If you thought artificial intelligence (AI) has been Wall Street's hottest investment in 2025, you haven't been paying close enough attention to precious metals.

Gold has skyrocketed by nearly 74% in 2025 to an all-time high of $4,562 per ounce (as of the close of trading on Dec. 26), representing its best annual performance since it rallied 126% in 1979. Meanwhile, silver has shone even brighter, with a year-to-date gain of 175%! Silver ended the Dec. 26 trading session just a stone's throw away from $80 per ounce. Gold and silver are also outperforming the benchmark S&P 500 (^GSPC 0.17%) over the trailing decade.

Catalysts have been abundant for precious metals in recent years, leading to eye-popping gains in physical gold and silver, as well as the mining companies that produce these in-demand metals.

Image source: Getty Images.

However, a strong argument can be made that these well-known catalysts, while foundational in supporting the multi-year ascents for gold and silver, aren't the primary reason the spot prices of both metals have gone parabolic. Instead, a far more subtle impetus has precious metals ascending to the heavens.

Multiple catalysts set the stage for a multi-year rally in gold and silver

Before unveiling this under-the-radar catalyst, let's walk through some of the foundational puzzle pieces that have laid the groundwork for this monumental multi-year rally in precious metals.

Historically, investors have turned to gold and, to a lesser extent, silver as safe havens for their capital during periods of uncertainty. Since the beginning of this decade, we've navigated a global pandemic, a bear market on Wall Street, and a significant shift in global trade policy.

President Donald Trump's tariff and trade policy, introduced in early April, set a 10% global tariff rate and instituted higher "reciprocal tariffs" on dozens of countries deemed to have adverse trade imbalances with America. This has cast a cloud over global trade and U.S. economic growth, which Wall Street typically dislikes. Precious metals often flourish as a safe-haven investment during periods of economic turbulence and uncertainty.

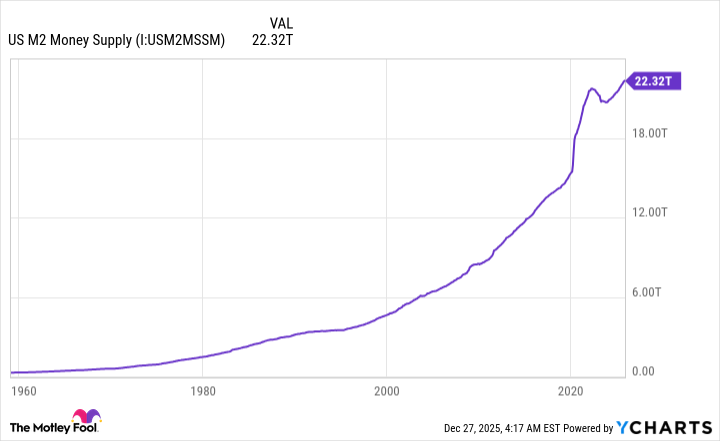

US M2 Money Supply data by YCharts.

Another foundational aspect of the multi-year rally in gold and silver is the significant increase in U.S. M2 money supply during the COVID-19 pandemic. M2 money supply accounts for everything in M1 (cash and coins in circulation, along with demand deposits in a checking account) and adds in savings accounts, money market accounts, and certificates of deposit (CDs) below $100,000.

When U.S. money supply rapidly increases, the inflation rate also (eventually) climbs. A high inflation rate weakens the purchasing power of the U.S. dollar, making physically finite precious metals like gold and silver that much more valuable.

Physical demand for gold and silver is likely playing a role, as well. While we can't examine an income statement or balance sheet for gold or silver in the same manner as we do for public companies, the demand for silver, for example, is expected to grow in solar panels and the specialized batteries used in electric vehicles. If the supply of a physical good struggles to keep up with demand, upward pressure on prices would be expected.

On the other hand, short-sellers (investors who wager on the price of a security to decline) being forced to cover their positions doesn't appear to be a meaningful contributor to the rally in either gold or silver. Although social media message boards are abuzz with the prospect of a short squeeze in silver, publicly available data doesn't point to short-sellers being trapped or the mechanics of a squeeze materially contributing to its gains.

Fed Chair Jerome Powell delivering remarks. Image source: Official Federal Reserve Photo.

This is the subtle reason gold and silver have gone parabolic

While the aforementioned catalysts helped set the stage for a steady uptrend in the spot prices of gold and silver, the off-the-radar impetus that has both precious metals climbing at a seemingly parabolic pace is dissent at America's foremost financial institution, the Federal Reserve.

The Fed is responsible for overseeing our nation's monetary policy, with its core goals being to maximize employment and stabilize prices. The most common way for the nation's central bank to influence the U.S. economy is through adjustments to the federal funds target rate (the overnight lending rate between U.S. banks). Increasing or decreasing the federal funds target rate ultimately impacts borrowing rates for businesses and consumers.

The Federal Open Market Committee (FOMC) -- the 12-person body responsible for making and overseeing monetary policy decisions -- can also undertake open market operations, such as buying and selling long-term Treasury bonds to influence yields.

With few exceptions spanning multiple decades, the Federal Reserve has been a stabilizing force for Wall Street and investors. Even though the FOMC isn't always correct with its decisions, there's a level of certainty in having all 12 Fed Board governors agree on the strategy being employed.

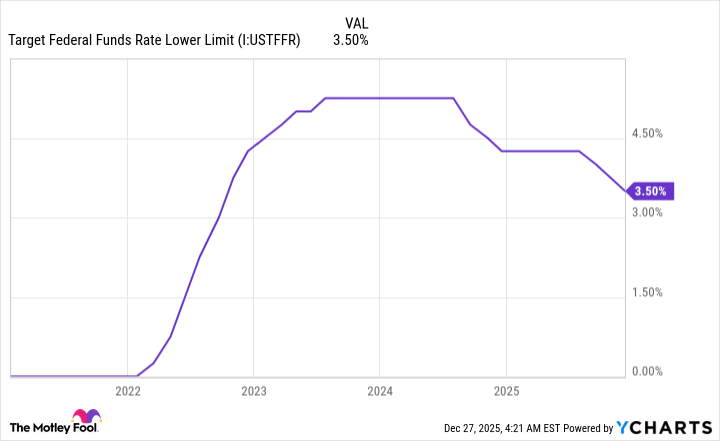

Target Federal Funds Rate Lower Limit data by YCharts.

However, dissenting opinions among FOMC members have occurred in all four meetings in the second half of 2025. In particular, the last two FOMC meetings have featured dissents in opposite directions. While the FOMC has voted in favor of lowering the federal funds target rate by 25 basis points in both meetings, at least one member was opposed to any reduction, while another favored a 50-basis-point cut both times. There have only been three FOMC meetings with opposite dissents in the last 35 years... and two have occurred since late October.

The Fed is transforming from a historically stabilizing force for financial markets into a liability before our eyes. It also doesn't help that Jerome Powell's term as Fed Chair ends in May 2026. There isn't any clarity as to who will replace him, as of this writing.

A central bank that lacks a cohesive message is a potentially major red flag for Wall Street. With the U.S. inflation rate and unemployment rate both modestly increasing, some of the key puzzle pieces necessary for stagflation to take shape are in place.

Gold and especially silver really took off following the last two FOMC meetings, where dissents in opposite policy directions were revealed. Although parabolic ascents in precious metals have never proved sustainable over long periods, moves of this magnitude in gold and silver have previously foreshadowed trouble for the U.S. economy and/or stock market.

Until all members of the FOMC get on the same page, gold and silver can remain lustrous.