Netflix (NFLX 0.22%) operates the world's largest streaming platform for movies and television shows, with over 300 million paying members. The company is using its immense scale and soaring profits to outspend its competition when it comes to creating and licensing content, further cementing its dominance.

Despite Netflix's continued success, its stock has declined by 32% from its mid-2025 peak. However, it's still up 84,837% since its initial public offering (IPO) in 2002, so history would suggest the recent dip could be a mere bump in the road ahead of further gains in the future.

Netflix will certainly face challenges along the way, but opportunities to invest in this stock at such a steep discount don't come around very often. Is it time to buy?

Image source: Netflix.

Netflix recently announced a significant acquisition

Netflix is constantly innovating to attract subscribers, which involves designing new pricing structures that appeal to people of all income levels. In 2022, the company launched a subscription tier supplemented by advertising for a price of just $7.99 per month, making it far cheaper than the Standard ($17.99 per month) and Premium ($24.99 per month) tiers.

The ad tier often accounts for around half of all new signups in countries where it's available, so it's been a raging success. Plus, while the value of each Standard and Premium member is relatively static, the value of an ad-tier member increases over time because Netflix can charge businesses a higher amount for advertising slots as this member base grows.

Therefore, offering high-quality content not only attracts new members, but also increases the amount of money Netflix can charge businesses to run ads. Live sports, for example, command a premium, which is why the company is investing heavily to license everything from boxing to the National Football League.

NASDAQ: NFLX

Key Data Points

Netflix also announced plans to acquire Warner Bros Discovery (WBD 0.94%) in December, which will add an entire slate of high-quality content to its catalog. Warner's intellectual property includes rights to the Harry Potter and The Lord of the Rings movies, and the Game of Thrones, The Sopranos, and White Lotus television shows. Warner also owns the entire DC Entertainment universe, which includes the rights to Batman, Superman, Wonder Woman, and more.

The proposed acquisition will cost $82.7 billion, which Netflix will reportedly pay using a combination of cash and its own stock. But it's far from a done deal, because regulators will have serious concerns about what it means for the competitive landscape. Netflix is already the dominant player in the streaming space but could become completely untouchable if this acquisition is allowed to go through.

Netflix stock is trading at an attractive valuation

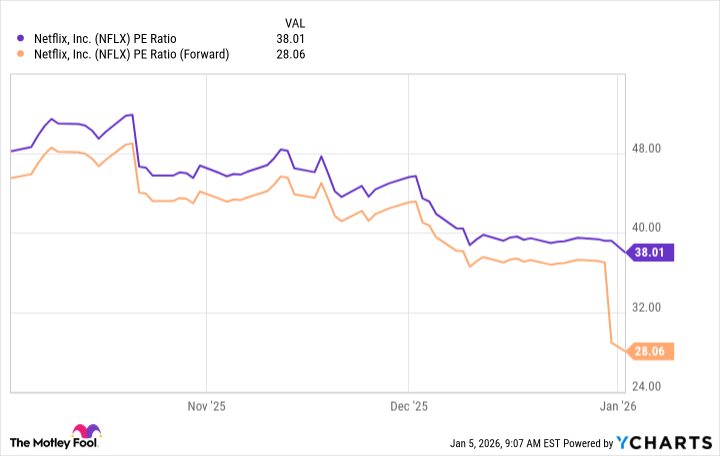

Netflix delivered earnings of $2.39 per share over the last four quarters (ended Sept. 30). That places its stock at a price-to-earnings (P/E) ratio of 38, which is a discount to its three-year average of 44.8.

Looking ahead, however, Wall Street's consensus estimate (provided by Yahoo! Finance) suggests the company could produce earnings of $3.23 per share during 2026, placing its stock at a forward P/E of just 28.1.

NFLX P/E Ratio data by YCharts.

That means Netflix stock would have to climb by 35% this year just to maintain its current P/E ratio of 38, assuming Wall Street's 2026 earnings estimate proves to be accurate.

Later this month, Netflix will report its operating results for the final quarter of 2025, which is expected to cap off a record year from a financial perspective. Investors will be eyeing an update on the company's booming advertising business, where revenue doubled in 2024 and was expected to more than double again in 2025, based on management's most recent guidance.

As I mentioned earlier, each Netflix ad-tier member could become more valuable over time. Because they account for such a large chunk of new signups, they'll have a growing influence over the company's financial results in 2026 and beyond.

There is definitely some uncertainty on the horizon, mainly surrounding Netflix's pending acquisition of Warner Bros. But the company was already doing fine without this deal, and if it does go through, it will only add value for shareholders. Therefore, the recent 32% dip in Netflix stock might be a great buying opportunity for long-term investors.