If you have cash available to invest, the best time to get started always is "now" -- regardless of the time of year. That's because the earlier you begin, the more time you have to grow your portfolio. Investing isn't about jumping in and out of stocks; instead, it's about choosing excellent players, paying a reasonable price, and keeping them in your portfolio for a number of years. This long-term investing strategy is more likely to score a win for you than if you try to quickly buy and then sell the day's hottest stocks -- and it's definitely less stressful.

Investing doesn't require thousands of dollars or more -- you could get started with very little if you're buying lower-priced stocks or investing in fractional shares of some of the market's bigger players. You might buy a share or two and add to your investments when it's financially possible for you to do so.

For the purposes of this article, I'll talk about where to deploy $10,000 at the start of this new year. But even with a much smaller amount, you can apply the same ideas and potentially score a win over the long term. Let's get started.

Image source: Getty Images.

Looking ahead to what's next

So, first, it's important to note that, as one year turns to the next, it's not as if an on-off switch has been flipped in the investing world. If AI stocks were popular in 2025, they won't automatically become unpopular at the stroke of midnight on Jan. 1, 2026. But at the start of a new year, investors often like to look ahead at what may be next. Investing themes are likely to evolve and could even change as the year progresses -- so now is a great time to prepare.

One key thing to note: How to structure your $10,000 investment depends on your relationship with risk. If you're an aggressive investor, you may want to favor high-growth stocks, while cautious investors might favor the safer plays I'll mention here. Right now, I would spread this $10,000 across artificial intelligence (AI) stocks that may benefit from AI infrastructure spending, reasonably priced technology stocks that don't rely uniquely on AI, and dividend stocks, as they offer you the security of passive income. I would also set aside some cash to deploy as opportunities arise.

Choices and investment styles

Keep in mind that, in what I mention below, the dividend stocks and the tech companies that aren't heavily reliant on AI represent choices cautious investors might favor. Aggressive investors may focus on the AI stocks. In either case, though, it's important to diversify so that you have a broad selection of stocks and themes in your portfolio.

Today, companies such as Nvidia (NVDA 0.18%) and Taiwan Semiconductor Manufacturing (TSM +0.61%) are well positioned to gain from the ramp-up of AI infrastructure -- spending in that area may reach $4 trillion by the end of the decade, Nvidia predicts. Nvidia is the top AI chip designer, and TSMC actually manufactures the world's leading chips -- including Nvidia's. As data centers expand, demand should march on for these chips, leading to revenue growth for these two companies.

NASDAQ: NVDA

Key Data Points

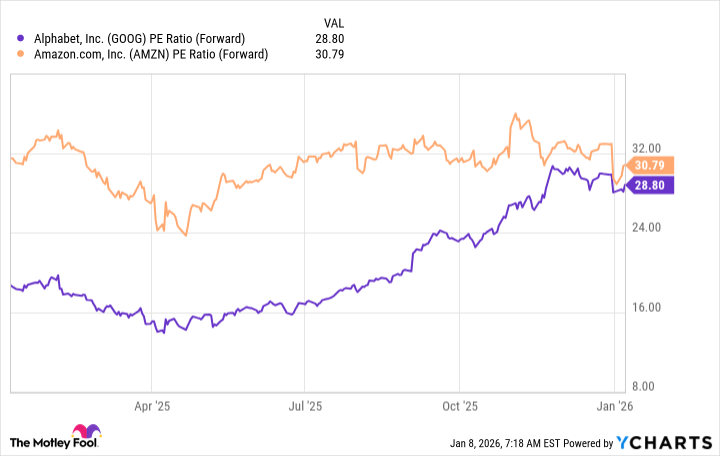

For a mix of growth and safety, investors may choose e-commerce and cloud giant Amazon (AMZN +0.14%) and Alphabet (GOOG 0.18%) (GOOGL 0.20%), owner of Google Search and Google Cloud. These stocks are reasonably priced today, and though they may benefit from the AI boom, their businesses also are thriving for other reasons -- Amazon generates growth through e-commerce and Alphabet through advertising across its Google platform.

GOOG PE Ratio (Forward) data by YCharts

Stocks for any market environment

Dividend stocks represent a great addition to any portfolio for any market environment. They offer you passive income that may support your investments during difficult times, and during better days, they'll offer you an extra lift. Without knowing exactly what 2026 will bring, it's a fantastic idea to add this sort of player to your portfolio. To choose, head for the list of Dividend Kings as these players have a track record of at least 50 years of dividend increases. This shows their commitment to rewarding shareholders.

Coca-Cola and Abbott Laboratories are among my favorites -- the former for its solid moat, or competitive advantage, and the latter for its well-diversified healthcare business.

Finally, set aside some cash for opportunities. This way, if a stock you've been watching dips and valuation looks interesting, you may scoop it up. It's important to note that before setting this plan into action, make sure all of your bills are paid and you don't need this cash for other purposes.

And then, take your $10,000 (or even a much smaller amount) and put it to work for you in 2026 -- and beyond.