Quantum computers use a concept called superposition to simulate several different solutions to a given problem. In theory, this can speed up highly complex workloads and lead to breakthroughs in areas like science and cryptography, which is why investors have piled into quantum stocks like Rigetti Computing (RGTI 5.04%) in 2025.

However, most of the quantum computers available today still produce very high error rates, so they aren't very useful for solving real-world problems. As a result, companies like Rigetti are still a long way from commercializing their quantum platforms at scale.

Rigetti stock has more than doubled over the past 12 months alone, and its market capitalization stands at $8.5 billion as I write this. But the company might struggle to maintain that valuation in 2026 based on its minimal revenue, which is why I predict its stock will plunge in the new year. Read on.

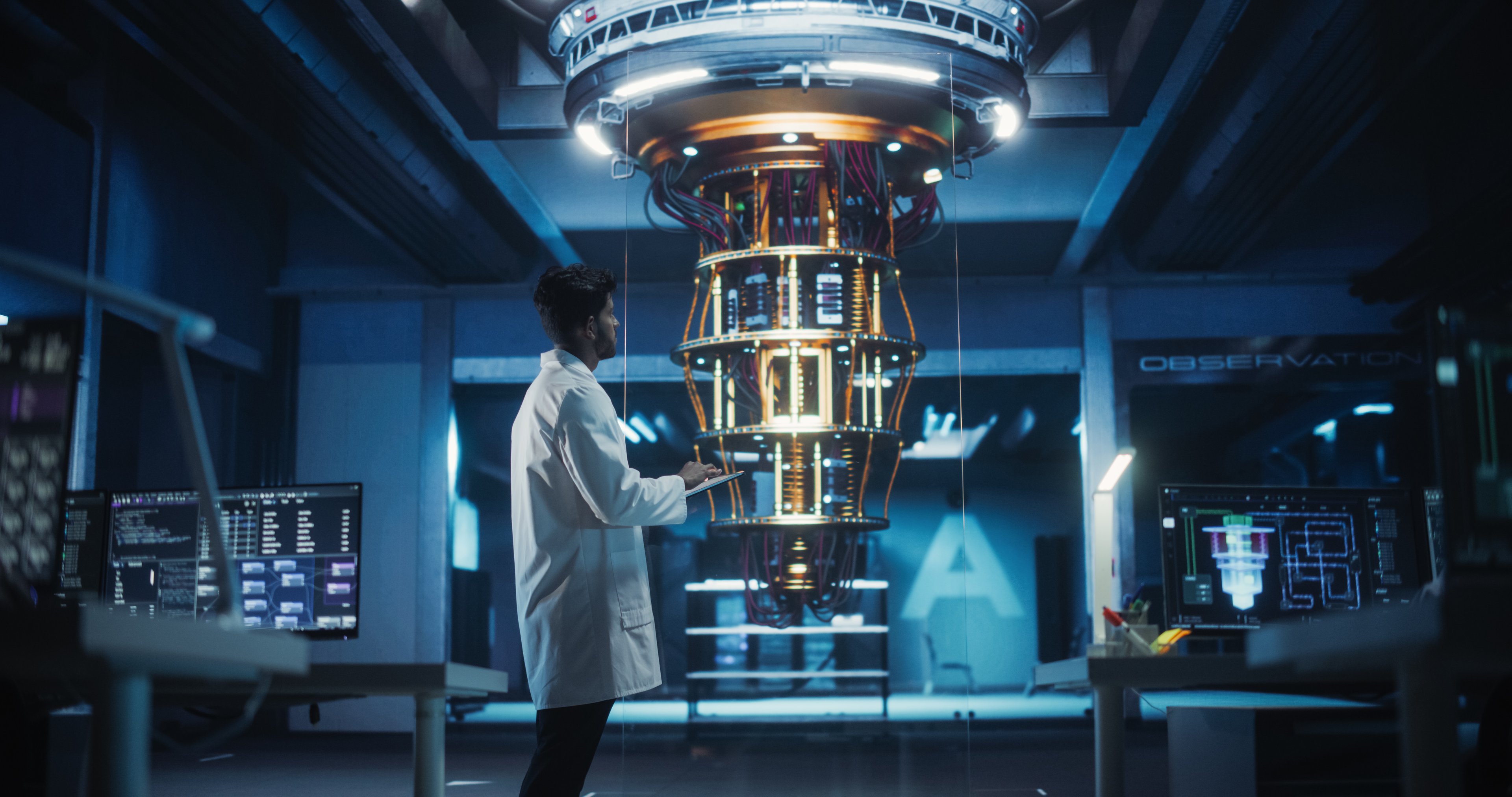

Image source: Getty Images.

