When it comes to famous investment personalities, names such as Warren Buffett or Jamie Dimon usually get mentioned first. In the world of hedge funds, though, Ken Griffin is the cream of the crop.

Griffin founded Citadel in 1990, shortly after graduating from Harvard. Since its inception, that hedge fund has generated compound annualized returns of nearly 20% -- roughly double the performance of the S&P 500. Even more important, as those greater returns compound over time, they add up to results that far exceed the market. Considering the magnitude of Citadel's outperformance, it would be fair to say that Griffin and his team are expert stock pickers.

According to its latest 13F filing, in the third quarter, Citadel purchased 169,057 shares of D-Wave Quantum (QBTS 1.18%), increasing its stake in the quantum computing pure play by 201%.

Among Wall Street analysts covering the stock, the average 12-month price target is $38, which implies 59% upside from its current level. Nathaniel Bolton of Needham is even more bullish, projecting up to 101% upside, with a price target of $48.

With all that in mind, is now a good time to follow Griffin's lead into D-Wave Quantum?

NYSE: QBTS

Key Data Points

What does D-Wave Quantum do?

The company is developing quantum computers that use a technique called quantum annealing. Unlike the gate-based approaches employed by most other quantum computer developers, D-Wave's machines target narrower classes of optimization and probabilistic sampling problems, finding solutions that will be among the most optimal for them.

That narrower range of use cases, however, does include a host of complex problems faced by companies in the logistics, manufacturing, supply chains, and telecom industries, as well as in city planning.

Image source: Getty Images.

D-Wave insiders are selling like there's no tomorrow

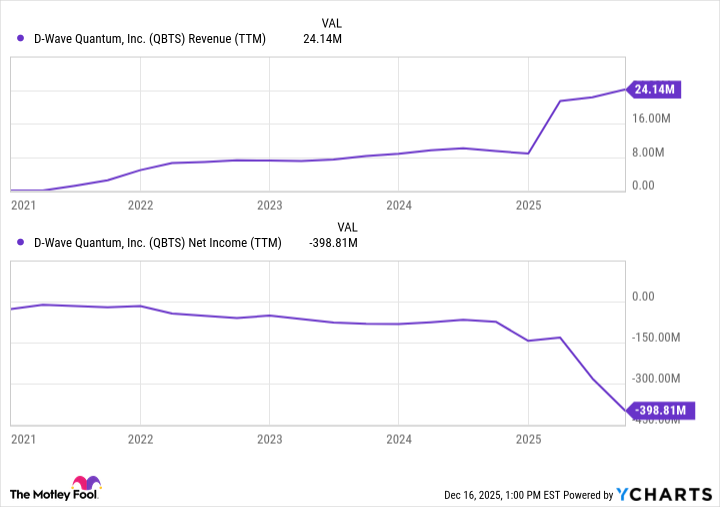

On the surface, it would appear that D-Wave has identified some practical use cases for its quantum technology -- and they are tasks that even a classical supercomputer would struggle with. However, while the company's revenue growth trajectory is impressive, it's piling up losses.

QBTS Revenue (TTM) data by YCharts.

My interpretation of the financial profile shown in the charts above is that D-Wave's traction remains limited. In other words, the company's technology hasn't yet found broad commercial adoption -- hence, sales are negligible. At the same time, investing in research and development (R&D) to build these quantum systems requires heavy ongoing outlays.

With large-scale enterprise adoption of its systems still years away under the best-case scenario, D-Wave's unit economics don't look too compelling. Perhaps this is a driving factor behind insiders -- including the CEO, CFO, and several board members -- selling shares this year.

Is now a good time to buy D-Wave Quantum stock?

In addition to holding D-Wave stock, Citadel also owns a combination of call and put options in the quantum computing business.

While it's impossible to know exactly which option chains Citadel owns and at what strike prices, my hunch is that it's hedged to make money whether D-Wave stock rises or falls. Building positions in your portfolio with both options and outright shares is a fairly complex approach that is not suitable for the average investor.

Moreover, it's not the best idea to buy any stock simply because Citadel has a position or Wall Street analysts are predicting further upside. Instead, smart investors should focus more on classic valuation assessments.

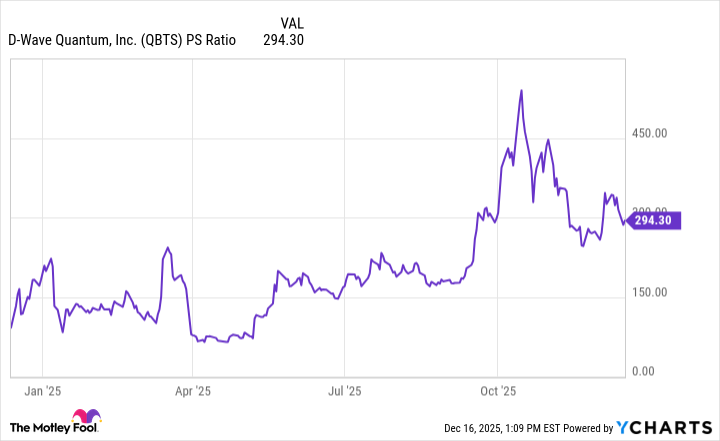

QBTS PS Ratio data by YCharts.

As of Dec. 16, D-Wave boasted a price-to-sales ratio (P/S) of 294. While the shares could be headed higher in the near term, history shows that valuation multiples of this magnitude aren't sustainable.

After the dot-com bubble burst in early 2000, even the highest-flying darlings of the early internet era saw their valuations plummet by nearly 80%. In the long run, I think a similar outcome is far more likely for D-Wave than a further climb.

Only day traders and those willing to accept outsized volatility and risk should consider buying D-Wave stock. For most retail investors, there are more prudent opportunities in the quantum computing realm that don't require complicated trade structures akin to Griffin's position.