The S&P 500 had another banner year in 2025, ending it with a 16% gain. Although some investors are worried about an artificial intelligence (AI) bubble, the economy is sending several signals of strength; interest rates are on their way down and retail sales are holding steady, and large companies are still pouring money into AI development, expecting to turn their investments into thriving, profitable businesses.

The market climb can continue this year, but investors should definitely be cautious; it's rare for the S&P 500 to report gains for four years in a row. Make sure you're well diversified with some strong, protective stocks as well as growth stocks that have excellent long-term prospects.

If you're in need of a top growth stock, here are three reasons to buy coffee chain Dutch Bros (BROS 5.52%).

Image source: Dutch Bros.

1. It has massive expansion opportunities

When Dutch Bros went public in 2021, it had just reached 500 stores. Most of them were on the West Coast as the company spread south from its original Oregon headquarters. As of last March, it had doubled its store count. But more importantly from an investing standpoint, it plans to double again and hit 2,029 stores by 2029. That should lead to a huge increase in revenue.

Further down the line, it sees the opportunity for 7,000 stores, again, a massive expansion that should lead to a windfall for investors.

Management has guided for at least 160 stores to open for 2025, and investors will find out if the company surpassed that when it reports fourth-quarter earnings. It's targeting 175 stores in 2026.

Management recently restructured its real estate approach, and its new model should help it boost the store opening rate. It has been experimenting with different formats, working with its mostly drive-thru portfolio and adding other features, like walk-up windows, based on location.

As of the end of the third quarter, Dutch Bros has a presence in 24 states, and it has successfully replicated its model to appeal to all kinds of customers as it moves across the country.

NYSE: BROS

Key Data Points

2. Customers are loving its beverages

There's no business without a product that resonates with customers, and loyal fans have been loving Dutch Bros' innovative and exclusive customized beverages. Investors can track that through the company's same-shop-sales growth, which has been very healthy. Same-shop sales increased 5.7% over last year in the third quarter and 7.4% for company-operated stores; Dutch Bros is partially a franchise business.

Not all same-shop, or comparable, sales are the same, though. Often, this metric contains some amount of price increases, and you need to dig in a little deeper to see where the growth is coming from. Dutch Bros' same-shop transactions increased 4.7% in the third quarter, and 6.8% for company-operated shops. That means people are purchasing more frequently.

While total revenue increased 25% over last year, and clearly much of that growth came from new stores, the comps growth is solid. That's an important piece of a viable, long-term business model.

3. It's starting to generate cash

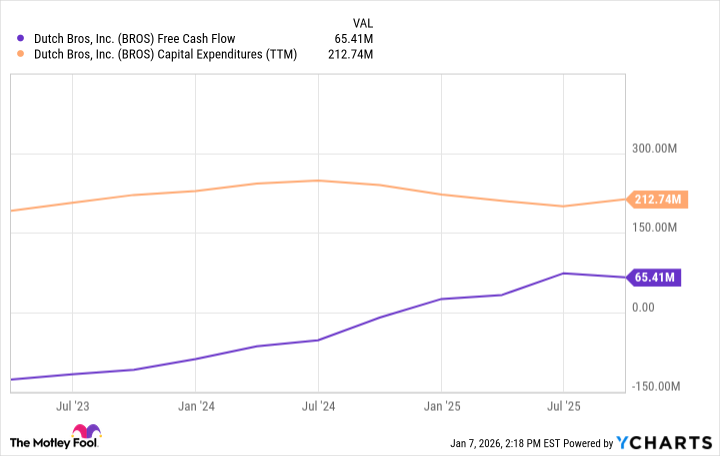

Restaurant chains like Dutch Bros need to sink a lot of cash into expansion, especially when they're just starting. Real estate and equipment cost money, and it takes time until fixed costs begin to spread out and each new store adds scale. Dutch Bros has been profitable for a few years already, and it's just starting to generate positive free cash flow.

As management develops a more efficient expansion strategy, capital expenditures have remained relatively flat, and free cash flow has turned positive.

BROS Free Cash Flow data by YCharts

Dutch Bros is now fully profitable and cash-flow-positive, and it's still reporting robust growth. It's well positioned to keep soaring and rewarding investors over many years.