For the last three years, the S&P 500 index has generated abnormally high returns thanks to absurd levels of demand for artificial intelligence (AI). In particular, the technology and infrastructure sectors have benefited greatly from the AI revolution.

One industry that sits neatly at the intersection of technology and infrastructure is the semiconductor industry. Chips are the cornerstone hardware that developers use to build generative AI models like ChatGPT.

In the semiconductor landscape, growth investors tend to flock toward the usual suspects: Nvidia, Advanced Micro Devices, and Broadcom. While each of these chip giants has posted market-beating gains over the last three years, the smartest investors are looking outside of the most obvious opportunities.

Perhaps one of the most underrated positions in AI right now is the pick-and-shovel sellers. While everyone else lives and breathes by Nvidia's latest headline, Taiwan Semiconductor Manufacturing (TSM 4.45%) might be the real gatekeeper of the AI realm. Let's break down why investors should be keeping a close eye on TSMC right now.

Image source: Taiwan Semiconductor Manufacturing.

Is AI in a bubble? Just ask TSMC

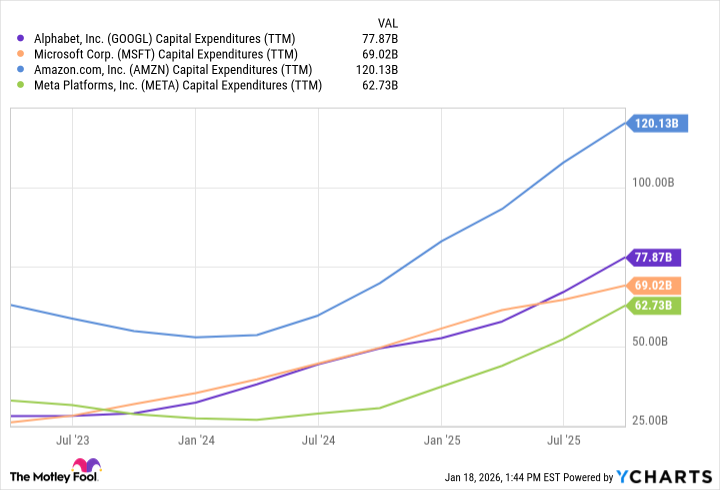

In the eyes of bearish investors, the seemingly unstoppable euphoria fueling AI's momentum looks like what we saw in the late 1990s during the dot-com boom. For some, the accelerating spend from hyperscalers on capital expenditures (capex) -- data center buildouts and chip procurement -- is lending credence to the idea that AI might be in a bubble.

GOOGL Capital Expenditures (TTM) data by YCharts

For the last three years, investors across Wall Street have adopted a similar mindset: If Nvidia reports strong earnings and guidance, then the AI movement is alive and well. Indeed, given Nvidia's dominant market share in the graphics processing unit (GPU) industry, the company should be viewed as a proxy for the overall health of the AI narrative.

However, if investors really want to understand whether AI is in a bubble or not, I think the better company to analyze is TSMC. Let's take a look at the company's recent earnings report to assess the trajectory of the AI revolution.

Why Taiwan Semi could be the best AI chip stock of the decade

TSMC is the largest chip manufacturer by revenue -- handily topping rivals like Samsung and Intel. The company's foundries are heavily used by leaders across the chip value chain.

TSMC manufactures GPUs for Nvidia, accelerators for AMD, custom application-specific integrated circuits (ASICs) for Broadcom, and high-bandwidth memory chips for Micron Technology. Considering each of these chip designers is selling its solutions to AI's largest developers -- Microsoft, Alphabet, Amazon, Meta Platforms, and Oracle -- it's really TSMC that sits at the center of the virtuous cycle defining the current semiconductor supercycle.

NYSE: TSM

Key Data Points

Last week, TSMC reported earnings for the fourth quarter of 2025. Spoiler alert: The company didn't just hit a home run. TSMC hit a grand slam.

In the fourth quarter, the company generated $33.7 billion in revenue -- an increase of 25% year over year. Gross margin for the quarter came in at 62%. By comparison, the company's gross margin was 59% at the beginning of 2025.

These are important figures to dial in on because they suggest that larger capex budgets from the hyperscalers are fueling consistent, increased demand for different types of chips, which in turn is leading to more business for TSMC. And what's amazing is that the company is able to command a degree of pricing power that not only accelerates its top line, but also widens its profit margins. These are powerful unit economics that growth investors should not take for granted.

It's this dynamic that sets the stage for long-term growth. On the earnings call, TSMC's CEO, C. C. Wei, made it clear that the company plans to methodically allocate capital toward further geographic expansion -- hinting that new facilities could begin contributing growth by the end of the decade.

Against this backdrop, I think the AI megatrend is poised to be a multiyear catalyst for TSMC as secular tailwinds fueling the infrastructure era continue to blow.

Wall Street is calling TSMC a screaming buy

Among the 18 sell-side analysts who cover Taiwan Semi, 17 of them rate the stock a buy or the equivalent.

The average price target for TSMC is $408, implying 19% upside from where shares closed on Friday, Jan. 16. However, some analysts are even more optimistic. Simon Coles of Barclays raised his price target from $380 to $450 following Taiwan Semi's monster earnings report.

Smart investors shouldn't be thinking about near-term upside. The main takeaway from this analysis is that TSMC is poised for explosive growth thanks to an ongoing AI infrastructure supercycle.

Given Wall Street's near-unanimous bullish outlook and the company's ability to continue growing its revenue and profitability profile, TSMC looks like a compelling no-brainer stock to own for decades to come.