If you've got $1,000 ready to invest in the market, I can think of no better time than right now to deploy it. The research is clear: investing now is better than investing tomorrow. That's because the market tends to rise more often than it falls, so even if you think the market might be expensive now, the consequences of missing out on the next run are far greater than minor losses you may sustain if you buy now.

Here's a group of stocks that appear to be strong buys now. All of these stocks are primed for an excellent 2026, and investing now gives you the best chance to capitalize on the growth they expect to deliver this year.

Image source: Getty Images.

Broadcom

Broadcom (AVGO +0.17%) has emerged as a top option in the artificial intelligence investment realm, thanks to its custom AI accelerators. It's partnering with many of the AI hyperscalers to design their own custom chips, including generative AI leaders like Alphabet (GOOG +2.04%) (GOOGL +2.27%) and OpenAI, the makers of ChatGPT. This doesn't mean that Nvidia's dominance is over; it just means that viable alternatives are starting to show up.

NASDAQ: AVGO

Key Data Points

The growth of Broadcom's AI business is expected to pay off significantly in the next few years. For fiscal year 2026, its revenue is expected to rise 50% year over year. For FY 2027, its growth is projected to be 36%. For reference, Broadcom's FY 2025 growth was 24%. That rapid growth acceleration is a great reason to buy Broadcom's stock now, and I think it's well-positioned to dominate in 2026 and beyond.

Alphabet

Alphabet was once the laughingstock of the AI race, but that's no longer the case. Gemini has emerged as one of the top generative AI models, marking a huge comeback after falling behind in the race. Alongside Alphabet's reemergence in this realm are the impressive results of existing businesses.

NASDAQ: GOOGL

Key Data Points

Google Search delivered strong 15% year-over-year growth during the third quarter, pretty good for a mature business unit that many expected would be disrupted by generative AI in 2025. Google Cloud, Alphabet's cloud computing wing, also posted a strong Q3, with revenue rising 33% year over year and its operating margin expanding from 17% last year to 24% this year.

Everything is going right for Alphabet right now, and I don't see that changing in 2026.

Amazon

Amazon (AMZN +1.16%) is similarly doing quite well. Its base commerce business is thriving, driven by consumers who continue to increase their spending, with online sales growth of 10% and third-party seller service growth of 12%. Both of those are recent highs for performance, showcasing Amazon's ability to increase its market share in the commerce realm.

Its more growth-oriented divisions, Amazon Web Services (AWS) and advertising services, also had impressive Q3 results, with revenue rising 20% and 24% respectively. Similarly, Q3 was the best quarter either of these divisions had had in multiple quarters.

Amazon is truly firing on all cylinders and crushing results, but the stock hasn't followed suit. Amazon's stock rose about 6% in 2025, far underperforming the market.

NASDAQ: AMZN

Key Data Points

When a stock underperforms, yet the underlying business is outperforming, that indicates that a comeback could be imminent. I think Amazon will post strong results in 2026, and the stock should rebound as a result.

MercadoLibre

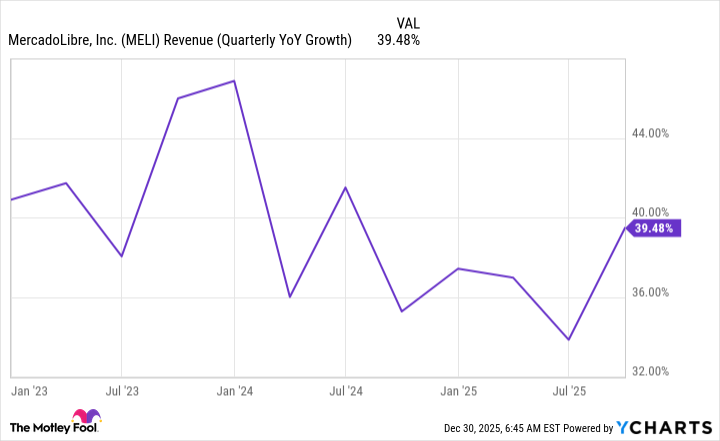

MercadoLibre (MELI 1.56%) is one of the most successful companies that few have heard of. It duplicated Amazon's business model in Latin America, and also expanded on it by adding a fintech wing to facilitate payments in a region where online payment methods aren't prevalent. This has led to year after year of incredible growth for MercadoLibre.

MELI Revenue (Quarterly YoY Growth) data by YCharts.

I don't see anything stopping MercadoLibre's growth in 2026, and with the stock down around 25% from its all-time high, now could be the perfect time to scoop up shares.