Nvidia (NVDA 0.44%) reached a significant milestone last year: It became the world's first $4 trillion company -- and along the way surpassed longtime market giants Apple and Microsoft. Prior to 2025, these two had reigned as the biggest companies for a number of years. The reason for such a shift? Nvidia's earnings growth took off as it became the key player in the artificial intelligence (AI) revolution.

Nvidia designs the most powerful AI chips around, and customers have raced to add these valuable tools to their data centers. Meanwhile, investors, seeing AI's growth as well as forecasts predicting the market will soon reach into the trillions of dollars, have jumped on board, buying shares of leading AI companies such as Nvidia.

As 2026 gets started, it's not surprising to see investors speculating about the company's next market cap milestone. My prediction is that Nvidia will become the first $6 trillion company in 2026. Let's find out how this might unfold.

Image source: Getty Images.

Nvidia's path to $4 trillion

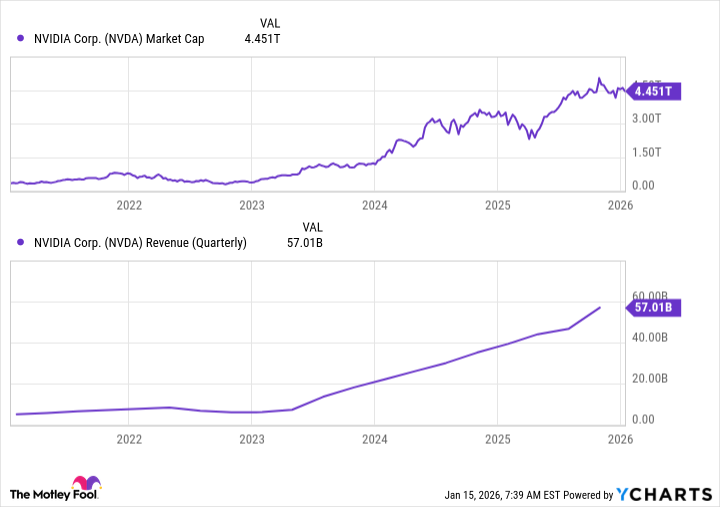

First, it's important to trace Nvidia's path so far along the market value road. Nvidia became a trillion-dollar company just a couple of years ago, with market value rising along with the company's revenue -- and the momentum accelerated over the past year.

NVDA Market Cap data by YCharts

As mentioned, this is thanks to Nvidia's dominance in the AI market and investors' interest in betting on this potentially game-changing technology. The obvious investment choice has been Nvidia, considering its market position and proven ability to bring in high levels of revenue and profit. In the recent quarter, for example, revenue climbed 62% to $57 billion, and net income advanced 65% to $31 billion. The company also has a solid level of cash at $60 billion, allowing it to invest in innovation.

And speaking of innovation, Nvidia continues to uphold its promise of releasing new chips annually -- the Rubin system is on track for launch later this year, representing a potential catalyst for earnings and stock performance.

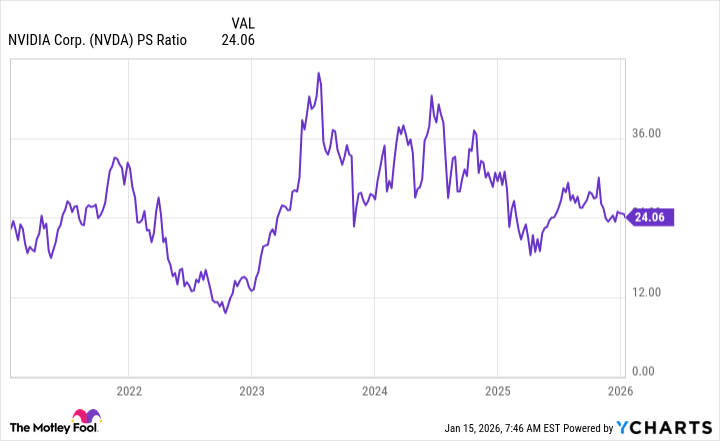

Now, let's consider the path to $6 trillion. Today, Nvidia trades for 24x sales, but a look at this metric over the past few years shows the company has supported higher levels, well into the 30s.

NVDA PS Ratio data by YCharts

Considering Wall Street's average estimate of $213 billion in annual revenue for 2026, a $6 trillion market value would result in a price-to-sales ratio of 28 -- a level that's very reasonable for Nvidia. For the stock price, this implies a 34% gain from today's level, and that's also within reach for a company like Nvidia over a 12-month period.

NASDAQ: NVDA

Key Data Points

Predicting strong demand

So, from a mathematical perspective, Nvidia could reach $6 trillion in market value this year. Nvidia's recent comments, as well as signals we're seeing from the general market, also support this idea. For example, Nvidia chief financial officer Colette Kress recently said that demand is strong and AI product orders, including last year and this year, are surpassing the original forecast of $500 billion. And just this week, chip manufacturer Taiwan Semiconductor Manufacturing also spoke of high demand from customers and their customers.

This suggests solid earnings growth for Nvidia this year, potentially supercharged by the Rubin release, as I mentioned earlier.

Of course, these positive elements could be upset by various external factors, from disappointing economic data to political decisions. Last year, for example, the announcement of import tariffs temporarily weighed on Nvidia's stock price. There's also the possibility that concerns about valuations -- which remain high -- may resurface. Any of these points could represent risk and weigh on Nvidia stock. These potential uncertainties also may create volatility, which could result in ups and downs for the shares this year.

Still, if we set aside those external risks, I'm optimistic about Nvidia this year thanks to the points I talked about above -- and that's why I'm predicting this top AI player will become the first $6 trillion company in 2026.