Quantum computing is moving from the theoretical to the commercially applicable, but only one company has achieved 99.99% two-qubit gate fidelity (a measure of results accuracy). That company is IonQ (IONQ 0.23%), and it is ready to soar in 2026.

The only company to reach the "four-nines"

IonQ has considerable momentum on its side. After achieving the momentous "four-nines" level of accuracy, IonQ demonstrated to the world that it has a competitive edge.

The company also has an impressive list of customers and partners. From Hyundai to AstraZeneca, IonQ's use cases span multiple industries, including automotive battery technology, autonomous driving, and new drug development. These partnerships with large companies are crucial in advancing the technology, demonstrating use cases in real-world settings, and ultimately, generating sustainable revenue.

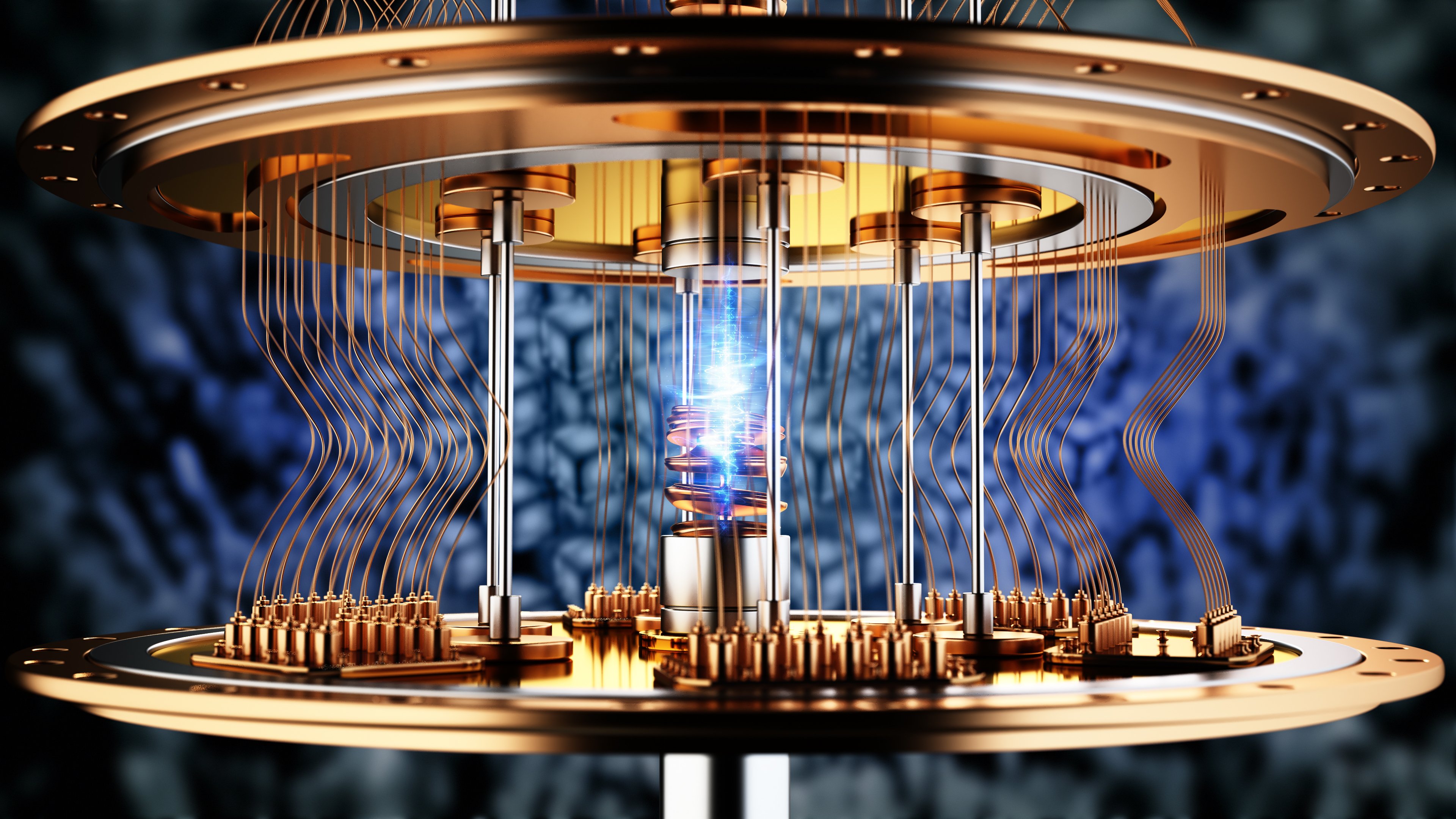

Image source: Getty Images.

Is it hype or a $100 billion opportunity?

The total addressable market for quantum computing and IonQ could reach $100 billion in the next decade. There's still plenty of risk in quantum computing. Across the quantum computing industry, there's a lot left to prove. Commercial viability is still in its early stages, and it may fall short of the hype.

Quantum computing is also a capital-intensive endeavor. IonQ reported research and development costs of $62.9 million in its latest quarter, along with total operating costs exceeding $208 million. This is compared to just $39.8 million in revenue.

NYSE: IONQ

Key Data Points

Is IonQ stock a buy?

IonQ stock is expensive right now. The stock has increased by over 63% in the past 12 months. Its price-to-sales ratio is 153 as of Jan. 9. The company's market capitalization is a whopping $17.5 billion. Is it justified? If quantum computing and IonQ's ability to achieve 99.99% fidelity keep it head and shoulders above competitors, then the stock's price is well worth the future revenue IonQ could produce.