About halfway through every quarter, any institutional investment fund that manages more than $100 million is required to file a Form 13F with the Securities and Exchange Commission (SEC), documenting all the stocks that it bought and sold during the prior quarter.

One such firm that I monitor closely is Coatue Management, founded by Philippe Laffont. During the third quarter, Coatue reduced its position in Nvidia (NVDA 2.89%) by 14% -- selling 1.6 million shares. At the same time, Laffont increased the fund's stake in Alphabet (GOOGL +1.72%) (GOOG +1.88%) by 259% -- acquiring 5.2 million shares.

Let's explore what may have motivated these moves and assess if now would be a good time to follow Laffont's lead.

Image source: Getty Images.

Is selling Nvidia stock right now a good idea?

When OpenAI released ChatGPT to the general public in November 2022, Nvidia's market capitalization was roughly $345 billion. Today, the company is worth $4.3 trillion -- making the chip designer the world's most valuable company.

According to Coatue's filings, the firm has held some exposure to Nvidia stock since 2016. Given Nvidia's meteoric rise over the last few years, taking some gains from a winning long-term position off the table seems reasonable.

NASDAQ: NVDA

Key Data Points

More importantly, Nvidia remains the eighth-largest position in Laffont's portfolio -- alongside other AI leaders such as Meta Platforms, Microsoft, Taiwan Semiconductor Manufacturing, Amazon, and Broadcom.

In my view, Laffont is employing prudent financial judgment by modestly reducing Coatue's allocation to Nvidia and rotating some capital into other growth opportunities.

Image source: Nvidia.

Why might Laffont like Alphabet stock?

Alphabet's trajectory throughout the AI revolution has been almost the opposite of Nvidia's. Following the release of ChatGPT, many on Wall Street started sounding the alarm that the rise of large language models (LLMs) and chatbots could spell the end of traditional internet search engines.

The bear thesis was real: Chatbots were expected to eat Google's lunch, and Alphabet was facing an existential crisis. It seems like the only people who didn't buy into this doomsday scenario were the executives in charge at Alphabet.

Over the last three years, the company has quietly made significant progress across a number of different areas within the AI realm:

- Alphabet released its own LLM, called Gemini, which is now a fixture on the Google search homepage.

- Beyond its core advertising business, Alphabet has done a stellar job growing its cloud infrastructure business -- Google Cloud Platform (GCP). GCP has inked a number of high-profile deals with major players including OpenAI and Meta, proving it can compete with Amazon Web Services and Microsoft Azure, which have larger shares of the cloud market.

- Alphabet is also a strategic investor in OpenAI's top rival, Anthropic. As part of their relationship, Anthropic is using Google Cloud to meet some of its computing power needs. Their deal includes access to Alphabet's custom Tensor Processing Units (TPUs).

- Lastly, Alphabet is one of the leaders in the autonomous driving space; its Waymo self-driving taxi service is operating in several U.S. cities.

NASDAQ: GOOG

Key Data Points

I think the biggest selling point for Alphabet is its vertically integrated business model. The company's various assets in search (Google), streaming video (YouTube), consumer electronics (Android), cloud computing (GCP), autonomous vehicles (Waymo), and now custom hardware (TPUs) all share a common thread: artificial intelligence.

Laffont may be hedging his portfolio away from pure-play semiconductor and data center businesses while seeking exposure to broader pockets of the ongoing AI infrastructure movement.

Is Alphabet stock a good buy right now?

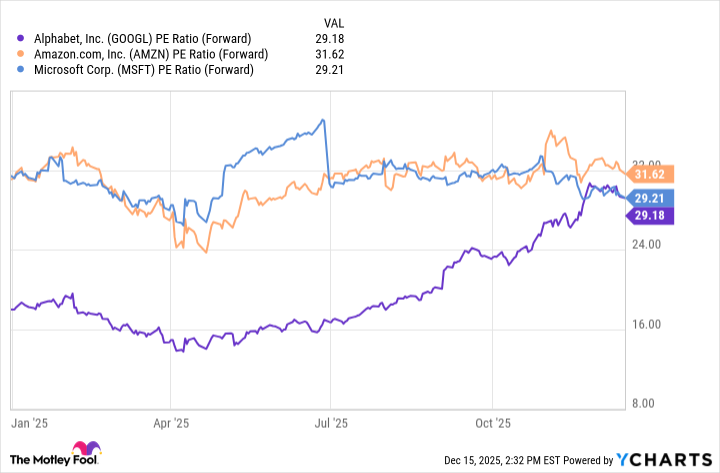

Among the cloud hyperscalers, Alphabet's stock is still the cheapest by forward price-to-earnings (P/E) ratio, though it has in recent months climbed back to near parity with Microsoft.

GOOGL PE Ratio (Forward) data by YCharts.

The caveat from the analysis above is that Alphabet has clearly experienced a meaningful valuation expansion over the last couple of months, while the valuations of Amazon and Microsoft have both compressed a bit.

I think there are two primary factors driving the increased buying.

First, Laffont isn't the only big-name investor betting on Alphabet stock. Warren Buffett also initiated a position in Alphabet last quarter. In addition, a growing number of technologists are beginning to propose that application-specific integrated circuits -- including Google's TPUs -- could pose a threat to Nvidia's dominance in the AI accelerator realm.

Against this backdrop, investors have flocked to Alphabet, which was trading at reasonable valuations relative to its megacap tech peers. While I think Alphabet remains a compelling buy-and-hold opportunity, there are a couple of important points to think about before jumping into the stock.

After its recent run, Alphabet stock is no longer such a bargain. Moreover, the bull thesis around its opportunity in the chip landscape is currently somewhat theoretical.

Nevertheless, I think following Laffont's lead here could prove wise. If you've owned Nvidia stock throughout the AI revolution, then odds are you're sitting on a nice gain. It might not be a bad choice to take some profits and buy into other emerging players such as Alphabet as the AI infrastructure buildout continues to accelerate.