There are many interesting candidates for Stock of the Year in 2025. But Oracle (ORCL +0.39%) stands out to this investor as the story stock of 2025.

Here's why Oracle plays a linchpin role in the artificial intelligence (AI) trade today, its relationship to AI first-mover OpenAI, and why it's so important to focus on this stock in 2026.

NYSE: ORCL

Key Data Points

Oracle's wild ride

Like most stocks, Oracle had a rough start to 2025, with tariff uncertainty causing a sell-off in the first quarter of the year, culminating in early April's "Liberation Day." But like most tech and AI stocks, Oracle began to recover over the summer, setting up a blockbuster earnings report on Sept. 9.

That's when Oracle's stock surged 40% in a single day, reaching a near-100% gain for the year. That big of a move usually doesn't happen with the stock of a company as old and as large as Oracle, which was established in 1977 and sports a market cap of $568 billion today.

Yet by the end of the year, that 40% post-earnings surge completely disappeared, and then some. In fact, Oracle's stock is ending the year even lower than it was prior to the September earnings report. Still, that left Oracle's stock up a "meager" 19.6% on the year overall, slightly higher than the 18.8% total return for the S&P 500 (^GSPC 0.06%), as of this writing.

What caused Oracle's September launch?

The major news from Oracle's September earnings report was a substantial increase in the remaining performance obligations (RPO) for its cloud unit. With a core business in database software, Oracle was a late entrant to the cloud infrastructure wars. However, chairman Larry Ellison has made a big effort to procure a fourth-place position in this oligopoly over the past few years.

The bet has paid off, with the generative AI boom spurring an acceleration in demand for computing power. Oracle grew its cloud IaaS revenue 68% last quarter, reaching a quarterly revenue of $4.1 billion. That's still well behind the top three players, but a $16.5 billion run-rate business is still significant.

Oracle also discloses RPO on its earnings releases, defined as Oracle's total future cloud revenue that's already under contract. In the quarter ended in August, that number jumped a stunning 359% to $455 billion, and would later increase to $523 billion by the end of Oracle's November quarter.

Given that Oracle's cloud revenue run rate is just over $16 billion today, even if those RPOs are spread over, say, five years or more, Oracle's cloud revenue could increase by multiples of current levels.

Image source: Getty Images.

Then why the fall?

Unfortunately, doubts regarding that half-trillion RPO number began to creep into the news almost as quickly as the post-earnings surge. Days after Oracle's September earnings report, it was reported that $300 billion of that $455 billion in cloud RPO came from just one company: OpenAI.

OpenAI's ChatGPT is the first mover in generative AI, with weekly active users reaching 800 million as of October, the largest of any AI chatbot, according to the company's most recent disclosure.

However, OpenAI is also incurring tens of billions of dollars in losses, with recent estimates placing last quarter's losses at $11.5 billion and a whopping $25 billion over the first three quarters of 2025. Not only is OpenAI losing an astonishing amount of money, but it has also signed up for $1.4 trillion of future spending commitments. So, the $300 billion committed to Oracle amounts to just 21% of OpenAI's total future obligations.

While OpenAI is undoubtedly posting tremendous revenue growth, with CEO Sam Altman recently forecasting $20 billion in annualized recurring revenue (ARR) for 2025, the concentration of future revenue has raised eyebrows for Oracle.

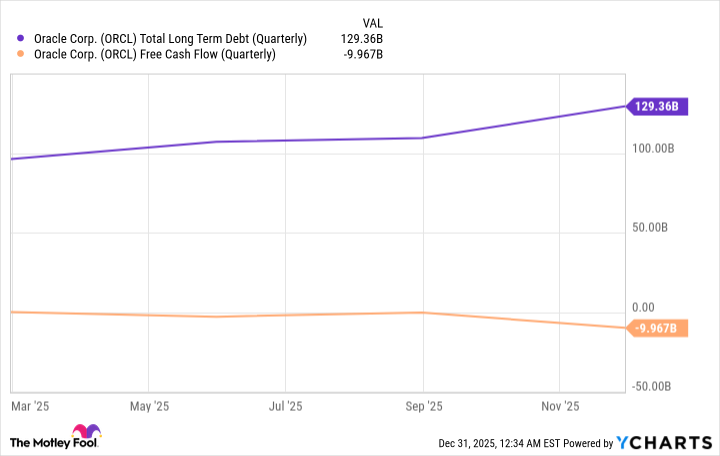

Oracle is also funding the massive data center buildout with debt, increasing the risk to the company. This year, Oracle's total gross debt grew from $96 billion to nearly $130 billion, as free cash flow flipped from positive to -$10 billion last quarter alone.

ORCL Total Long Term Debt (Quarterly) data by YCharts

Meanwhile, Oracle has said that when fully ramped, it expects AI-specific cloud commitments to generate a 30% to 40% gross margin. That's a lower margin than traditional cloud computing, judging by the 35% operating margin at which Amazon Web Services operates.

Now, if OpenAI lives up to its commitments and Oracle achieves that margin on lots of new revenue, the economics should work out. However, increasing debt to fund lower-margin business well out into the future leaves little room for error.

The debt markets take notice of the competition

A lower margin of error collided with a big potential risk during the fourth quarter. That's when Alphabet (GOOG +0.18%) (GOOGL +0.36%) released its Gemini 3 model.

Trained on Alphabet's proprietary TPU chips, Gemini 3 presented a serious challenge to OpenAI's lead in frontier large language models. And that's on top of big improvements from other competitors, such as Anthropic's Claude model and xAI's Grok. In December, OpenAI CEO Sam Altman declared a "Code Red" to refocus the company on regaining model superiority.

In response to the new competitive threat, the debt markets sold off Oracle's debt, and the cost to ensure Oracle's debt against default rose to a 16-year high in December to 1.41%, according to Intercontinental Exchange Data Services. That may not sound high, but it's the highest insurance premium on Oracle's debt since the great financial crisis in 2009.

Oracle is an indicator of the AI trade and, therefore, the market

One could say that the most consequential stock in the market would be OpenAI, if it were public. However, the stock most closely correlated with OpenAI appears to be Oracle. If AI scaling continues and models continue to improve exponentially, Oracle's significant investment in AI infrastructure should pay off. However, Oracle also needs OpenAI specifically to be at least one of the eventual AI winners.

Yet if model improvement hits a scaling roadblock, or if OpenAI somehow loses its leadership position in the dynamic AI market, things could become complicated for Oracle.

2026 will bring more data to support this thesis on OpenAI, and therefore also Oracle. OpenAI may go public through an IPO to raise more of the money, and investors will have the opportunity to track Oracle's growth through its earnings reports.

However, the concern over customer concentration may not dissipate for Oracle by the end of 2026, even if both companies continue to grow this year. That's because of the inherent dynamism and medium-term uncertainty of the AI revolution in general, as is the case with any disruptive technology.