Investors always are on the lookout for the next big thing. And over the past few years, this has been artificial intelligence (AI). The technology has promised to transform processes and operations as well as spark game-changing discoveries -- and the idea is that all of this could lead to massive earnings growth across the corporate world. Some companies, such as Nvidia (NASDAQ: NVDA) and Amazon, already are generating billions of dollars in revenue thanks to AI.

And that's why investors have piled into these players, driving the S&P 500 to what soon may be three straight double-digit annual gains. But in recent times, some investors have worried about the enormous spending levels at certain AI companies, as well as the high valuations of stocks. This has led to a pullback among AI stocks and other growth companies.

Now, as you think of what's ahead in 2026, should you worry about an AI bubble? The evidence is piling up, and here's what it shows.

Image source: Getty Images.

The AI boom so far

First, let's consider what's unfolded so far in this AI boom. Companies have understood that by applying AI to their operations, they may gain in efficiency or set themselves up to make new discoveries. This has prompted them to turn to sellers of AI products and services for the tools they need to harness the power of AI. Players like Nvidia sell the world's top chips, and cloud businesses from Amazon Web Services to Microsoft's Azure offer these and other systems to customers.

NASDAQ: NVDA

Key Data Points

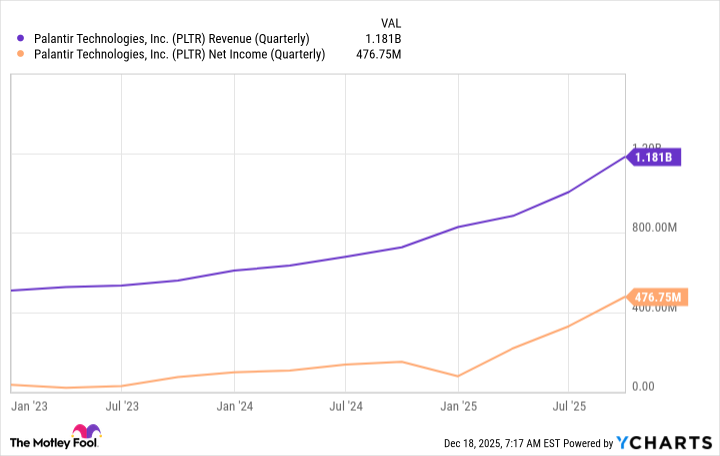

Companies aiming to use AI also might turn to software players with platforms that allow them to apply the technology to their businesses -- Palantir Technologies (NASDAQ: PLTR), offering software that aggregates and analyzes data, is a perfect example of this. And then you'll find others, such as SoundHound AI, that specialize in developing one particular area of AI -- in this case, it's voice AI that can be used to take orders at a restaurant or for communications with your car.

All of these companies, selling AI products and services, have seen explosive revenue growth, but they've also had to heavily invest to keep up with demand and continue innovating.

Investors' big concern

As mentioned, AI players across the board have seen their share prices soar in recent years due to optimism about AI-driven growth. But investors have started to worry that, in some cases, future earnings won't justify the spending and stock prices we're seeing today.

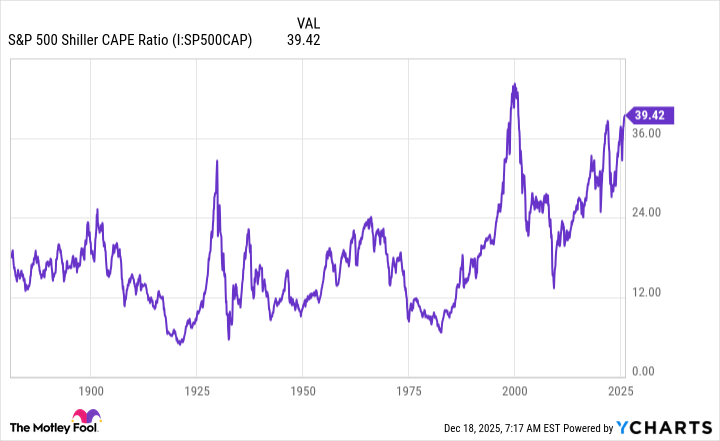

The S&P 500 Shiller CAPE ratio, a measure of stock prices in relation to earnings over a 10-year period, has climbed to a high it's only reached once before throughout its history. And that other time was before the dot-com bubble burst.

S&P 500 Shiller CAPE Ratio data by YCharts

So, stocks clearly have become expensive, and this is something that happens before a bubble deflates. But before declaring that a bubble is here, it's important to consider additional clues. An important one is that companies driving the AI revolution aren't small or new players, as was the case during the dot-com boom. Today, companies with the financial strength to invest, such as Nvidia or Meta Platforms, are leading the charge. Meta has the resources to invest in growth and continue paying a dividend to shareholders. And cloud giants like Amazon and Microsoft have been profitable for years.

Another element to consider is that major players have been growing revenue and net income quarter after quarter, and demand for their AI services has been extremely strong. Palantir is a great example of this.

PLTR Revenue (Quarterly) data by YCharts

Of course, there still is the risk that AI won't take off to the extent that analysts expect, and that certain companies will have spent too much considering the actual revenue opportunity.

An AI bubble?

So, what does all of this evidence suggest about the possibility of an AI bubble in 2026? It shows us a few things. First, the fact that this boom is led by market-powerhouses with long track records of profitability makes it less fragile than the dot-com boom. Second, the earnings growth and level of demand for AI remain positive signs for the future. Nvidia chief Jensen Huang recently said today's situation doesn't look like a bubble.

One risk is that certain companies may overspend, though I would expect a tech giant to carefully pace spending and monitor demand so that any overspend wouldn't be catastrophic. And, as I said above, it's true that valuations have reached high levels -- some companies may grow into their valuations, while some may not.

All of this suggests that, in 2026, we might not see an actual AI bubble bursting -- but we could start to see the emergence of AI winners and losers. And while even the strongest AI players may experience turbulence here and there, they should go on to deliver growth over time.

For you as an investor, to win in such an environment, it's key to buy quality players that have the financial strength to develop and grow, pick them up for good prices, and hold on for the long haul.