A new investing year is here, and if you have cash to deploy, now is a great time to get started. Here, I'll highlight several stocks that offer one or more of the following: an interesting valuation, a recovery story, a solid track record of earnings success, and leadership in a growth market. If you invest in a handful of these players, you'll offer yourself diversification -- and potentially a long-term investing win.

Let's check out my 10 top stocks to buy to start the new year off right.

Image source: Getty Images.

1. Palantir Technologies

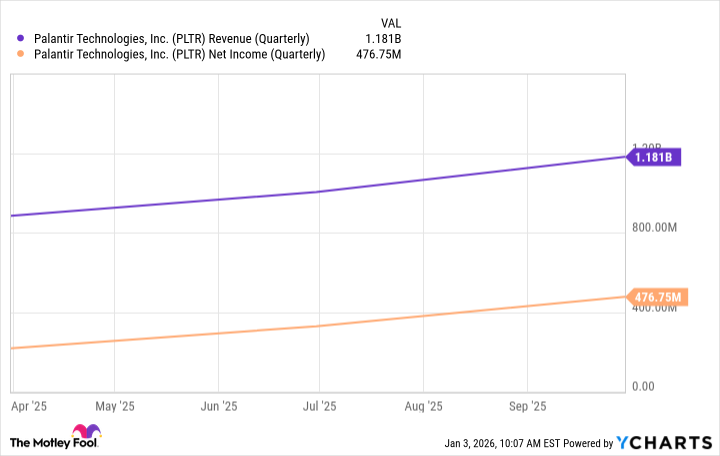

Palantir Technologies (PLTR 0.69%) is winning in the growth market of artificial intelligence (AI). The company's AI-driven software platform, Artificial Intelligence Platform (AIP), helps customers make better use of their data, and this has spurred enormous earnings growth over the past several quarters.

PLTR Revenue (Quarterly) data by YCharts

Palantir's revenue, once driven by government customers, today is driven by both government and commercial customers. They've flocked to AIP as it allows them to easily and immediately apply AI to their needs. The company has seen high demand quarter after quarter, and this may continue as the AI boom marches on.

2. IonQ

IonQ (IONQ +1.36%) is an innovator in the hot growth area of quantum computing. These computers offer the opportunity to solve problems that are impossible for classical computers. Though it may take several years for quantum computers to become generally useful, progress is being made -- and IonQ is one of the promising players.

NYSE: IONQ

Key Data Points

IonQ uses trapped ions for computation, and this system has several key advantages, such as lower error rates and long coherence times (this allows more time for computation). The company currently sells access to its computers through major cloud service providers. We're still in the early days of this growth story, making now an ideal time to buy and hold this exciting quantum stock.

3. Nvidia

Nvidia (NVDA +1.70%) is a proven winner in AI. The company sells the world's most powerful AI chips, and these, as well as related products and services, are generating record earnings. Demand continues to be high, and Nvidia plans on updating its chips on an annual basis to maintain its leadership.

The company predicts that AI infrastructure spending may reach $4 trillion by the end of the decade -- and Nvidia is ready to benefit since data centers need the company's systems as they ramp up to serve more and more customers.

Even though Nvidia stock has soared 1,100% in three years, it still has room to run as the AI story unfolds.

4. Microsoft

Microsoft (MSFT +1.86%) offers you exposure to high-growth areas such as AI and quantum computing -- it's involved in both, and recently said it would increase investment in AI to benefit from the "massive opportunity ahead."

The tech giant also offers you safety thanks to its long track record of earnings growth. And Microsoft's software, cloud business, and other revenue sources should continue to power earnings higher well into the future.

NASDAQ: MSFT

Key Data Points

Considering all of this, today, trading for 29x forward earnings estimates, down from 36x several months ago, the stock looks particularly cheap.

