As we head into 2026, many investors are having mixed feelings about the stock market. While 37% of U.S. investors feel optimistic about the next six months, according to the most recent weekly survey from the American Association of Individual Investors, around 35% feel pessimistic.

Regardless of where you believe the market is headed next year, continuing to invest consistently is one of the most effective ways to build long-term wealth. Even if stocks take a turn for the worse in 2026, staying in the market for many years can reduce the impact of any short-term volatility.

The right investment is key to surviving market downturns, however. Exchange-traded funds (ETFs) are a fantastic option for many people, and there's one Vanguard ETF I personally own and highly recommend heading into the new year.

Image source: Getty Images.

How to generate wealth while reducing risk

Nobody knows where the market will be in the next six or 12 months. Stocks could continue surging, or we may be inching closer to the next recession. No matter what happens, though, the Vanguard Total Stock Market ETF (VTI +0.70%) can help protect your portfolio.

The Vanguard Total Stock Market ETF is a broad fund encompassing the entire U.S. stock market. It contains 3,527 stocks, ranging from small-cap to megacap and everything in between. Covering all sectors of the market, it's as diversified as you can get when investing in equities.

Because it aims to follow the performance of the market as a whole, this ETF is incredibly likely to survive periods of volatility. The market itself has survived every downturn it's ever faced, and there's a very good chance that trend will continue.

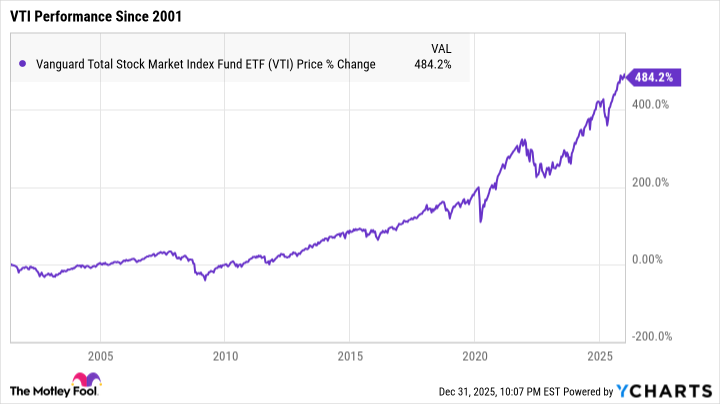

In fact, not only has the market pulled through recessions and crashes, but it's also thrived over time. Since its inception in 2001, the Vanguard Total Stock Market ETF has experienced significant short-term volatility -- from the dot-com bubble burst to the Great Recession to the bear market throughout 2022, and more. Yet, it's still managed to earn total returns of more than 484% in that time.

Historically, this ETF has earned an average rate of return of 9.25% per year -- which is roughly in line with the market's average over the last 50 years.

At that rate, if you were to invest $200 per month, here's approximately how much you could earn in total, depending on how many years you have to save:

| Number of Years | Total Portfolio Value |

|---|---|

| 10 | $37,000 |

| 20 | $126,000 |

| 30 | $343,000 |

| 40 | $867,000 |

Data source: Author's calculations via investor.gov.

The stock market itself has impressive wealth-building potential, and this ETF can make it easier to capitalize on it. The sooner you get started and the more consistently you invest, the more you can potentially earn.

The Vanguard Total Stock Market ETF is one of the safer ETFs out there, making it a fantastic choice for those who are unnerved about the market's future. But with enough time, it can also be incredibly lucrative.