When investing, it's often a great idea to consider the moves of billionaire fund managers. They've demonstrated their knowledge of the stock market over the years, so by following their lead on certain occasions, you might score an investing win too. This doesn't mean you should always copy their moves, though. They might have a tolerance for risk that differs from yours or a shorter or longer investment horizon, for example.

And it's important to remember that even these experts often disagree -- while one billionaire may pile into a particular stock, another billionaire may sell or avoid it. So it's key to pay attention to their moves, but then consider your own strategy and budget before taking action.

Today, I'm taking a look at the recent moves of Stanley Druckenmiller, who oversees $4 billion in 13F securities as head of the Duquesne Family Office. Managers of more than $100 million must declare the buying or selling of these securities to the Securities and Exchange Commission on a quarterly basis -- and this is great for us because it allows us a glimpse into the investment moves of these experts.

Let's check out Druckenmiller's latest moves and consider whether AI stocks still may deliver big returns in 2026.

Image source: Getty Images.

30 years of investment success

So, first, it's important to consider Druckenmiller's background. The billionaire operated Duquesne Capital Management for 30 years, and during that time, he didn't have any money-losing years -- and he delivered an annual average return of 30%. Druckenmiller closed the fund about 15 years ago, but he continues to manage money at the helm of his family office.

Druckenmiller has been an investor in AI stocks in recent years, but he shocked the market when he exited top-performing players Nvidia in late 2024 and Palantir Technologies in early 2025. And only one AI stock -- Taiwan Semiconductor Manufacturing -- is among the top five positions in his portfolio. The stock has a 5.2% weight in the portfolio for the No. 4 spot.

Still, in the third quarter of last year, Druckenmiller made three moves that could be seen as a renewed shift into top AI players. Here they are in detail:

- Druckenmiller opened a position in Amazon (AMZN 1.93%), buying 437,070 shares. The stock now makes up 2.3% of his portfolio.

- He opened a position in Meta Platforms (META 1.47%), buying 76,100 shares. The stock makes up 1.3% of Druckenmiller's holdings.

- The billionaire opened a position in Alphabet (GOOGL +0.69%) (GOOG +0.48%). He bought 102,200 shares, and the stock makes up 0.6% of his portfolio.

NASDAQ: AMZN

Key Data Points

AI in 2026

These stocks may not be Druckenmiller's biggest positions, but it's clear that he's confident about the future of AI. Now the question is: Could AI stocks still deliver big returns in 2026?

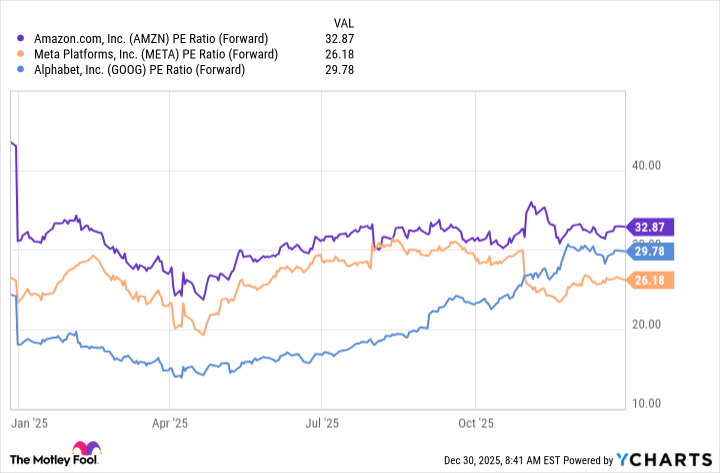

It's true that AI players have soared in recent years, and the valuations of many also have climbed. But certain players, such as Druckenmiller's purchases, remain reasonably priced considering what I'm about to mention right now.

AMZN PE Ratio (Forward) data by YCharts

We're still in the early stages of the AI growth story. While training of AI models has been a big thing in recent times, we have yet to actually apply these models to real-life situations in a major way. This will involve inferencing, or the powering of the models through their "thinking" processes so that they can serve their purposes. We should see growth here throughout industries -- and down the road, robotics, telecom, and many other areas should keep the AI growth engine running.

Jensen Huang's prediction

And even in the next few years, we may see a huge wave of growth. Nvidia chief Jensen Huang predicts AI infrastructure spending may reach as much as $4 trillion.

Trends tech companies have seen so far support these growth forecasts, with demand for AI products and services soaring in recent quarters.

Of course, stocks may not continue to climb without any interruption -- and it's impossible to predict when temporary pauses may occur. But, considering these points I've mentioned, AI stocks could continue to deliver big returns in 2026, and even if they don't, they're well-positioned to do so over the long term. That's why, for growth investors, it's a great idea to follow billionaire Stanley Druckenmiller's moves and pick up a few reasonably priced AI stocks as we head into 2026.