5. Costco

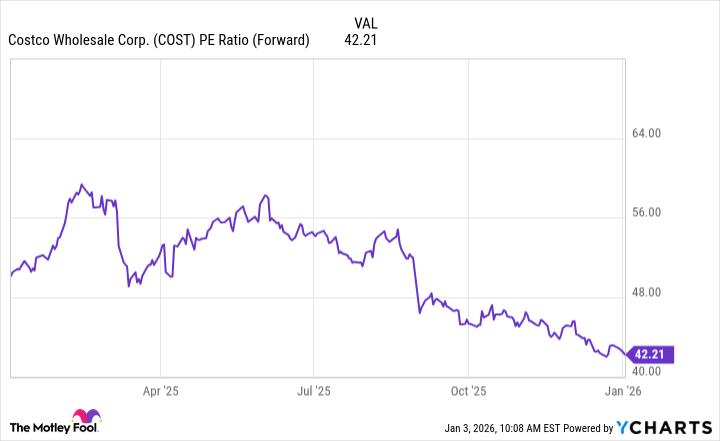

Costco (COST 1.29%) has been a winning investment, climbing 87% over the past three years, for example. But the stock has plenty of room to march higher over time. I like Costco for its business model, generating most of its profit from membership fees -- and high renewal rates year after year offer us reason to be optimistic about earnings to come.

This company also is one that may excel in any economic environment since it offers customers access to dirt cheap prices on essentials from food to gas. Right now, it's trading at its lowest in relation to forward earnings estimates over the past year, offering investors a solid buying opportunity.

COST PE Ratio (Forward) data by YCharts

6. Carnival

Carnival's (CCL 0.33%) (CUK 0.37%) story wasn't so bright in early pandemic days when a halt to sailings pushed the company to a loss and into heavy debt. But Carnival has expertly turned things around, paying down debt, becoming more efficient, and returning to profitability.

In fact, Carnival has reached record levels of revenue and adjusted net income in recent quarters -- and bookings for future cruises have reached highs, even at higher price levels. The company even has returned to an investment grade credit rating at Fitch Ratings.

So now looks like a great time to hop on board and bet on Carnival stock for 2026 and beyond.

Image source: Getty Images.

7. Target

Target (TGT 0.24%) has been going through difficult times in recent years, with a variety of challenges holding back revenue growth. But the company, under the direction of new chief executive officer Michael Fiddelke as of next month, may be about to turn things around.

The retailer already has made several moves -- from job cuts to improving service in stores -- that may help spur recovery. And it's important to remember that Target has many billion-dollar owned brands that may drive growth -- they're higher margin for the company than national brands.

Target trades for 13x forward earnings estimates right now, making it a great bargain recovery buy for 2026.

8. Intuitive Surgical

Intuitive Surgical (ISRG 0.28%) is the world's leader in robotic surgery. The company's flagship Da Vinci system is a favorite of doctors, and this has helped it establish a strong moat or competitive advantage: Most surgeons train on the Da Vinci, so they are likely to prefer using this system they know well. It's also important to note that hospitals, after making a major investment in a robotic system, aim to amortize that investment so they won't easily switch to another.

NASDAQ: ISRG

Key Data Points

Intuitive has updated the Da Vinci system over time to offer surgeons top performance -- yet another reason to stick with the product. Finally, I like the fact that Intuitive generates most of its revenue through the sales of accessories used during surgeries -- and this equals recurrent revenue for the company.

All of this makes the stock a fantastic long-term holding.

9. Vertex Pharmaceuticals

Vertex Pharmaceuticals (VRTX +1.10%) is the global leader in cystic fibrosis (CF) treatment, and thanks to this portfolio, it's brought in billions of dollars in earnings. This is likely to continue as Vertex's intellectual property protects the portfolio through at least the late 2030s.

On top of this, Vertex launched two products outside of this specialty area over the past couple of years: Casgevy for blood disorders and Journavx for pain management. Both have billion-dollar potential, and the company has progressed in the rollout of these treatments.

Vertex has proven its ability to excel in CF and expand into other areas as well, and the company's pipeline is strong -- so this biotech offers you security and growth.

10. American Express

American Express (AXP 1.42%) has proven itself over the long term, delivering earnings growth, stock price performance, and passive income to shareholders. In the recent quarter, this well-established payment card company reinforced its strong track record, with revenue increasing in the double-digits to a record of more than $18 billion. And earnings per share also climbed in the double digits.

NYSE: AXP

Key Data Points

The company has seen growth in younger customers, which is a great sign for the future. And demand for recently updated U.S. consumer and business Platinum cards beat American Express' expectations.

I particularly like the fact that, by serving high-income customers, American Express is less vulnerable when periods of economic weakness arise. All of this makes this stock a great one to own during any market environment.