CoreWeave (CRWV +5.74%) stock went on a roller-coaster ride in 2025, rising as much as 367% following its initial public offering (IPO) in March last year before losing its wheels dramatically after hitting a 52-week high in June. The stock has lost 51% of its value from its 52-week high.

Despite the dropoff, CoreWeave stock is still up 125% since its IPO less than a year ago. And I wouldn't be surprised if the stock regained its mojo in 2026 and doubled in value by the end of the year. Let's see why that may be the case.

Image source: Getty Images

CoreWeave's solid growth doesn't justify the stock's pullback

CoreWeave is a neocloud company that operates specialized artificial intelligence (AI) data center infrastructure powered by graphics processing units (GPUs). Its data centers are utilized by AI companies, enterprises, and start-ups for building, deploying, and scaling AI applications. Additionally, major cloud computing giants needing more computing power for handling AI workloads also reach out to the company.

Therefore, CoreWeave operates in a market where demand exceeds supply by a big margin. The productivity gains delivered by AI applications in various industries have led to a big increase in data center compute demand. According to Goldman Sachs, the U.S. could witness a data center capacity shortage of around 10 gigawatts (GW) every year through 2028.

As a result, all the data center capacity that CoreWeave is building is quickly taken up. Not surprisingly, the company pointed out in November last year that it operates in a "highly supply-constrained environment where the demand for CoreWeave best-in-class AI cloud platform far exceeds available capacity."

The company was operating 41 dedicated AI data centers at the end of the third quarter of 2025 in the U.S. and Europe, offering 590 megawatts (MW) of active power capacity. CoreWeave management added that it plans to bring online at least 1 GW of active capacity in the next year or two. The good news is that it has already sold this additional capacity to customers.

NASDAQ: CRWV

Key Data Points

CoreWeave's revenue backlog was almost $56 billion at the end of Q3 2025, growing by almost 4x from the prior-year period. Its revenue, for comparison, increased by 134% year over year to $1.36 billion during the quarter. CoreWeave, therefore, has the potential to become a much bigger company in the future as it activates additional data center capacity.

The company already has lucrative contracts with major AI players, including OpenAI and Meta Platforms, among others. Importantly, CoreWeave continues to secure more contracts, despite being short of data center capacity. It recently signed a deal with Runway, which offers video generation models to production houses, gaming studios, and film studios to provide data center capacity and software solutions for accelerating its AI models.

It won't be surprising to see CoreWeave's backlog increasing further, setting up the company for stronger growth in 2026 and beyond. After all, the company can significantly expand its connected data center capacity since it reported 2.9 GW of contracted power at the end of Q3 2025. This is the amount of electrical power available to CoreWeave for setting up new data center capacity, suggesting that it can convert its impressive backlog into revenue.

The discounted valuation suggests that the stock could skyrocket

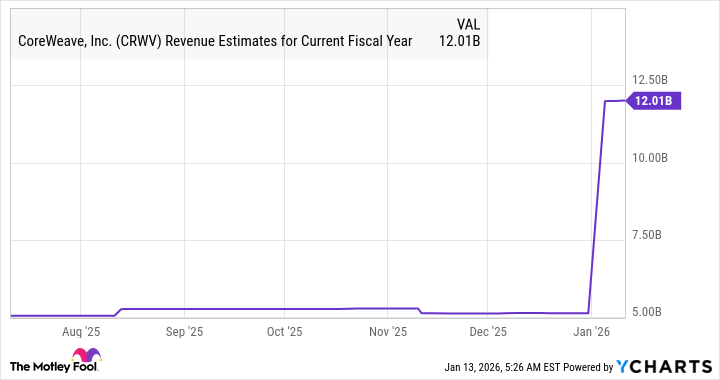

CoreWeave management forecasted $5.1 billion in revenue for 2025, which would be a 165% improvement over its 2024 revenue of $1.92 billion. Analysts expect CoreWeave's top line to more than double once again in 2026 to almost $12 billion.

Data by YCharts.

CoreWeave stock trades at 9.3 times sales, despite its remarkably impressive growth. That's just a tad higher than the 8.7x sales multiple of the U.S. technology sector. Of course, CoreWeave seems deserving of a higher sales multiple on the back of its red-hot growth and massive revenue backlog that points toward better times ahead.

However, even if the company's stock trades in line with the U.S. tech sector's average sales multiple at the end of 2026 and achieves $12 billion in sales, its market cap could jump to just over $104 billion. That's more than double CoreWeave's current market cap of $45 billion.

Investors looking to add a beaten-down AI stock that could make them significantly richer in 2026 and beyond would do well to take a closer look at CoreWeave. Its stunning growth could eventually lead to a turnaround in its fortunes on the market in the new year.