Nvidia (NVDA 0.72%) currently has a $4.5 trillion market cap. If it were to rise to $7 trillion in 2026, that would require the stock to rise by 56%. Any stock that rises that fast in a year is well worth an investment, and if Nvidia truly has a shot at becoming a $7 trillion company in 2026, it should be at the top of every investor's shopping list.

I think that Nvidia can achieve this lofty goal in 2026, but it will require a few things to happen. If these things transpire, I have no doubt that Nvidia will be a top stock to own for this year.

Image source: Getty Images.

AI spending isn't slowing down

AI hyperscalers spent a record amount of money constructing data centers in 2025. All of them have informed investors that 2026 will see increased spending as well. That's a big deal for Nvidia, as its graphics processing units (GPUs) are the gold standard computing unit used to train and run artificial intelligence models.

Nvidia's GPUs are the best available, but so are the supporting components, like its controlling software and connecting infrastructure. This makes Nvidia the go-to company to outfit data centers, but there's an issue: Nvidia has sold out all of its cloud GPU capacity. Nvidia must work to increase its capacity to meet this unprecedented demand, and it has already taken several steps to maximize its output.

NASDAQ: NVDA

Key Data Points

First, Nvidia plans to significantly reduce its gaming GPU output in 2026. That move will free up chips to be used in the more profitable and in-demand cloud GPUs. Second, Nvidia is pushing its chip supplier, Taiwan Semiconductor Manufacturing, to increase its output. That will give Nvidia greater supply and allow it to increase production to meet the massive demand in the market for its chips.

I believe both of these items are achievable for 2026, which will enable Nvidia to maintain its rapid growth rate. For fiscal year 2027 (ending January 2027), Wall Street analysts expect Nvidia to grow its revenue by 50%. Analysts have consistently underestimated Nvidia's growth potential, so I wouldn't be surprised if the actual figure exceeds that. Furthermore, there's a somewhat unknown factor that could boost Nvidia's sales even further: China.

Nvidia appears poised to resume shipments of chip sales to China. According to Reuters, there is demand for about 2 million units, while Nvidia has about 700,000 H200 chips on hand. There could be even more demand if these initial shipments go well, and that could also boost Nvidia's growth rate this year.

All of this adds up to a company that could be worth $7 trillion if everything goes as planned for Nvidia.

A $7 trillion market cap won't be easy to achieve

For Nvidia to get to a $7 trillion market cap, we need to make a few assumptions:

- Nvidia's profit margins maintain their current level.

- Nvidia meets analysts' expectations of 50% growth.

- Nvidia's valuation stays at its current level.

- AI spending is projected to continue in 2027.

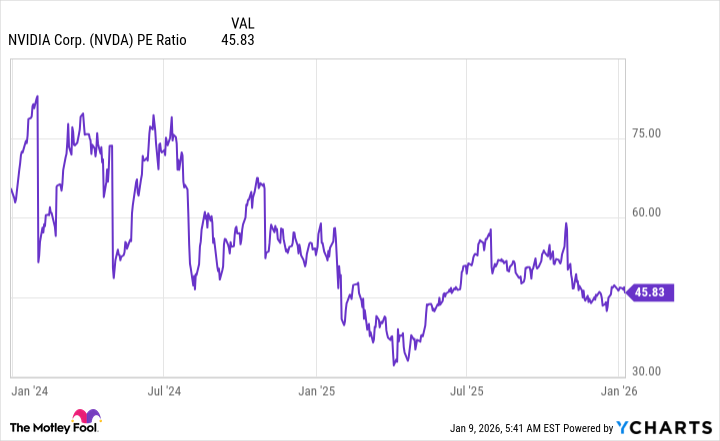

The average Wall Street analyst projects $320 billion in revenue for fiscal year 2027, at Nvidia's current 53% profit margin, which would equate to $170 billion in profits by the end of the fiscal year. Nvidia's current price-to-earnings ratio is 46, which is actually cheaper than it has been over the past few years.

NVDA PE Ratio data by YCharts

With $320 billion in profits at a P/E ratio of 46, that would value the stock at $7.8 trillion.

That would result in a monster win for investors if it occurs, and there really aren't that many unrealistic assumptions in this projection, giving me even more confidence. However, there needs to be signs of growth for 2027 as well by the end of the year; otherwise, Nvidia's stock will decline in anticipation of a demand slowdown. Multiple projections indicate that AI spending will continue to grow through 2030, making Nvidia a no-brainer stock to buy today.