Intel (INTC 3.53%) stock has surged to start the year. The tech company's stock is up 15.5% year-to-date as of this writing -- and that's on top of a gain of more than 80% last year. The strong momentum has likely caught the attention of many investors. Can the chipmaker's stock continue to outperform?

Much of the stock's gain so far in 2025 has been fueled by hype around the company's new Intel Core Ultra Series 3 processors -- the company's first compute platform built on its Intel 18A semiconductor foundry in the U.S.

With its Core Ultra Series 3 processors, being the first AI (artificial intelligence) personal computing platform built on the company's new U.S.-based Intel 18A process technology, some investors may be betting that this could be a major accelerant for Intel's turnaround effort as it repositions its business to benefit from AI. After all, not only could the Ultra Series 3 processors be a game changer, but perhaps Intel's 18A manufacturing process can attract other chip customers looking for U.S.-based manufacturing.

But are investors getting ahead of themselves?

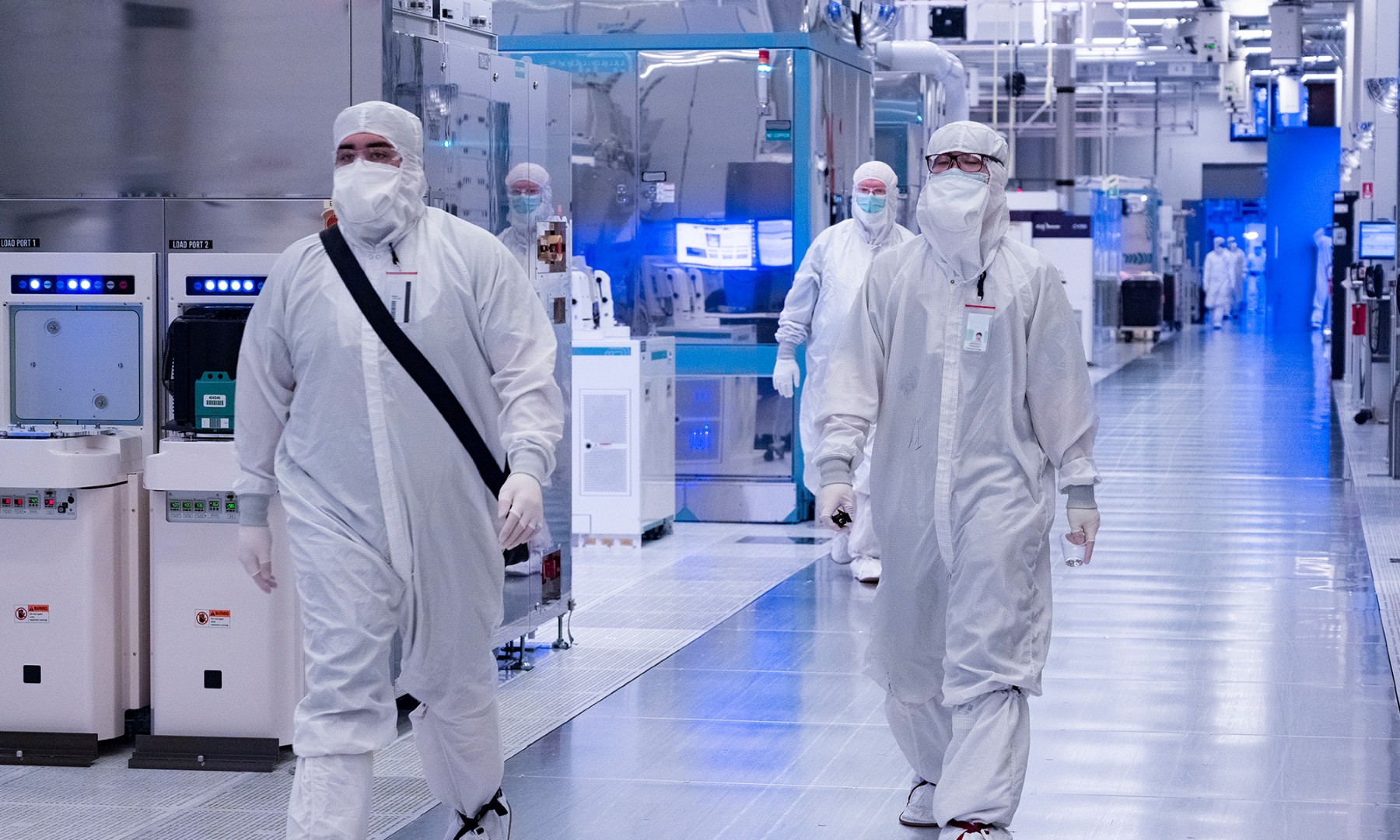

Imag source: Getty Images.

What we know about Intel's latest chips

Intel is talking a big game when it comes to both its core Ultra Series 3 processors and the underlying 18A manufacturing process.

In fact, Intel said in a Jan. 5 press release about the new technologies that 18A is the "most advanced semiconductor process ever developed and manufactured in the United States."

Additionally, Intel asserts that its Core Ultra Series 3 has a competitive advantage over other chips in terms of critical edge AI workloads. Specifically, the chip can deliver "up to 1.9x higher large language model (LLM) performance," as well as improved performance when it comes to power efficiency, the company said in the press release for the chip.

While it may be some time before investors have clear insights into customer demand for the Core Ultra Series 3 processors since pre-orders didn't start until Jan. 6, it's possible that the company was already having some serious conversations with a few big customers before it announced the chip.

Intel said the chips will be available globally beginning Jan. 27.

What about the stock?

Of course, the average investor won't be able to make much sense of the technical specs of both Intel's new chips or even its underlying U.S.-based manufacturing process. What will really matter is when Intel provides insights into orders. Hopefully, investors will hear about this when the company reports its fourth-quarter earnings on Thursday, Jan. 22.

