion. That exceeded the high end of management's guidance, which was $50.5 billion.

It's difficult for a company this size to grow as fast as it has, but part of the reason for its rise is its various uses of artificial intelligence (AI). CEO Mark Zuckerberg said that its AI-powered recommendations delivered more-relevant content, leading users to spend about 5% more time on Facebook and 10% more on Threads in the third quarter.

NASDAQ: META

Key Data Points

More time on the platform means more ads served to the viewer, thus increasing revenue. The biggest benefactor by far is Instagram -- time spent there is up more than 30% since last year. This also shows that the company's apps are holding their own against TikTok, which was supposed to end its dominance. Clearly, that's not the case.

But the company's growth in the third quarter isn't what the market was concerned with anyway. The biggest issue investors had was its spending plans. Management said that 2026 will have a "dollar growth that's notably larger in 2026 than in 2025." For 2025, it expects $66 billion to $72 billion in capital expenditures (capex). In 2024, the company spent $39.2 billion.

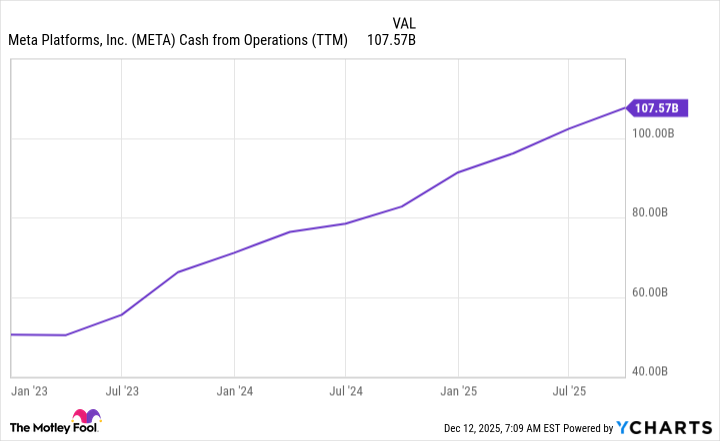

That means Meta could be headed for more than $100 billion in capex in 2026, which will stress its finances. Cash from operations measures how much money it generates every 12 months that could be spent on capex.

META Cash from Operations (TTM), data by YCharts; TTM = trailing 12 months.

Its capex projections are nearly the same as cash from operations, meaning that the company will devote nearly all of its available resources to building out data centers to power its AI aspirations. The market is understandably concerned about this, but I think it's something that nearly every AI hyperscaler will deal with before too long.

A key supplier forecasts what to expect

A significant amount of computing hardware in the AI realm comes from Nvidia, so it has its finger on the pulse of the appetite for AI computing hardware. The chipmaker expects significant growth over the next few years, with global data center capex reaching $3 trillion to $4 trillion annually by 2030. That's up from $600 billion in 2025.

Reaching that level will require nearly every AI hyperscaler to devote all its operating cash flow to building data centers, and Meta happens to be the first one to reach this threshold, so it's being punished for it. I think that's a silly move, because in the next year, all of the other companies should be in the same boat.

I think this makes Meta's stock a great value, since it trades for a mere 21.5 times 2026 earnings.

META PE Ratio (Forward 1 year), data by YCharts; PE = price to earnings.

Meta Platforms is primed for a comeback in 2026 if it continues posting strong growth, as it has recently. Eventually, the market should come around to its spending plans, because nearly every other tech giant will be doing the same before too long.