Looking at what stocks billionaire hedge fund managers own can be a smart investment strategy. While blindly following their trades isn't a smart move because of information delay, seeing what stocks they all have in common may reveal some great insights to investors.

The reason for the information delay is due to U.S. Securities and Exchange Commission (SEC) reporting requirements. Any money manager with more than $100 million in assets must report end-of-quarter holdings to the SEC. Then, that information is made available to the public 45 days after the quarter ends in a Form 13F. So, if you see that your favorite fund manager bought a position in a hot AI stock, they may have done it months ago.

The key is to find fund managers who don't make massive trades every quarter on a single position. Instead, they add or trim as necessary to manage their risk. One stock that popped up in multiple funds I follow is Taiwan Semiconductor Manufacturing (TSM +1.33%), also known as TSMC. It's a huge holding in many portfolios, and I think it's set to skyrocket in 2026 as artificial intelligence demand ramps up.

Image source: Getty Images.

Taiwan Semiconductor plays a key role in the AI realm

The four billionaires who all own shares of Taiwan Semiconductor are:

- Chase Coleman at Tiger Global Management (4% of portfolio)

- Steve Mandel at Lone Pine Capital (6.2% of portfolio)

- David Tepper at Appaloosa Management (4% of portfolio)

- Daniel Loeb at Third Point (3.7% of portfolio)

Clearly, these four billionaires are very bullish on Taiwan Semiconductor's prospects, and it doesn't take a genius to figure out why.

It can be difficult to determine whose computing units are the best at any given time. For most of the AI arms race, Nvidia and its leading graphics processing units (GPUs) have dominated this conversation. However, rising competition from Advanced Micro Devices and custom AI accelerators from Broadcom has made this analysis more difficult.

But all three of these companies have one thing in common: They get most of their chips from Taiwan Semiconductor. This places TSMC in the ultimate neutral position, as it is supplying chips to competitors. So, as long as there are massive data center buildouts ongoing to develop generative AI technologies, Taiwan Semiconductor will be in an excellent position.

NYSE: TSM

Key Data Points

Nvidia informed investors that it expects global data center capital expenditures to total $3 trillion to $4 trillion by 2030 -- a huge expansion from 2025's $600 billion. That's total capital expenditures, which is far broader than just computing. AMD offered a similar projection, estimating that computing will be a $1 trillion market opportunity by 2030.

This bodes well for one of the key providers of chips in the world, making it no surprise that these four billionaires own shares.

Is Taiwan Semiconductor a buy now?

As mentioned above, the information we have on the ownership of Taiwan Semiconductor among the four billionaires is old information. All we know is that they owned shares on Sept. 30. Since then, TSMC's stock has basically been flat, up around 3%. This likely means they still own the shares, as there haven't been any huge drops.

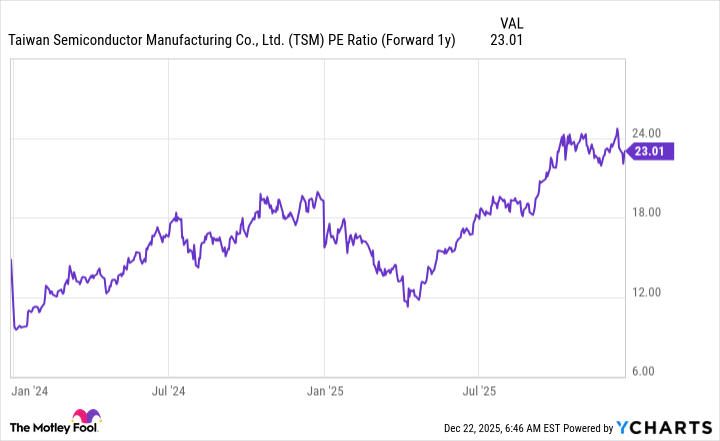

Furthermore, Taiwan Semiconductor's stock is reasonably valued heading into 2026.

TSM PE Ratio (Forward 1y) data by YCharts

At 23 times 2026 earnings, Taiwan Semiconductor isn't all that expensive compared to its peers. Factor in its critical position and monster growth that's expected to persist for several years after 2026, and Taiwan Semiconductor looks like one of the best buys in the market.

I think investors should follow these four billionaires' lead and take a hefty position in Taiwan Semiconductor. It's a critical company, and with massive spending expected to occur over the next five years, it's well-positioned to be a huge winner and could skyrocket in 2026 as a result.