With Warren Buffett about to step down as the CEO of Berkshire Hathaway (BRK.A 0.56%)(BRK.B 0.56%), investors will surely be sad to see the Oracle of Omaha go.

Not only was Buffett a great CEO and investor who delivered outsize returns for Berkshire shareholders over six decades, but he also uniquely viewed the world, which was fascinating to observe when given the opportunity. Buffett also provided many important life lessons, whether in his annual letters to shareholders or in his occasional television appearances.

Image source: Motley Fool.

Naturally, as Buffett got older, many investors wondered if the 95-year-old was still as good as he used to be. After all, not many people work into their 90s, let alone run one of the largest conglomerates in the world. Luckily, there is an easy way to check.

If you'd invested $500 in Berkshire Class B shares a decade ago, here's how much you would have today.

NYSE: BRK.B

Key Data Points

Berkshire is a different company than it used to be

As Buffett tends to remind investors, Berkshire is quite different from how it used to be, mainly because it is now so large, with an equities portfolio exceeding $300 billion.

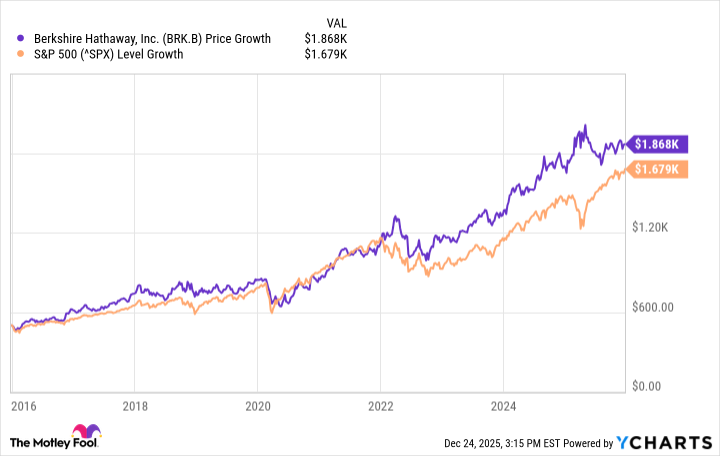

This makes it significantly harder for Buffett and his team to move in and out of positions so easily, and Berkshire rarely encounters opportunities large enough that it finds attractive. Still, Berkshire has managed to beat the broader benchmark S&P 500 Index over the past decade.

Data by YCharts.

As you can see above, $500 invested in Berkshire Class B shares a decade ago is now worth $1,868, representing a total return of 274% and just edging out the broader market. I consider this a success, given Berkshire's size and the market's strength over the past decade.

With so much of the S&P 500 currently dominated by high-flying artificial intelligence stocks, I'd also consider Berkshire's stock a safer investment to hold through the business cycle than the broader market.