Growth stocks have soared over the past few years, with many well surpassing the S&P 500's gains. Certain players have climbed in the triple and even quadruple digits as investors rushed to get in on companies focused on artificial intelligence (AI), quantum computing -- and even players involved in high-growth healthcare areas such as weight loss drugs.

Investors also have flocked to growth stocks amid optimism about the current bull market and a better interest rate environment -- the Federal Reserve has been lowering rates in recent times, a move that makes it easier for companies to borrow and expand. All of this has made growth stocks a favorite of investors, and one stock in particular continues to crush the market.

This player, one that's already winning in the AI space, has soared 2,700% over the past three years. Could the gains continue? Let's find out.

Image source: Getty Images.

The AI boom supercharges growth

This company isn't new to the scene; instead, it's been around for more than 20 years. But the AI boom supercharged revenue growth and brought this tech player into the spotlight. The company I'm talking about is Palantir Technologies (PLTR 3.47%).

Several years ago, Palantir was most known for its contracts with governments. The company's software platforms help customers aggregate often difficult-to-access data, analyze it, and put it to work -- various government departments and agencies have found this useful, and that's translated into steady growth for Palantir.

But the launch of Palantir's artificial intelligence-driven product, called Artificial Intelligence Platform (AIP), more than two years ago represented a turning point for the company. Revenue growth took off as this system offered customers -- eager to get in on the AI story -- a way to immediately apply AI to their needs.

Palantir launched AIP bootcamps to introduce potential customers to the service, and these have resulted in significant contract wins. For example, a healthcare company completed a bootcamp in April of last year and then signed a $88 million contract with Palantir a month later.

NASDAQ: PLTR

Key Data Points

A flourishing commercial business

And speaking of companies, they have become major growth drivers for Palantir -- so the software player no longer leans heavily on government contracts for growth. Instead, the government and commercial businesses each are generating major revenue gains quarter after quarter. Business in the U.S. is particularly strong, with U.S. government revenue advancing 52% in the latest quarter and U.S. commercial revenue surging 121%.

Palantir's U.S. commercial business included 14 customers about five years ago, and now the company has hundreds of commercial customers -- and U.S. commercial deal value has reached records. In the quarter, it rose more than 340% to $1.31 billion. So we can see how far this business has come, and considering the demand for AI, it's likely that positive momentum will continue.

The company also has expertly balanced its growth ambitions with profitability, as we can see through its Rule of 40 score of 114%. A score of at least 40% signals a company is doing well here, so Palantir's levels look particularly impressive.

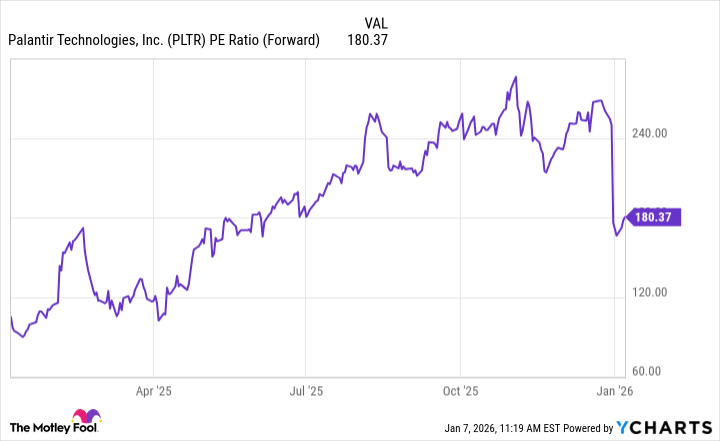

Valuation troubles

One problem Palantir has faced in recent quarters, though, is valuation. As the stock exploded higher, so did its price tag, prompting some investors to worry about whether it could sustain such levels. In recent weeks, valuation has slipped, though it still remains at lofty levels.

PLTR PE Ratio (Forward) data by YCharts

So now, especially at the start of a new year, it's logical to wonder if this AI star will continue to outperform the S&P 500. It's impossible to predict short-term movements, of course, but it's reasonable to be optimistic about Palantir's trajectory -- especially if we take a long-term view.

The recent dip in valuation may encourage some investors to get in on this growth story. And it's also worth noting that many tech companies go through periods of high valuation in their early days of growth -- so if you buy at today's levels and hold on for a few years, you may see valuation even out.

Palantir should continue to benefit from the quality of the technology it's built out over the years and from ongoing demand for AI-driven products and services. Investors have recognized these strengths, and that's why the stock has taken off -- and over time, it may continue to crush the market.