Centrus Energy (LEU +4.96%) is a U.S.-based uranium enricher and nuclear fuel supplier.

The company makes money by supplying uranium fuel, as well as performing contract work, like its recent demonstration of high-assay, low-enriched uranium (HALEU) for the Department of Energy (DOE).

If that doesn't sound exciting to you, consider this: With the U.S. trying to reduce reliance on Russian nuclear fuel, Centrus has gone from a mostly obscure nuclear supplier to an essential component in a nuclear supply chain.

Still not exciting? How about this: The stock has gained over 218% on the year (as of writing). At one point in mid-October, it had grown fivefold on the year, before sinking with nuclear stocks more broadly.

If that has piqued your interest, here are two other things investors should know.

1. Centrus is a strategic asset for the U.S. government

Centrus' biggest advantage is its uniqueness. It's one of the only U.S.-owned, publicly traded uranium enrichers. It was also the first U.S. company to hold a license to produce HALEU, a higher-assay nuclear fuel that many next-generation reactors are expected to use.

That detail matters. For years, much of the world's enrichment capacity has belonged to just a few countries, with Russia being the most dominant. If advanced reactors become part of the future power mix for the U.S., including as a potential source of reliable electricity for data centers, shoring up a HALEU supply chain would be a priority.

Image source: Centrus Energy.

Indeed, the DOE is already working closely with Centrus to help expand its HALEU production. In simple terms, it's paying Centrus to run a HALEU production demonstration in Piketon, Ohio, and to deliver HALEU to the government. Centrus has already hit a major milestone under that agreement by delivering 900 kilograms of HALEU, and the DOE has extended its contract for another 900 kilos in 2026.

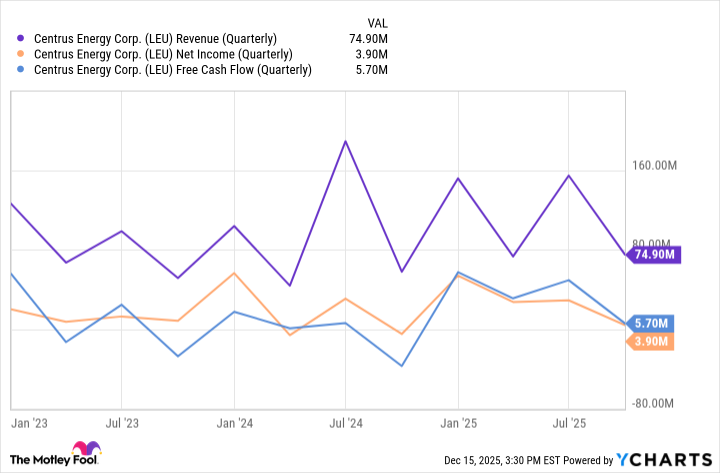

2. Finances are strong, but don't expect every quarter to be smooth

Centrus is already profitable, which sets it apart from other speculative nuclear stocks, like Oklo and Nano Nuclear Energy.

In the third quarter of 2025, Centrus posted roughly $4 million in net income on about $75 million in revenue.

Both were lower than its second quarter, which saw net income of about $29 million on roughly $155 million in revenue. At the same time, Centrus' contracts don't generate steady, quarter-by-quarter revenue, and earnings can swing depending on pricing when customers take delivery.

LEU Revenue (Quarterly) data by YCharts

Centrus' balance sheet is also strong. After raising about $805 million through a convertible note deal in August, the company ended its third quarter with about $1.6 billion in unrestricted cash. That gives it exceptional flexibility for a business of its size, especially as it prepares to expand its enrichment plant in Piketon, Ohio.

The trade-off, however, is those same notes could turn into new shares later, which would dilute existing shareholders.

Is Centrus a buy?

Centrus makes sense for patient investors who can stomach volatility and believe in a long-term nuclear revival. It's not, however, a safe, steady stock. For those who want more predictability, a nuclear energy exchange-traded fund (ETF) might be better suited.