An early leader in the quantum race

Rigetti Computing was founded in 2013, and in just 12 years, it has built an entire in-house supply chain, which sets it apart from the competition. It owns a fabrication facility where it manufactures quantum chips, it designed its own quantum programming language called Quil, and it also developed a cloud computing platform where businesses can rent quantum computing capacity for a fee.

Rigetti can bring updates to market much faster than other companies in this space because of its vertically integrated business, which is why it currently boasts the industry's largest multichip quantum computer. It's called Cepheus-1-36Q, and it has achieved a high fidelity of 99.5%. Fidelity measures the accuracy of each quantum operation, so a higher reading means fewer errors, thus making the computer more useful for solving real problems.

Regular computers use bits, which are simple to read because they are always in a state of either 0 or 1. Quantum computers use qubits, which can take a "superposition," meaning they can assume the position of 0 and 1 at the same time. This allows them to run significantly more computations in a much shorter time span, which could transform data-intensive fields like science in the future.

Cepheus-1-36Q uses four chips with 9 qubits each (36 qubits in total). But Rigetti isn't stopping there, because it intends to launch a new system with over 1,000 qubits by 2027, which could achieve a fidelity of 99.8%. In other words, the company is rapidly progressing toward commercial-grade quantum computers that businesses in many different industries might find useful.

Minimal revenue, with mounting losses

Rigetti generated just $5.2 million in revenue during the first three quarters of 2025 (from Jan. 1 to Sept. 30). That's a tiny amount of money for an $8.5 billion company. To make matters worse, revenue was actually down 39% from the same period in 2024.

On the plus side, Rigetti secured purchase orders for two quantum computing systems in September, which should result in $5.7 million in revenue in the first half of 2026. These sales will give the company an opportunity to deliver full-year revenue growth.

But Rigetti faces a big challenge at the bottom line, because the company continues to increase its operating expenses even in the face of declining revenues. As a result, it generated a net loss of $198 million on a generally accepted accounting principles (GAAP) basis during the first three quarters of 2025.

Even after stripping out one-off and noncash expenses, Rigetti still lost $39 million during the period. As of Nov. 6, the company had around $600 million in cash, equivalents, and short-term investments on its balance sheet, which is enough liquidity to sustain its current losses for the foreseeable future.

However, if Rigetti's quantum systems aren't commercialized at scale in the next couple of years, the company might have to raise more money, which could lead to dilution for existing shareholders.

NASDAQ: RGTI

Key Data Points

Rigetti stock trades at a mind-boggling valuation

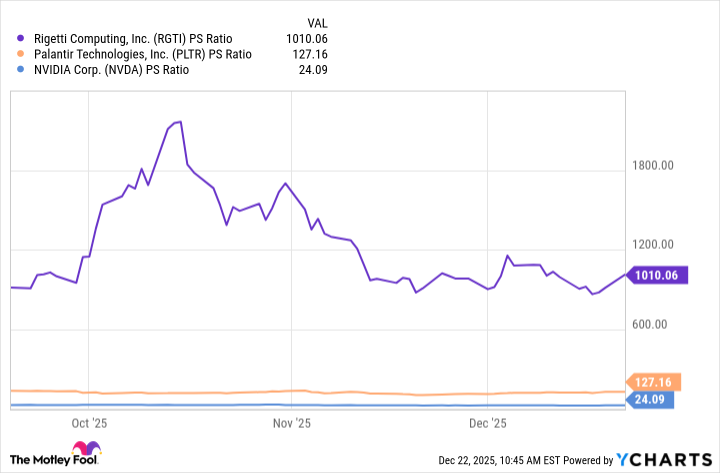

Valuation is the biggest reason I think Rigetti stock will plunge in 2026. It's trading at an eye-popping price-to-sales (P/S) ratio of 1,010 as I write this, which simply isn't sustainable.

Nvidia, one of the highest-quality computing hardware companies in the world, has a P/S ratio of just 24. Rigetti even makes Palantir Technologies' P/S ratio of 127 look reasonable, even though it's completely ludicrous in its own right.

RGTI PS Ratio data by YCharts

Rigetti's technology is definitely exciting, but managing risk is one of the most important parts of investing. Paying such a premium for a company with minimal revenue and significant losses often ends in disaster. In fact, Rigetti stock is already down 53% from its October peak.

Considering the stock would have to slide by a further 87% from here just to match Palantir's P/S ratio, I predict downside is the likely outcome in 2026.