The "Magnificent Seven" stocks are a popular grouping that makes up some of the biggest and most prominent names in the stock market. It includes:

- Nvidia (NVDA 2.59%)

- Alphabet (GOOG 0.23%) (GOOGL 0.20%)

- Apple (AAPL 1.11%)

- Microsoft (MSFT 2.82%)

- Amazon (AMZN 2.42%)

- Meta Platforms (META 2.20%)

- Tesla (TSLA 2.37%)

These companies are consistently among the top 10 in the world by market cap, and watching what they do is key to investment success.

One area that gets investors excited is stock splits, and there could be two from this group that are coming in 2026. That would generate a lot of buzz in the market, but which two stocks are poised for potential stock splits? Let's take a look.

Image source: Getty Images.

The Magnificent Seven are no strangers to stock splits

Since 2020, many companies in this cohort have split their stocks. Nvidia, Alphabet, Apple, Amazon, and Tesla have all split their stocks. That leaves out two notable exceptions: Meta Platforms and Microsoft. Neither of these two has had a stock split in a while.

For Microsoft, its last stock split came in 2003. Before that, Microsoft had a strong history of splitting its stock every few years. With a stock price approaching $500, it may be in line for one in 2026.

Meta Platforms has never undergone a stock split since its IPO in 2012. It's the most expensive stock in the Magnificent Seven at about $650 per share, but it used to trade at nearly $800 before its stock sold off following a poorly received Q3 earnings report.

NASDAQ: META

Key Data Points

I wouldn't be surprised to see either of these companies announce a stock split in 2026, which could send their shares up as a result of the hype that usually comes to a prominent stock that announces a stock split. However, I think both stocks have much better reasons to invest in them, and I think each could be a solid investment for 2026 in general.

Microsoft and Meta Platforms don't need a stock split to make them worth owning

Both Microsoft and Meta Platforms are heavily competing in the artificial intelligence sector, but with different approaches. Microsoft is taking a neutral approach and becoming an AI facilitator rather than one trying to push its own solution onto clients. While it has partnered with OpenAI, the makers of ChatGPT, to integrate its products into some of its own lineup (like Copilot in its Office platform), it also offers competing models like Grok from xAI and R1 from DeepSeek in its Azure library. This allows users to build with a wide variety of generative AI models on Microsoft's cloud computing platform, making it a neutral party in the AI arena.

While it has a vested interest in OpenAI's success, Microsoft isn't tying its success to just one product. That strategy has allowed Microsoft to achieve impressive revenue growth, specifically in the cloud computing sector, where Azure is the fastest-growing among all major cloud computing providers. I think this momentum will continue throughout 2206, making it a strong investment option.

NASDAQ: MSFT

Key Data Points

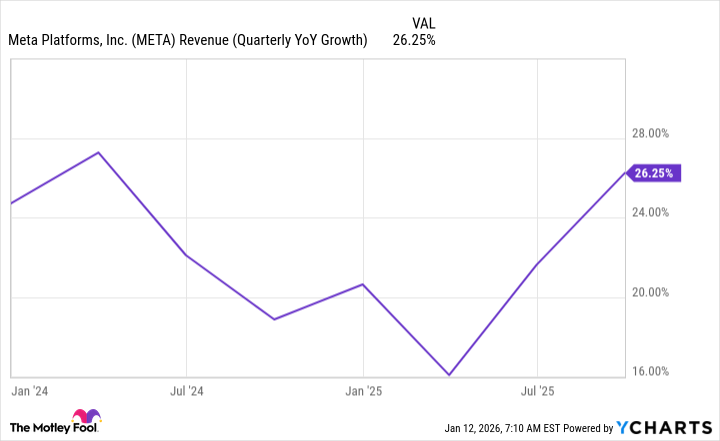

Meta Platforms is the parent company of social media platforms Facebook and Instagram. It derives most of its revenue from ads, which are already seeing huge improvements from generative AI. This has allowed Meta to grow its revenue at a rapid pace over the past few quarters.

META Revenue (Quarterly YoY Growth) data by YCharts

That's the kind of return on investment investors are looking for in generative AI, but there's one problem: Investors don't like how much money Meta is spending. They've already informed investors that projected capital expenditures, mostly being spent on AI data centers, are projected to grow at a faster dollar-figure pace in 2026 than in 2025. That likely pushes Meta's spending over the $100 billion mark, which is too far for many investors. As a result, the stock sold off.

However, I think Meta can bounce back throughout the year if the company can show investors continued returns on investments as well as breakthroughs in its AI glasses. If it does those things, Meta could be a great stock to own in 2026, regardless of whether it implements a stock split or not.