Almost a decade ago, the legendary investor Warren Buffett admitted that he made a mistake in not buying shares of Alphabet (GOOGL +0.96%), saying on CNBC's Squawk Box that he should have realized its potential years ago. The Oracle of Omaha chalked up the miss to his lack of understanding of tech companies, which caused him to misunderstand their value proposition.

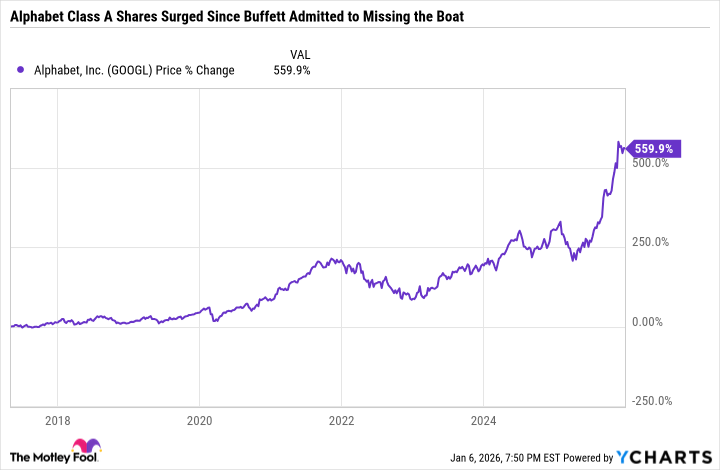

Yet for over eight years after that interview, Buffett declined to buy shares of Alphabet. While the exact date of Berkshire Hathaway's (BRK.B +0.00%) purchase of Alphabet shares in Q3 wasn't disclosed, the stock rose 559% from Buffett's May 7, 2017 interview to Sept. 30, 2025, the end of the quarter.

Why would Buffett feel that he had missed out on a fantastic stock before its additional 559% run, but not after? Or was it one of his lieutenants at Berkshire who made the call? Here's what we know.

Image source: Getty Images.

Why Buffett kicked himself for missing Alphabet

Buffett was hard on himself in the 2017 interview for a reason beyond the stock's meteoric rise. With Berkshire's consumer insurance company subsidiary paying Alphabet $10 or $11 per click, he said, it should have been clear to him that this was a special company.

But in the same interview, he admitted to having gotten still another tech stock wrong when he had bought shares of International Business Machines in 2011, saying, "I don't value IBM the same way that I did six years ago when I started buying." He also noted that the company had "run into some pretty tough competitors."

Buffett said that if forced to either buy shares of Alphabet or short them, he would choose to buy. Of course, that's hardly a ringing endorsement -- and as noted, he would hold off on Alphabet shares until late 2025. So, what changed?

It's speculation on my part, but after watching IBM be undercut by those "pretty tough competitors," Buffett was deeply hesitant to buy another tech stock unless he was confident it could maintain an advantage over competition--the business "moat" he has said he looks for in his investments.

True, that interview was a year after the biggest tech investment of Buffett's career, his 2016 move on Apple. But at another CNBC interview, Buffett emphasized the strength of Apple's moat, going so far as to say that iPhone users wouldn't accept a $10,000 payout if it meant giving up iPhones forever.

NASDAQ: GOOGL

Key Data Points

A two-billion-user "network effect" might protect Alphabet from competition

Alphabet enjoys an advantage that goes beyond typical brand loyalty, stemming from what's called the network effect. As more people use its search engine, Alphabet gathers more data to improve the user experience, thus attracting more users, which brings even more data to refine the user experience, which attracts still more users, creating a virtuous cycle.

And it's possible that in Q2, the last quarter before Berkshire's Alphabet investment, the power of its network-driven moat became too much for Buffett to ignore. Every year since 2011, its ad revenue has grown as it gathers more and more data to monetize its billions of users. In 2024, Alphabet logged $350 billion in ad revenue, up from $307 billion in 2023 and almost 10 times its 2011 total of $37.9 billion. That's an average annual growth rate of 18.7%.

In Alphabet's Q2 earnings report, there was certainly no sign of the vulnerability to competitors that plagued IBM and possibly made Buffett leery of almost all tech stocks. From Search and YouTube advertising, to its Subscriptions, Platforms and Devices segments, to Google Cloud, each enjoyed double-digit revenue growth. And Alphabet's new Search feature, AI Overviews, has attracted two billion monthly users across 200 countries, making it perhaps the most valuable network in human history.

It's possible that one of Buffett's lieutenants, Ted Weschler or Todd Combs, made the decision to invest in Alphabet rather than Buffett himself (Combs left Berkshire in December 2025, after this purchase was made). But my hunch is that Buffett saw the prolific revenue growth across Alphabet's segments, powered by its network effect that provides the moat he cherishes in investments, and decided that it's never too late to buy a terrific company.