AGNC Investment (AGNC 0.90%) is a difficult company to understand. Its business model is fairly complex. Its overarching goal seems to run counter to key metrics that investors track. For a select group of investors, it could be a huge disappointment; for others, it could be a key part of a millionaire-maker portfolio. Here's what you need to know before you buy this real estate investment trust (REIT) and its shockingly high 13% dividend yield.

Image source: Getty Images.

What are you looking for?

One of the first things that every investor needs to identify is their investment goal. That simple step will help you narrow your universe of potential investments to a more manageable level. However, sometimes, there are nuances that you have to deal with. AGNC Investment is a great example.

With a 13% dividend yield, AGNC appears to be a dividend stock. That's backed up by the fact that it is a REIT, a business structure that is specifically designed to pass income on to shareholders in a tax-advantaged manner. REITs avoid corporate-level taxation if they pass at least 90% of taxable income on to shareholders as dividends. REIT shareholders have to pay taxes on their dividends as if they were earned income.

The problem here is that most dividend investors are looking for a company that pays a large, sustainable dividend. A steadily growing dividend would be even better. AGNC Investment's dividend has been volatile, and for more than a decade, it has been in decline. The stock price has basically followed the dividend. The falling stock price has allowed the dividend yield to remain elevated throughout this period, but the end of the story is that investors have been left with less income and less capital.

AGNC is not a bad investment

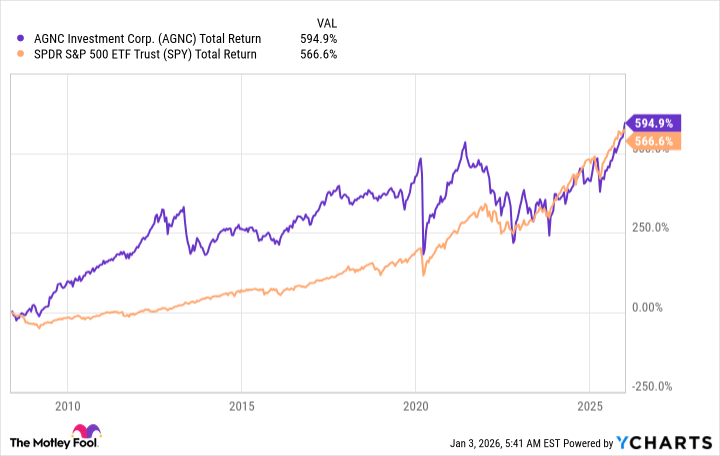

If you are a dividend investor, AGNC is probably best avoided. However, that doesn't mean it is a bad investment. The key is that management's goal isn't reliable dividend payments. The goal is total return, which assumes the reinvestment of dividends. If you look at total return, AGNC has actually performed fairly well.

Since the mortgage REIT's (mREIT) inception, it has actually outperformed the S&P 500 (^GSPC 0.34%) index. Notably, the stock has performed very differently from the index, suggesting it could provide valuable diversification benefits to a long-term investor focused on asset allocation. Viewed in this way, AGNC Investment could be a key part of a diversified portfolio that builds wealth over the long term.

AGNC Total Return Level data by YCharts.

That said, investors need to understand that AGNC Investment, like all mREITs, is a complex business. It basically manages a portfolio of mortgage securities. These securities are created by pooling together mortgages into bond-like investments. In some ways, it is more like a mutual fund than a traditional operating business. However, if you are willing to do a little extra legwork to understand the business, it could be a valuable part of a millionaire-maker portfolio.

Understand yourself and what you are buying

AGNC Investment, when used correctly, can be a valuable component of a diversified portfolio. However, you must understand that it is a total return investment, not an income stock. If you are looking for reliable dividend stocks and buy AGNC, you are likely to be let down by its volatile dividend. If you are an asset allocator focused on total return, however, it could be just what you are looking for.

In other words, ensure you understand both your personal investment goals and the goals of the investment you are purchasing. If they line up, you could be a big winner. If they don't line up, as AGNC Investment highlights, you could end up disappointed.