2025 brought another year of record highs for the S&P 500, Nasdaq Composite, and the Dow Jones Industrial Average. But the energy sector gained just 4.4%, and the consumer staples sector lost 1.2% compared to a 16.4% jump in the S&P 500.

With 2025 now in the past, investors may want to take a closer look at beaten-down value stocks with high dividend yields to power their passive income stream. Here's why Chevron (CVX +0.93%), Kinder Morgan (KMI +0.85%), and Kimberly-Clark (KMB 0.49%) stand out as top buys in January 2026.

Image source: Getty Images.

Chevron is staying disciplined and rewarding shareholders

Investors will be looking to see how Chevron capitalizes on its acquisition of Hess amid mid-cycle oil prices. Hess has valuable assets in the Bakken Basin in North Dakota and offshore in Guyana, through a consortium with ExxonMobil and the Chinese state-owned company CNOOC.

In early December, Chevron said that it anticipated its 2026 capital expenditures (capex) to be $18 billion to $19 billion, which is on the low end of its long-term $18 billion to $21 billion range. More than half the budget is devoted to the U.S., including $6 billion in the Permian, DJ, and Bakken basins. Chevron is also investing $7 billion in offshore capex due to a heightened focus on Guyana and Gulf of Mexico, which President Donald Trump renamed via executive order the Gulf of America, plays.

Chevron's emphasis on international upstream production, mainly from offshore, paired with its primarily onshore U.S. production, could pave the way for even lower production costs and higher margins.

The company has done a masterful job of reducing its costs, enabling it to fund its operating expenses, long-term investments, and capital plan (including dividends and stock repurchases) even at lower oil prices. Chevron expects to maintain a capex and dividend breakeven below $50 per barrel of Brent Crude oil through 2030.

With 38 consecutive years of increasing its dividend, a yield of 4.5%, and a forward price-to-earnings (P/E) ratio of 20.2, Chevron is a well-rounded buy for value and income investors alike in 2026.

NYSE: CVX

Key Data Points

Fuel your passive income pipeline with Kinder Morgan

Midstream companies like Kinder Morgan invest in and maintain energy infrastructure assets like pipelines and terminals, which play pivotal roles in transporting, storing, and processing hydrocarbons.

Despite volatility in oil and gas prices, Kinder Morgan's cash flow structure is predictable. Indeed, 64% of its cash flows come from take-or-pay contracts -- where customers book capacity and pay Kinder Morgan regardless of throughput. And another 26% of cash flows are fee-based, which are independent of commodity price changes.

Kinder Morgan had a big 2024 -- soaring 55.3% before cooling off with a modest 0.3% gain in 2025. Investors gravitated toward midstream giants like Kinder Morgan because artificial intelligence (AI) is driving demand for energy-intensive data centers, which is a boon for Kinder Morgan's project roadmap.

However, many hyperscalers have sustainability goals, so powering data centers with nonrenewable resources isn't exactly a good look -- hence the emphasis on nuclear energy and solar. But Kinder Morgan remains optimistic that it can steadily grow its cash flows and dividend over time, thanks to higher domestic energy demand and increased U.S. energy exports, particularly through liquefied natural gas (LNG).

With a forward P/E ratio under 20 and a 4.2% dividend yield, Kinder Morgan is a great buy for passive income investors in the new year.

Kimberly-Clark has fallen far enough

Kimberly-Clark investors experienced a challenging 2025, as the stock price underwent a 23% sell-off. Entering 2026, the company is hovering around a 12-year low -- with considerable uncertainty surrounding the consumer staples giant.

Kimberly-Clark is acquiring Kenvue (KVUE 0.79%), which spun off from Johnson & Johnson as a pure-play consumer health company, in August 2023. The deal will pair Kimberly-Clark's focus on paper products (toilet paper, paper towels, tissues, diapers, adult care, and feminine care) with Kenvue's leading brands like Band-Aid, Tylenol, Aveeno, Listerine, and Neutrogena.

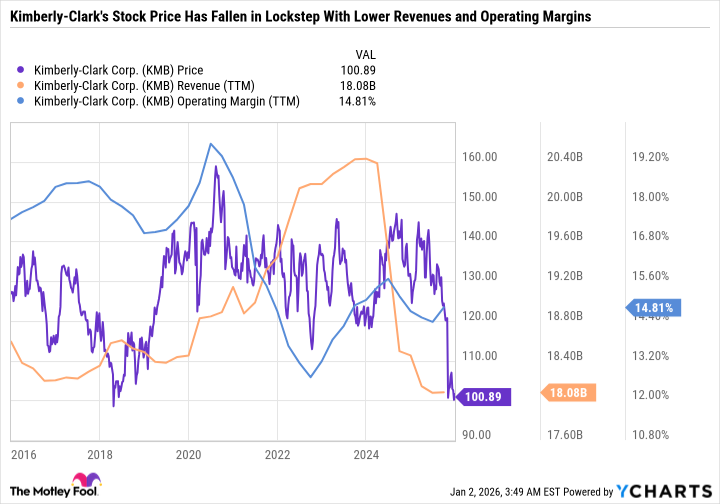

However, Kimberly-Clark, Kenvue, and the broader home and personal care industry are experiencing a slowdown as consumers reduce spending and resist price increases. Kimberly-Clark's earnings have been under pressure, and sales and margins are down. As you can see in the chart, Kimberly-Clark has gone from high-teens operating margins to mid-teens, and its revenue has plummeted to 10-year lows.

So with Kimberly-Clark in a slowdown and Kenvue struggling for similar reasons, investors may be wondering why the stock is worth a closer look in 2026. The answer centers around expectations.

Kimberly-Clark's stock price is so beaten down that it is trading for just 13.2 times forward earnings. That's dirt cheap for a historically reliable dividend stock like Kimberly-Clark, which has paid and raised its dividend for 53 consecutive years. The company's falling stock price, paired with ongoing dividend increases, has pushed its yield up to a whopping 5%.

All told, Kimberly-Clark is a no-brainer buy for investors who believe in the staying power of its brand and are willing to ride out a potentially prolonged period of consumer spending pressures.

Kick off the new year with these high-yield stocks

Chevron, Kinder Morgan, and Kimberly-Clark aren't flashy growth stocks with breakout potential. But they are quality value stocks with high dividend yields, which may appeal to investors looking to supplement income in retirement or balance out a growth stock-heavy financial portfolio.