There aren't too many companies with the global brand and reach of Nike (NKE 1.29%). Billions of people around the world could look at its iconic checkmark logo and know the brand. Unfortunately, its stock performance has been terrible in recent years and hasn't reflected the company's legacy well.

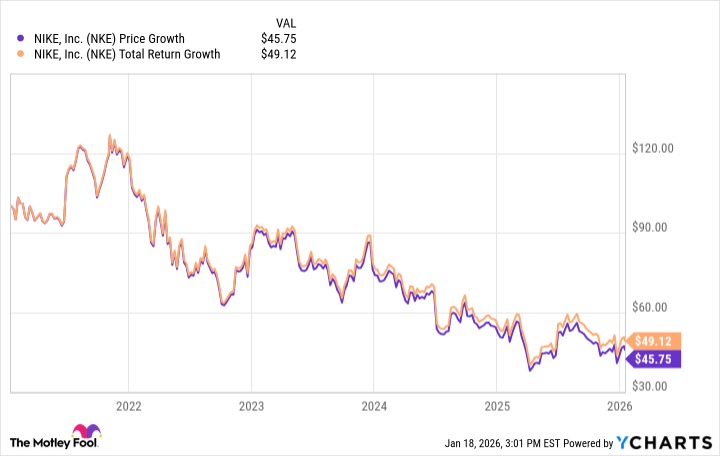

If you had invested $100 in Nike stock five years ago, it would be worth only $45.75 today. If you include dividends, it would be worth $49.12.

A lot of Nike's stock price struggles stem from a failed transition to focus on selling direct to consumers rather than wholesalers. The company drastically underestimated the importance of third-party retailers like Foot Locker, Dick's Sporting Goods, and Macy's to its business. They allowed Nike's products to be where consumers were already shopping. More eyeballs mean more sales.

Image source: Nike.

Add in complaints about the lack of innovation in recent years and increased competition from newer brands like On and Hoka, and it makes sense that investors are cautious and Nike's stock has lagged behind.

NYSE: NKE

Key Data Points

Nike has begun to reverse course a bit and refocus on its sports performance roots. It still hasn't translated into good stock performance, but it's a step in the right direction.