The main reason to consider buying Advance Auto Parts (AAP +1.12%) stock has stayed the same for years. The idea is simple: If the company can improve its performance to match competitors like AutoZone and O'Reilly Automotive, the stock could become a strong value. Although past attempts have not delivered lasting results, the latest turnaround plan appears to be a real restructuring, and there are early signs it might be working.

NYSE: AAP

Key Data Points

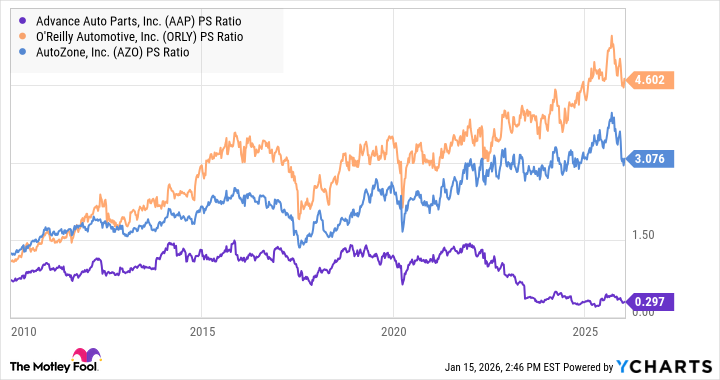

Why Advance Auto Parts is a value stock

On a price-to-sales basis, the stock is exceptionally cheap.

AAP PS Ratio data by YCharts

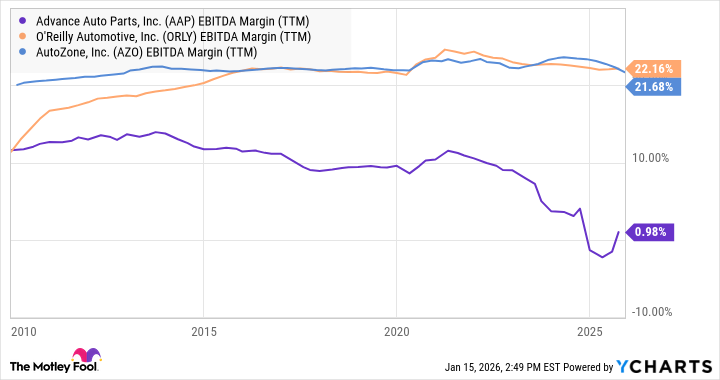

However, it is consistently cheap because it fails to generate earnings (measured here as earnings before interest, taxes, depreciation, and amortization, or EBITDA) margins in line with its peers.

AAP EBITDA Margin (TTM) data by YCharts

Is Advance Auto Parts on the right track?

Under CEO Shane O'Kelly (appointed September 2023), Advance Auto Parts closed more than 700 locations in a concerted effort to refocus operations in areas where it has a "No. 1 or No. 2 position based on store density," according to management. It plans to open 100 new stores through 2027, in addition to 30 already opened in 2025.

The guiding principle of the new strategy is to open so-called "market hub" stores that carry 3 to 4 times the stock-keeping units (SKUs) as the typical Advance store, and to enhance the company's same-day delivery of autoparts -- a big deal in the professional market in particular.

Image source: Getty Images.

As you can see in the chart above, there's been a slight uptick in profit margin, and this time around, the restructuring might work. All told, the stock will suit deep-value investors willing to take on some risk to capture significant upside potential.