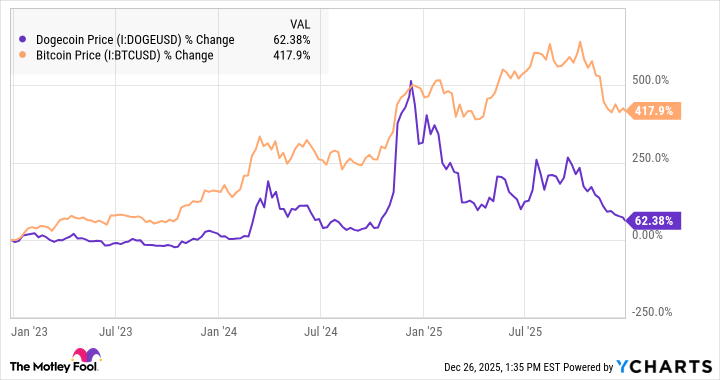

With prices down by a whopping 62% since the start of the year, Dogecoin (DOGE +0.20%) has underperformed in 2025. And even though Donald Trump's election victory has led to meaningful regulatory improvements for the asset class, it turned out to be a situation where most of the gains occurred in late 2024. Let's dig deeper to see what the next 12 months may have in store for the meme coin.

Buy the rumor, sell the news?

Buy the rumor, sell the news is a popular investing cliche that reflects the tendency for stocks and other financial assets to rise in anticipation of a potential positive catalyst and drop when it is actually announced. Donald Trump's election victory is an excellent example of this phenomenon.

CRYPTO: DOGE

Key Data Points

Cryptocurrency prices have fallen across the board despite the new administration's open support for the industry, including relaxed regulations from the Securities and Exchange Commission (SEC), the creation of the Bitcoin Strategic Reserve, and new legislation such as the Genius Act designed to facilitate stablecoins and integrate digital assets into the mainstream. And while Dogecoin has performed particularly poorly this year, it isn't the only one. Mainstream alternatives like Bitcoin (down 8%) and Ethereum (down 13%) have also had bad years.

This trend likely happened because the hype faded and investors wanted to take profits after the significant run-up in value that occurred in late 2024. Meme coins like Dogecoin are more vulnerable to this risk because of their highly speculative nature and less institutional ownership. Furthermore, unlike a traditional stock, Dogecoin has no intrinsic value based on cash flow, earnings, or growth, so investors have no reference point to analyze the impact of the regulatory changes.

The macroeconomics remain favorable in 2026

Despite the fading hype, there are a lot of positive catalysts for the cryptocurrency industry in 2026 and beyond. For starters, there is a growing incentive for US investors to diversify their holdings outside of the U.S. dollar, which is under pressure because of the country's increasingly uncertain fiscal and monetary policies.

In May, credit ratings firm Moody's downgraded U.S. debt from Aaa to Aa1 because of rising interest costs on its $38 trillion mountain of debt and the lack of political will to tackle the problem. America's indebtedness has negative implications for the currency because it undermines investor confidence and increases the risk of debt monetization, which is an inflationary way of funding the government, usually by printing more currency.

Falling interest rates and Trump's erratic trade policy could also play a role in reducing demand for U.S. currency. The U.S. Dollar Index is down by 9.6% year to date, halving the S&P 500's gain of 17%. Cryptocurrency lets U.S. investors hedge their portfolios against this uncertainty while also enjoying the potential for market-beating returns.

Image source: Getty Images.

Can Dogecoin outperform other cryptocurrencies?

Historically, Dogecoin has had a pattern of boom and bust cycles. During times of hype (such as late 2024), the asset strongly outperforms peers. However, when the industry mood sours, Dogecoin gives up its gains faster than the more mainstream assets like Bitcoin.

Dogecoin Price data by YCharts

This trend likely happens because Bitcoin's first-mover advantage and brand image as digital gold have attracted more ownership from institutional investors like insurance companies, endowments, and pension funds, which have deep pockets and long-term strategies.

Dogecoin has still failed to overcome its reputation as an unserious meme coin. And the asset's design also discourages long-term holding because the number of tokens is programmed to increase by 5 billion every year. With a total supply of 168 billion, this gives Dogecoin an expansion rate of around 3%, which is higher than the current U.S. inflation rate of 2.7%. Investors can win with Dogecoin if they time the market perfectly in 2026, but this is a risky strategy. Long-term investors will probably find more success with the alternatives.