Palantir Technologies (PLTR 0.80%) has registered stunning gains of 166% on the market in the past year, driven by the impressive acceleration in the company's growth, largely due to the fast-growing demand for its artificial intelligence (AI) software solutions.

Palantir's Artificial Intelligence Platform (AIP) has proven to be a major success, enabling it to land new customers at a healthy pace and secure larger contracts from existing ones. Investors are now looking ahead to its fourth-quarter results, which it will deliver on Feb. 2.

The company needs to deliver terrific results and guidance to justify its expensive valuation. After all, Palantir is trading at a whopping 416 times trailing earnings and 117 times sales. It remains to be seen whether its stock has room to fly higher following its upcoming report. However, there is another AI-related company that's trading at a significantly cheaper valuation than Palantir that will release its next earnings report on Feb. 3, and there is a chance that one could get a nice shot in the arm when it does.

Lumentum Holdings (LITE +3.51%) has shot up by a stunning 328% in the past year. Let's look at the reasons why this tech stock could sustain its red-hot momentum following its upcoming report.

Image source: Getty Images.

AI-driven demand could help Lumentum crush estimates

Lumentum Holdings has beaten Wall Street's earnings expectations in each of the last four quarters. That pattern is likely to continue this time. That's because it is not just witnessing robust demand for its optical and photonic components, which enable high-speed data transmission in AI data centers. It's also benefiting from higher utilization rates and a favorable product mix.

NASDAQ: LITE

Key Data Points

The company's non-GAAP (adjusted) operating margin shot up by a remarkable 15.7 percentage points year over year in the first quarter of its fiscal 2026 (which ended on Sept. 27) to 18.7%. Additionally, its revenue during the quarter increased by 58% to $337 million. This explains how its adjusted earnings shot up sixfold in the period to $1.10 per share.

For its fiscal Q2, Lumentum is forecasting $650 million in revenue at the midpoint of its guidance range. That would amount to a bigger year-over-year increase of 62%. Meanwhile, adjusted earnings are expected to more than triple year over year to $1.40 per share. The stronger top-line jump can be attributed to Lumentum's focus on boosting its manufacturing capacity.

Don't be surprised if management issues a strong outlook for the current quarter, too, because the company now generates more than 60% of its revenue from the cloud and AI infrastructure market. It has been experiencing robust demand from both hyperscalers and networking equipment manufacturers.

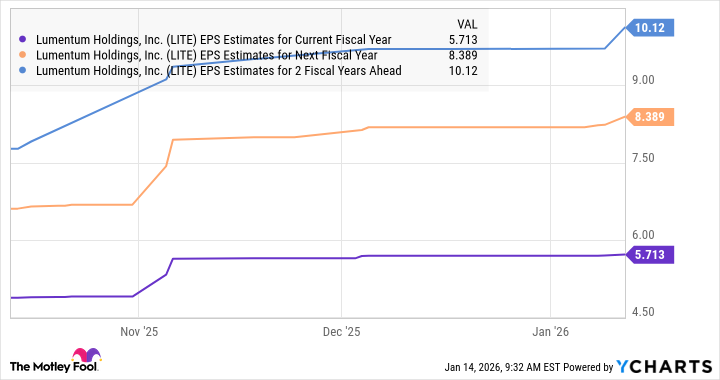

Given that the infrastructure investments by the major hyperscalers could hit $3 trillion in the next five years, according to Moody's, Lumentum has solid room for growth in its cloud and AI business. Not surprisingly, analysts have become bullish about the company's prospects, forecasting healthy double-digit-percentage earnings growth.

LITE EPS Estimates for Current Fiscal Year data by YCharts

The stock's expensive, but it is still worth buying

Lumentum's red-hot stock rally over the past year has brought its price-to-earnings ratio to 208. However, its phenomenal earnings growth and outlook explain why its forward earnings multiple is a significantly lower 58. It is worth noting that Lumentum's earnings are growing at a faster pace than Palantir's, but it trades at a substantially lower valuation.

What's more, Lumentum's sales multiple of 13 is significantly lower than Palantir's. Of course, it is not an apples-to-apples comparison since Lumentum is a hardware-centric company while Palantir is a software specialist, but both are serving the fast-growing AI market.

As such, buying Lumentum right now looks like a smart move, as its outstanding growth is likely to result in more upside for the stock. In fact, even if Lumentum's valuation multiple contracts so that it trades in line with the U.S. tech sector's average earnings multiple of 45 after three years, if it achieves the $10.12 EPS that analysts predict (as illustrated in the chart above), its stock price could jump to $455.

That would be a 28% jump from current levels, but don't be surprised to see this AI stock flying significantly higher than that, as it could continue to trade at a premium valuation thanks to its outstanding earnings growth.