Amazon (AMZN +1.98%) just wrapped up what most investors would consider a failure in 2025, at least for the stock. Amazon's stock rose about 5%, trailing the S&P 500's performance of 16%. Nobody who invested in Amazon expected it to lose to the market, but 2026 could be a year for it to bounce back and regain its status as a market-beating stock.

If you followed Amazon's business throughout 2025, it may come as a surprise that its stock underperformed the market, as its results were quite strong. If Amazon can produce another year of strong results, I have no doubt that it will be a great stock pick for 2026. There are a lot of signs that point in that direction, and I think it makes Amazon one of the top stocks to buy now.

Image source: Amazon.

Amazon is doing well across the board

Amazon is more than just the e-commerce site you visit to purchase products. While it sells its own goods on the platform, it also sells goods from other sellers, has subscription revenue from its Amazon Prime membership, and sells ads. If only one of these segments is doing well, it's not a great sign for the business overall. However, Amazon's commerce divisions have been knocking it out of the park recently.

In Q3, its online stores, third-party seller services, advertising services, and subscription services all posted recent highs or tied for recent highs. That's fantastic for Amazon, and if it can keep up these levels, it should result in a higher stock price in 2026. The best division of its commerce empire is actually its advertising services, which rose 24% year over year to $17.7 billion in revenue. That makes advertising its fourth-largest component. However, it's far more important than that.

NASDAQ: AMZN

Key Data Points

Although Amazon doesn't break out the operating margin of its advertising business, we know from other ad-focused businesses that its operating margin is likely in the 30% to 40% range. For reference, the North American commerce segment as a whole posts an operating margin of 4.5%.

If advertising services continue to grow at this rapid pace during 2026, Amazon's operating profits will increase at an outsize pace, as long as there aren't any other items that offset it. This could boost Amazon's profits by a wide margin -- a great sign that its stock is primed to soar in 2026.

The other part of Amazon's business is a similar story. Amazon Web Services (AWS) is Amazon's cloud computing segment. Like advertising services, its operating margin is far greater than the commerce side of Amazon. In Q3, AWS posted an operating margin of 35%. Although AWS only makes up 18% of Amazon's total revenue, it accounted for 66% of operating profits. Advertising services likely have a similar margin profile and makeup, and the continued success of these two businesses is what Amazon needs to be a successful stock pick in 2026.

But what kind of returns can investors expect?

Amazon isn't going to beat the market by a wide margin

Amazon isn't the Amazon of 10 years ago. It's a mature business looking to grow wherever it can, and expecting much more than mid-double-digit growth isn't wise. Amazon also carries a valuation similar to its peers.

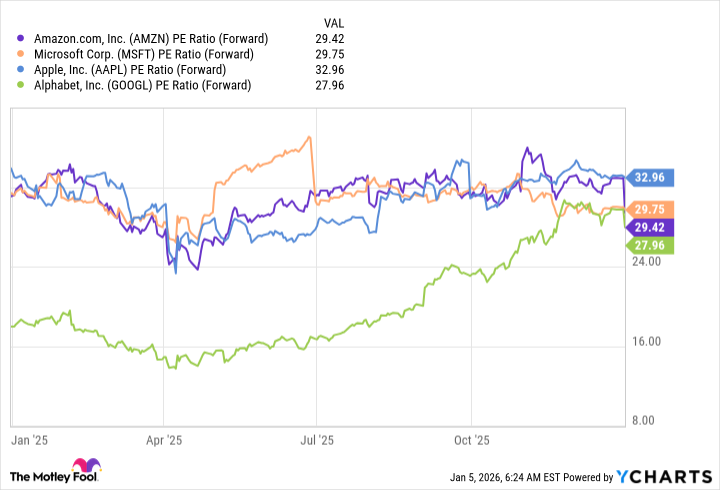

AMZN PE Ratio (Forward) data by YCharts

At 29 times forward earnings, Amazon's stock isn't cheap, but it's not terribly expensive either. The question is, do you think Amazon has a better chance to outperform its peers during 2026? If you think it does, then investing in Amazon now is a wise choice. If you don't think it can outperform them, it may be better to avoid the stock in favor of some of its peers.