2026 is right around the corner, and there are some incredible stocks available to buy. I've got three that I believe will crush the market in 2026, and I think investors should have some healthy exposure to them.

Nvidia (NVDA +1.09%), The Trade Desk (TTD +0.56%), and MercadoLibre (MELI +0.50%) make great buys. These three all operate in different areas, and are poised to continue 2025's success or make a huge comeback.

Image source: Getty Images.

1. Nvidia

Nvidia is the world's largest company by market cap. However, that isn't stopping it from growing at an unreal pace. Nvidia makes graphics processing units (GPUs) and the technology to support them, which are the preferred computing units to train and run artificial intelligence (AI) models. Nvidia expects monster growth in 2026, as the AI hyperscalers have all informed their investors that they will be spending a record amount constructing data centers in 2026.

NASDAQ: NVDA

Key Data Points

This bodes well for Nvidia, but it has one problem: It's sold out of cloud GPUs. With demand so high for its GPUs, it can start taking orders for computer graphics years in advance. This is what gives management confidence to provide a mind-blowing projection: It expects global data center capital expenditures to total $3 trillion to $4 trillion by 2030. That's up from 2025's $600 billion, and if Nvidia's projection pans out, it will be one of the best stocks to own in 2026 and beyond.

Furthermore, Nvidia's stock really isn't all that expensive. It trades for 24 times 2026's earnings, which isn't bad considering the multi-year growth it's expected to deliver.

2. The Trade Desk

The Trade Desk has had a bad year. It is currently the worst-performing company in the S&P 500 (^GSPC 0.03%) for 2025, down around 70% this year. That's a horrendous 2025 for one of the leading advertising software providers, but it's not because the company is necessarily doing poorly.

NASDAQ: TTD

Key Data Points

In Q3, The Trade Desk's revenue rose 18% year over year. The only issue is that The Trade Desk's revenue growth rate is slowing, thanks to rising competition and a poorly executed rollout of its new AI-powered platform, Kokai. However, part of The Trade Desk's decline was an elimination of the premium the stock used to trade at. Now, it's actually undervalued.

TTD PE Ratio (Forward 1y) data by YCharts

The Trade Desk now trades at less than 18 times 2026's earnings, making it a solid value in today's expensive market. I think The Trade Desk will mount a solid comeback in 2026 and provide market-beating returns along the way.

3. MercadoLibre

MercadoLibre hasn't had as bad a year as The Trade Desk, as it's still up around 17% for the year. However, that's about market-matching growth, which is disappointing considering MercadoLibre's long-term outperformance.

NASDAQ: MELI

Key Data Points

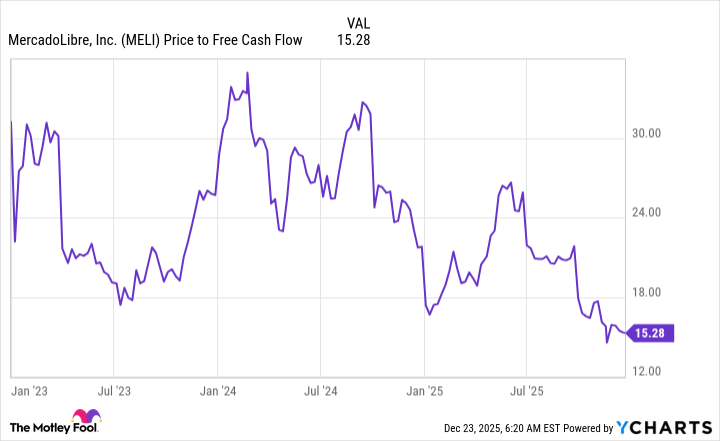

MercadoLibre is the dominant e-commerce and fintech company in Latin America. It's essentially a combination of Amazon (AMZN +0.06%) and PayPal (PYPL 0.17%), and shareholders have reaped the rewards of owning MercadoLibre as it has rapidly expanded to dominate the e-commerce market in Latin America. It still has a long way to go, and its stock is valued at the lowest level it has seen in a long time.

MELI Price to Free Cash Flow data by YCharts

At just 15 times free cash flow, MercadoLibre looks like a steal at these levels. Combine its low price tag with an incredible opportunity to dominate Latin American commerce, MercadoLibre looks like a no-brainer buy. It's down more than 20% from its all-time high established in July. I think MercadoLibre will return to its market-beating status in 2026, making it one of the top stocks to buy for the year.