As a group, dividend-paying stocks appear poised to perform well in 2026. There are two main reasons for this prediction, both of which stem from the recent decline and expected continued decline in interest rates.

Image source: Getty Images.

Why dividend stocks look poised to perform well in 2026

Interest rates are declining, and economists predict a couple of more interest rate cuts by the Federal Reserve in 2026. The Fed has cut interest rates six times since September 2024, with the last quarter-point (0.25%) cut occurring earlier this month.

Lower interest rates are not favorable for investors in fixed-income investments, such as government bonds. So when rates drop, some of these investors will seek stocks that pay dividends. The increased demand for these dividend payers typically boosts their share prices.

A second reason lower interest rates are beneficial for certain types of dividend stocks -- such as utility stocks and real estate investment trusts (REITs) -- relates to lower borrowing costs. Utilities and many REITs typically borrow a substantial amount of money. Servicing their debt is less costly when interest rates are lower.

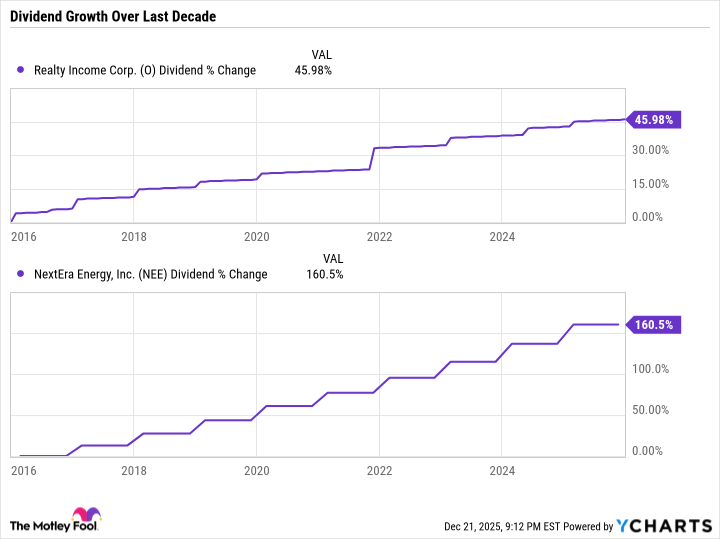

Data by YCharts.

2 Top Dividend Stocks to Buy for 2026

| Company | Dividend Yield | Market Cap | Wall Street's Projected Annualized 5-Year EPS Growth | Year-to-Date 2025 Stock Return | 20-Year Stock Return |

|---|---|---|---|---|---|

| Realty Income (O 1.31%) | 5.72% | $52.1 billion | 19.8%* | 12.2% | 633% |

| NextEra Energy (NEE 0.31%) | 2.83% | $167 billion | 8.5% | 14.3% | 1,290% |

| S&P 500 Index | 1.14% | N/A | N/A | 18.4% | 698% |

Data sources: Yahoo! Finance and YCharts. EPS = earnings per share. *Funds from operations (FFO) is a key financial metric for REITs, providing a better gauge than earnings of a REIT's profitability and ability to pay dividends. Data as of Dec. 22, 2025.

Realty Income: A high-quality REIT focused on stable tenants less affected by online competition

Realty Income is a real estate investment trust (REIT). REITs must distribute at least 90% of their taxable income as dividends, so the more successful ones tend to have quite high dividend yields.

Realty Income stock is an excellent choice for investors primarily concerned with dependable current income. The current dividend yield is juicy at 5.72%. Moreover, the company pays its dividend monthly, a plus for some investors. The company has a strong long-term track record of dividend payments and increases. It has declared 666 consecutive monthly dividends and has increased its dividend for over 30 years in a row.

Realty Income was founded in 1969 -- and went public in 1994 -- making it one of the most established and largest publicly traded REITs. It leases freestanding properties to single-occupancy tenants, primarily commercial and industrial, using long-term, triple-net leases (tenants pay the major variable expenses).

NYSE: O

Key Data Points

The company's 15,500-property portfolio is diversified by geography, tenant industry type, and individual tenant, which lowers its risk level. Most of its properties are located in the United States, although it expanded to the U.K. and several other European countries several years ago.

Realty Income focuses on tenants that can perform well in various economic climates and are at least somewhat insulated from competition from online retailers, such as Amazon. Many of its tenants provide services or sell non-discretionary items, such as convenience stores, quick-service restaurants, and fitness businesses. Its three largest tenants are 7-Eleven (3.3% of total portfolio annualized contractual rent), Dollar General, and Walgreens.

NextEra Energy: An electric utility and renewable energy powerhouse

NextEra Energy stock is an ideal stock for investors seeking a lower-risk investment that pays a decent dividend -- now yielding 2.83% -- while also offering solid capital appreciation potential.

NextEra operates Florida Power & Light Company (FPL), the largest rate-regulated electric utility in the U.S. Florida's population has been growing faster than the country's over the past several decades, making FPL's service territory highly attractive.

Another of NextEra's main competitive advantages is that it's the world's largest producer of renewable energy from the sun and wind. This feature should become increasingly beneficial to the company over time.

NYSE: NEE

Key Data Points

More recently, the incredible demand for artificial intelligence (AI) capabilities has become a catalyst for growth in the electric utilities industry, including for NextEra Energy. This is because AI data centers use enormous amounts of power.

NextEra's dividend should be considered very secure. The company has increased its dividend for 31 consecutive years, making it a very dependable dividend grower. At its 2025 investor conference earlier this month, management reaffirmed its plan to raise its dividend by 10% through 2026 (off a 2024 base), followed by a targeted 6% annual increase in 2027 and 2028 (off a 2026 base).