"Dividend stock" is probably not your first thought when you think of American Express (AXP +2.08%), but it is, indeed, a dividend stock. As of Jan. 15, its dividend yield is just around 0.9%, which is below the S&P 500 average.

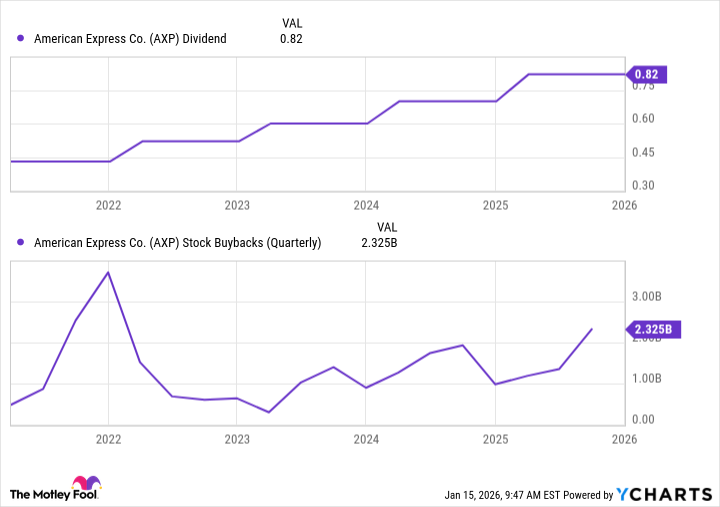

That said, the company has been aggressive with annual dividend increases and share repurchases. Its dividend over the past four payouts was $0.82 quarterly, or $3.28 annually. That's 17% higher than the previous year's dividend and more than 90% higher than what it was five years ago.

Dividend aside, AMEX has been aggressive with repurchasing shares. In the third quarter, it repurchased around $2.3 billion worth of shares (7.3 million bought). That makes well over $25 billion spent on repurchases in the past five years.

AXP Dividend data by YCharts

AMEX's business justifies these moves

One thing's for sure: Investors don't have to worry about the sustainability of AMEX's growing dividend and share repurchases. In the third quarter, its $0.82 dividend was only around 19% of its diluted earnings per share (EPS) for the quarter ($4.14).

AMEX says it expects full-year EPS to be between $15.20 and $15.50, more than enough to support the $3.28 it paid out. That leaves AMEX with plenty of money to continue investing in and expanding the business.

NYSE: AXP

Key Data Points

AMEX trails Visa and Mastercard in cards and acceptance worldwide, but that's by design. AMEX has positioned itself as the luxury credit card company, leaning on its perks to attract and retain customers. That premium branding has put AMEX in a unique -- and lucrative -- business position.

First, people are willing to pay extremely high annual fees to unlock the card's premium perks. This provides a guaranteed income that essentially works as a subscription.

It also helps that AMEX operates its own payment network and issues its own cards, allowing it to earn money from transactions, interest on balances, and merchant fees. Conversely, Visa and Mastercard operate the payment networks, but a separate bank issues the cards.

Why AMEX is a buy right now

AMEX has positioned itself well for long-term success, beginning with its diligence in attracting and retaining younger customers. Around 64% of new AMEX accounts globally were opened by millennials or Gen-Z customers. AMEX also noted that these customers have around 25% more transactions than other customers.

Between the shareholder-friendly dividend and share repurchases, premium brand, cash flow, and long-term prospects, AMEX is a great choice for someone looking to add a blue chip stock to their portfolio.