Easy come, easy go. Shares of Globalstar (GSAT 1.50%) stock, the satellite communications company that's helping Apple (AAPL 0.42%) offer emergency SOS text service to its customers in cellphone dead zones, surged 5% on Tuesday after Clear Street brokerage raised its price target to $71.

On Wednesday, however, the stock gave back all those gains and more, closing the day down 9.6%. Why?

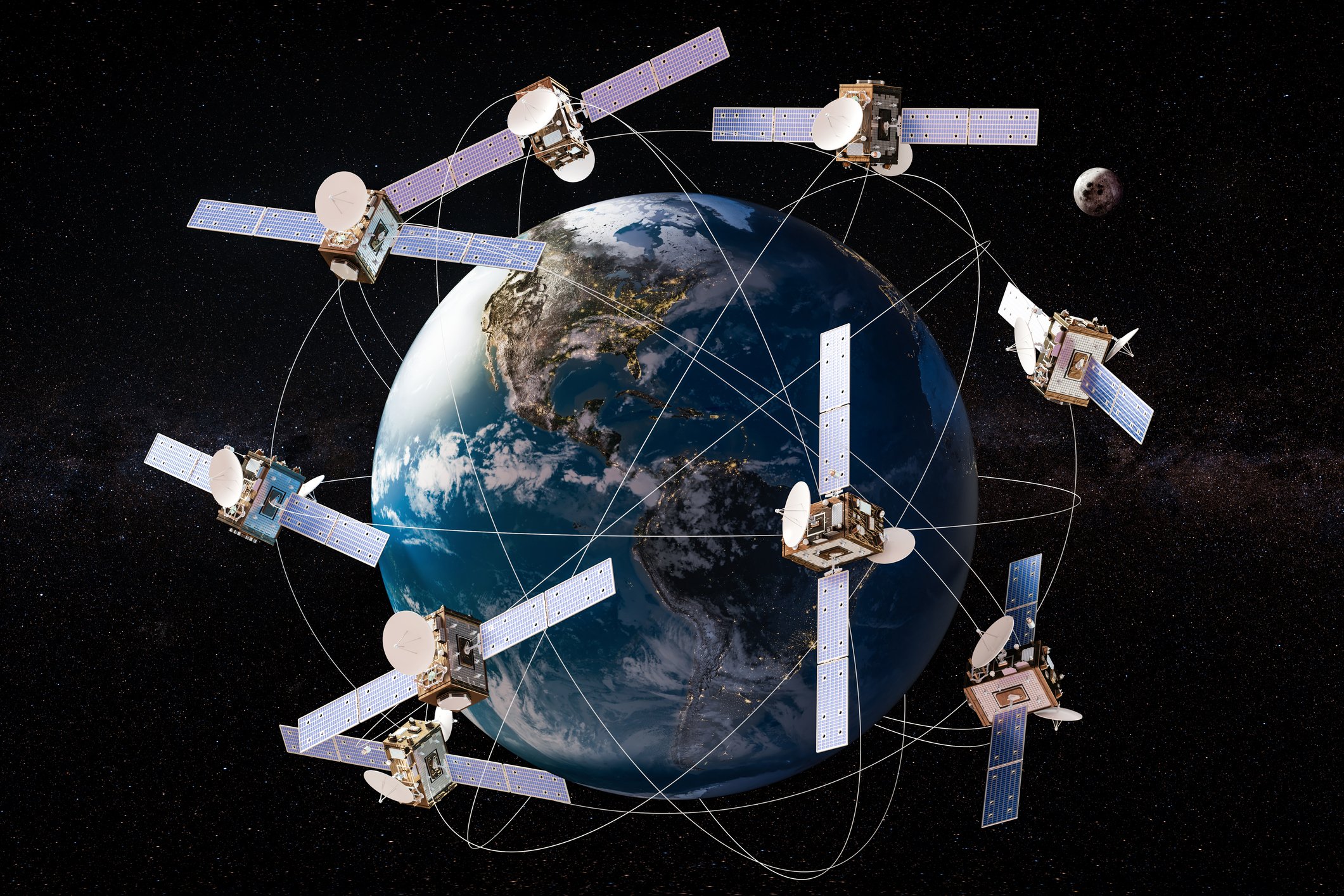

Image source: Getty Images.

Globalstar, global worries

In its note yesterday, Clear Street argued Globalstar stock looks "compelling" because its Apple contract makes it "de-risked," while the company has upside from selling its services to the government, as TheFly.com relates. A note from Scotiabank today, however, highlights other risks to Globalstar that Clear Street may have overlooked.

Specifically, in the course of downgrading shares of AST SpaceMobile (ASTS +5.63%), Scotiabank pointed out the wide disparity in capabilities between AST and SpaceX's Starlink satellite communications network, which is launching new satellites -- many equipped for direct-to-cell service -- at the rate of more than 3,000 per year.

That's a lot more than AST's mere six satellites in orbit -- but also quite a bit more than the two dozen satellites that Globalstar possesses.

NASDAQ: GSAT

Key Data Points

Is Globalstar stock a sell?

Furthering the contrast, says Coello, is the "global brand recognition" of SpaceX's Starlink system of communications satellites, that AST (and Globalstar) lack. This helps SpaceX to capitalize upon its rapid deployment of satellites. Coello calls SpaceX and Starlink "unstoppable." These companies could become even more unstoppable after SpaceX conducts a $1.5 trillion IPO later this year, flooding the company with cash that it can use to build its business even faster.

Can Globalstar, which earned a full-year profit only once in the past decade, and isn't expected to turn profitable again until 2027, compete with the unstoppable Mr. Musk?

I have my doubts.