QuantumScape (QS +3.27%) is at a pivotal inflection point, advancing from laboratory development to real-world testing and gearing up for mass production. In the third quarter, the company began shipping its next-generation solid-state lithium-metal battery cells. It also recently signed a joint development agreement with a top 10 automaker worldwide.

The company's battery technology could be a major breakthrough for electric vehicle (EV) manufacturers, due to its higher energy density and faster charging capabilities. However, QuantumScape remains in its early stages and will face more hurdles before achieving positive cash flow.

If you're considering an investment in QuantumScape, here's what you should know first.

NYSE: QS

Key Data Points

QuantumScape's recent breakthrough

The biggest stock-moving news for QuantumScape occurred in the third quarter, when it began shipping B1 samples of its QSE-5 cell. This is a significant step forward for QuantumScape and marks another milestone, checking off a key goal for 2025.

QuantumScape's batteries promise greater energy density, faster charging, and improved safety at scale compared to conventional lithium-ion cells. The company has been developing its Cobra separator process, a quicker, continuous manufacturing method that produces ultra-thin solid-state separators at scale.

The company uses code names for its various separator design processes that rely on precision sintering, in which ceramic precursor layers are heated to near-melting temperatures to induce controlled particle necking and densification. The process presents technical challenges, making it very delicate and time-consuming.

Its initial process, called Raptor, tripled throughput compared to the previous engineering line and served as the baseline for its B0 samples. While the process was successful, the time and costs were too high for large-scale production.

Image source: Getty Images.

The Cobra separator process is a significant step forward for QuantumScape, bringing it closer to production. This process refines sintering by optimizing energy transfer to the ceramic-metal interface. The process delivers a 25x increase in heat-treatment speed while efficiently utilizing factory space by increasing the output per square meter.

These Cobra-developed QSE-5 cells were featured on the Ducati V21L, a motorcycle from Volkswagen. A race bike like the V21L generates massive heat, and demonstrating that the ceramic separator can operate at these temperatures without an extensive liquid-cooling system validates the safety and stability of the solid-state design.

Ramping up production capabilities

QuantumScape and Murata Manufacturing entered into a joint development agreement to produce ceramic separators at high volume for its solid-state batteries. This collaboration follows discussions that confirmed Murata's technologies could be applied to high-volume production of QuantumScape's ceramic separators.

It also announced an agreement with Corning to jointly develop ceramic separator manufacturing capabilities for QS solid-state batteries. The companies will work toward high-volume production of these ceramic separators for commercial applications. These partnerships come as QuantumScape builds up a robust global supplier ecosystem.

The company is scaling its technology and achieving automotive-grade reliability by installing a highly automated cell-production pilot line, the Eagle Line, at its headquarters in San Jose, California. It also recently announced a new joint development agreement with an automotive original equipment manufacturer (OEM) customer, checking off another major goal for 2025.

Is QuantumScape a buy?

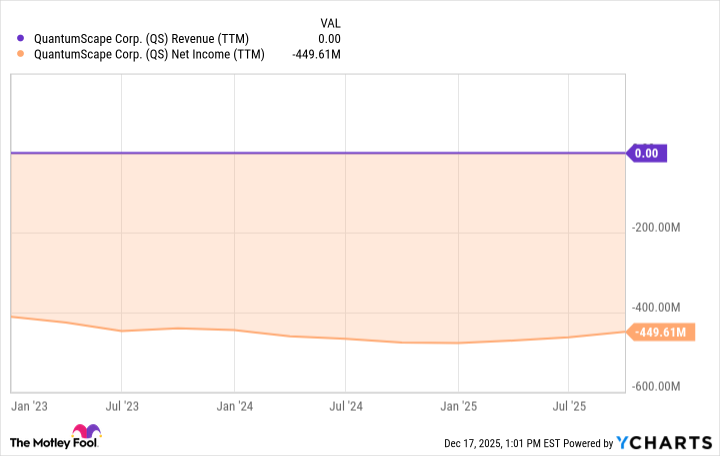

QuantumScape is making solid progress in its production process and is securing collaborations with major manufacturers to scale up production. That said, cash burn remains a concern. This year, it projects an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $245 million to $260 million. One positive is that it reduced its capital expenditure guidance to $30 million to $40 million, driven by efficiency gains and improvements.

QS Revenue (TTM) data by YCharts

While the commercial engagement and expanding ecosystem are all positive developments, the stock will likely remain story-driven for the time being. Evercore ISI analysts don't believe QuantumScape will make material automotive revenue until 2029, pushing back its original timeline two years.

Currently, QuantumScape remains years away from achieving positive cash flow. For these reasons, I believe investors are best off waiting to see further progress before purchasing the stock.