Until then, all investors can do is examine recent results and the stock's valuation, as well as management's statements about its business in recent earnings reports and earnings calls, to form an opinion about the stock.

Intel's fiscal third-quarter revenue rose 3% to $13.7 billion. But, more importantly, Intel CEO Lip-Bu Tan noted that, "AI is accelerating demand for compute and creating attractive opportunities across our portfolio, including our core x86 platforms, new efforts in purpose-built ASICs and accelerators, and foundry services."

Further, Intel's recent sequential progress in reaccelerating its business is noteworthy. It wasn't long ago that the company was reporting substantial year-over-year revenue declines. In the fourth quarter of its fiscal 2024 (the period ended Jan. 30, 2025), Intel's revenue was down 7% year over year. But trends have been improving. Revenue for the first quarter of fiscal 2025 was flat year over year, and revenue was flat compared to the year-ago quarter in fiscal Q2 as well. Of course, fiscal third-quarter revenue rose 3% year over year.

NASDAQ: INTC

Key Data Points

With Intel repositioning its business to capitalize on AI tailwinds, an eventual return to strong growth rates seems inevitable. But investors may have already priced a turnaround in. The company now commands a market capitalization of more than $200 billion despite Intel still struggling to be consistently profitable.

Sure, the company did swing to a profit in its most recent quarter, reporting earnings per share of 90 cents, up from a loss of $3.88 in the year-ago quarter and from a loss of $0.67 in fiscal Q2. In addition, Intel management noted in its third-quarter earnings release that demand for its products was outpacing supply, and that it expected this trend to persist into 2026. So, if Intel's business keeps up this trajectory, it's possible that the business grows into the stock's valuation.

Overall, however, I believe the risks of technological disruption or weaker-than-anticipated demand are too high, given the stock's marked-up price compared to where shares were trading a year ago.

Can the stock continue to rise sharply this year? It's possible. However, given the uncertainties in the fast-paced chip industry, we can't rule out the possibility that the company may stumble in an unexpected way, leading to a stock decline. In short, Intel is a risky stock at this valuation -- one I'll personally stay on the sidelines for.