Investors tend to see more companies issue stock splits when the market is doing well, and share prices are high. A stock split is the corporate version of taking a pie and cutting it into smaller, equal-sized slices. The pie remains the same size, but there are more slices, and each represents a smaller portion of the pie.

A stock split lowers a stock's share price, but it doesn't change any of its valuations or business fundamentals. Investors tend to applaud stock splits because they usually occur after a stock has performed well, and having more shares makes it easier to buy and sell.

It's been a fantastic year for many growth stocks across the market. ASML (ASML +0.68%), AppLovin (APP 1.82%), and Tesla (TSLA 2.08%) have risen by 54%, 125%, and 20% respectively, in 2025.

Here is why each stock is a potential buy and stock split candidate in 2026.

Image source: Getty Images

1. ASML

NASDAQ: ASML

Key Data Points

ASML plays a crucial role in semiconductor manufacturing as the only company that builds extreme ultraviolet (EUV) lithography machines, which etch complex designs on silicon wafers using light and are vital components in the manufacture of the most advanced semiconductor chipsets. The ongoing artificial intelligence boom is driving demand for ASML's EUV systems. The stock has been volatile at times. ASML became entangled in some geopolitical tensions between the United States and China over access to its machinery. Still, there is now sufficient clarity that management is guiding for 7.6% to 13.3% annualized revenue growth through 2030.

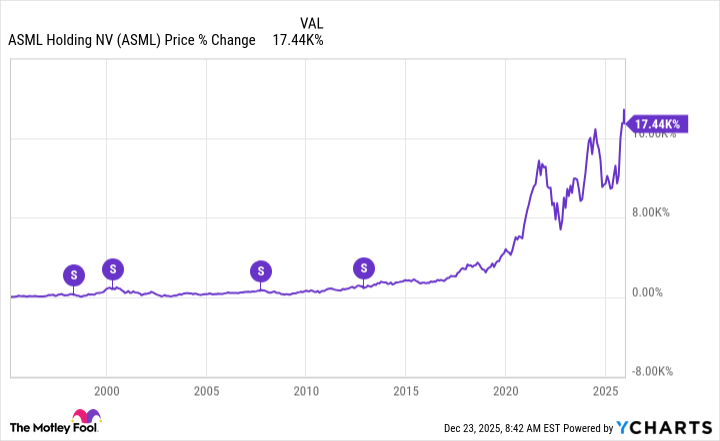

Data by YCharts. Circled Ss indicate previous stock splits.

The stock isn't cheap at a price-to-earnings ratio of 36 times full-year earnings estimates, but that's because analysts estimate ASML will grow earnings by over 22% annually for the next three to five years. ASML's last stock split occurred over a decade ago, and its shares have since skyrocketed higher. Trading at over $1,000 per share today, ASML seems ripe for a stock split in 2026.

2. AppLovin

NASDAQ: APP

Key Data Points

Mobile phones have become a massive market, with billions of people using smartphones and various applications every day. AppLovin's business caters to these smartphone users, and it has soared in recent years, as has the company's stock. AppLovin offers software tools that help mobile app and game developers target, acquire, and monetize users. The company went public amid a market bubble in 2021. Yet, the stock has still risen by 1,000% over its lifetime.

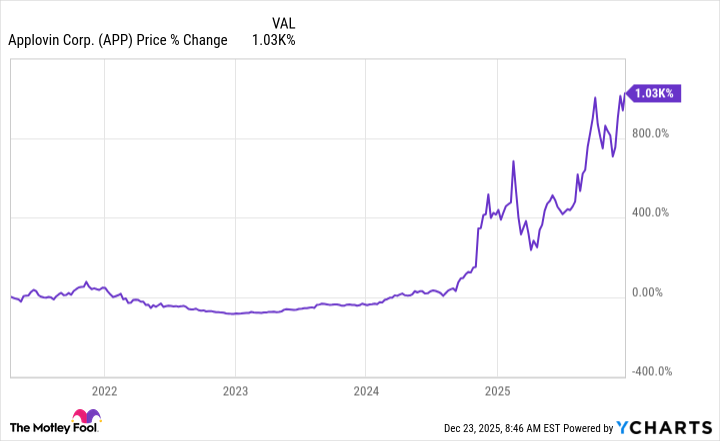

Data by YCharts.

AppLovin is currently one of the fastest-growing companies on the stock market. Revenue increased by a whopping 68% to $1.4 billion last quarter. The stock is priced accordingly at 78 times full-year earnings estimates, but it has room to grow into that valuation. Grand View Research estimates the mobile ad-tech market could approach $1 trillion by 2030. The stock now trades at over $700 per share, making it a prime candidate for its first-ever stock split.

3. Tesla

NASDAQ: TSLA

Key Data Points

Electric vehicle pioneer Tesla remains a controversial stock. Shares trade near all-time highs despite the company's core vehicle business slowing. Why? CEO Elon Musk has Tesla leaning into a colossal humanoid robotics opportunity. With its humanoid, Tesla Optimus, the company aims to take an early lead in what some researchers believe will ultimately become a multi-trillion-dollar opportunity, worth as much as $5 trillion worldwide by 2050.

Data by YCharts. Circled Ss indicate previous stock splits.

Tesla's slumping vehicle sales and a sky-high price-to-earnings ratio of 300 times full-year earnings estimates can be hard pills to swallow. That's understandable. That said, Tesla has long been a story stock, a bet on Elon Musk, which has (so far) produced life-changing investment returns for shareholders over time. Tesla has split its stock multiple times in its history. Shares currently trade at nearly $500, which could prompt the company to issue another split sooner rather than later.