The stock market has had quite a run over the past three years. It roared into bull territory, and that momentum has continued, with the S&P 500 delivering annual gains of 24%, 23%, and 16%, respectively. Artificial intelligence (AI) stocks, quantum computing players, and other growth companies have led the movement -- for a couple of reasons. Investors, seeing the potential of these exciting technologies, have aimed to get in on future leaders early in the story. That way, they may maximize their gains as developments unfold.

Investors also have liked the idea that we're heading into a lower interest rate environment. The Federal Reserve began cutting rates in 2024 and continued to do so last year. A lower rate environment is positive for companies as it reduces their borrowing costs, making it easier for them to grow. And it also offers relief to consumers' wallets -- and that's great news for consumer-related businesses.

Now, as we start off a new year, investors are wondering what's next for stocks. Will the market continue to soar in 2026? It's a great idea to zoom in on the market and consider the current picture closely. And when we do this, we can see that the stock market is doing something witnessed only twice in 153 years. And history is very clear about what may happen in the new year.

Image source: Getty Images.

Last year's headwinds

So, first, it's important to note that the stock market's path throughout this bull market hasn't been one straight line upward. Various elements have interrupted the action here and there. Last year, for example, President Donald Trump's plan to launch import tariffs weighed on the S&P 500 as investors worried about the impact on corporate earnings. Some U.S. companies, like Apple, produce their goods in other countries and must import them, while others, such as Target, source certain products internationally. They would bear the costs of the new tariffs.

But stocks quickly rebounded. Trump's negotiations with countries, various exceptions made for certain industries, and corporate earnings reports that showed continued growth offered investors reason to be optimistic.

The market also slid later in the year amid concern about the possibility of an AI bubble emerging. Again, investors quickly regained confidence as they focused on the high levels of demand for AI products and solid earnings reports from AI giants such as Nvidia and Advanced Micro Devices.

NASDAQ: AMD

Key Data Points

A rare move for the S&P 500

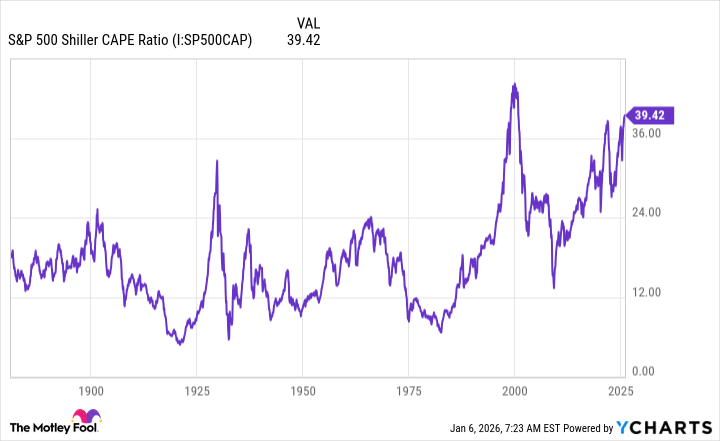

Market optimism has outweighed any of the potential problems, and that has driven the market to do something rarely seen in all of its history. This has to do with the S&P 500 Shiller CAPE ratio, a measure of valuation using stock prices and earnings per share. The measure is particularly accurate because it considers earnings over a decade, accounting for any shifts in economic conditions.

And this measure is telling us that stocks are at one of their most expensive levels ever. The Shiller CAPE ratio has reached 39, a level it only reached once before -- during the dot-com boom.

S&P 500 Shiller CAPE Ratio data by YCharts

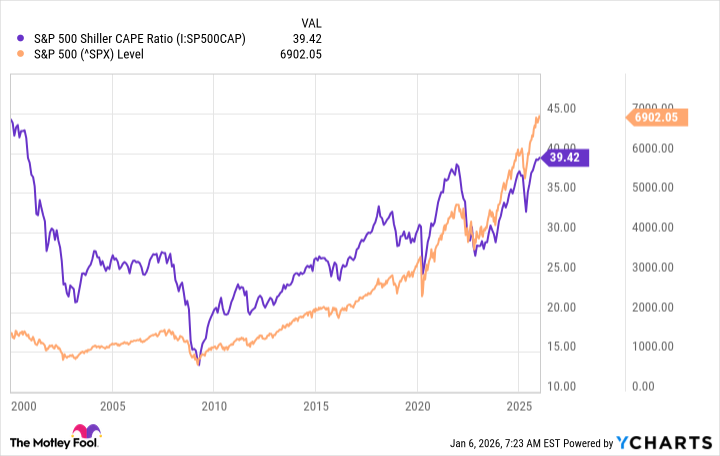

What's next for the market? A look at history shows us that following peaks in valuation levels, the S&P 500 has declined.

S&P 500 Shiller CAPE Ratio data by YCharts

And from early 2000, when the dot-com bubble started to deflate, through February 2003, the S&P 500 lost more than 40%.

So, the evidence is strikingly clear: When valuations soar, the index eventually will slip. This means we could be heading for a decline in 2026 -- but the good news is this doesn't necessarily mean a full-year or more in negative territory. The S&P 500 is likely to pull back at some point, if history is right, but this movement may be brief, lasting a few weeks or even a month or two. And the benchmark still could finish 2026 with a gain.

What does this mean for investors? It's important to pay attention to valuations and avoid buying stocks that are too expensive. But when the price is right, keep investing in quality players and plan on holding onto them for the long haul. With this strategy in place, you may score an investing victory over time -- even if the market slips at some point in 2026.