Several artificial intelligence (AI) stocks delivered astonishing returns over the past few years, expanding some valuations to uncomfortable heights and prompting speculation that the sector is approaching bubble territory. Despite what looks to be valid concerns in a few cases, a Motley Fool survey suggests that AI remains a high-conviction play for many individual investors.

The Motley Fool's 2026 AI Investor Outlook Report found that 9-in-10 AI investors plan to hold or buy more AI stocks in the next 12 months. Around 60% of all Motley Fool survey respondents said they're confident that AI stocks will deliver strong returns over the long term.

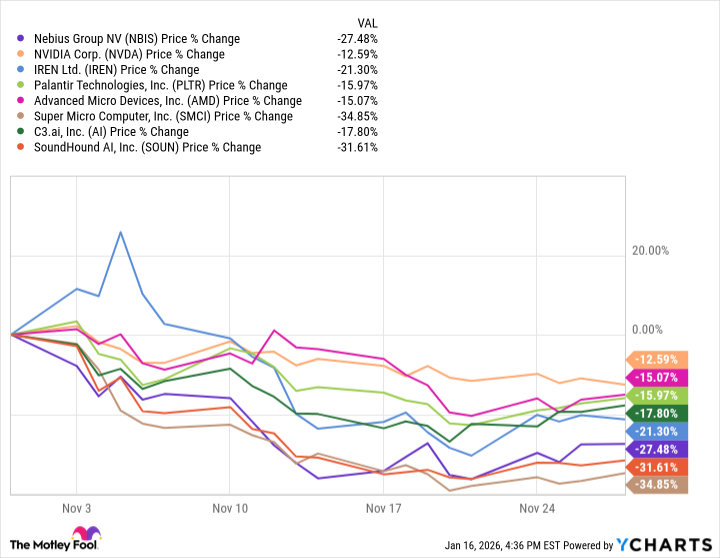

The timing of the survey was significant, in my opinion. The Motley Fool conducted the survey in November 2025, which was a brutal month for many popular AI and AI-adjacent stocks, as bubble concerns percolated amid a broader pullback in the tech sector.

Data by YCharts.

Despite the share price pullback in AI stocks at the time of the survey release, just 7% of AI investors said they plan to reduce their exposure to the cohort. Those results suggest that retail investors are willing to look past short-term volatility as the AI story unfolds, even if that means holding on for dear life (HODL) in a turbulent tape.

Image source: Getty Images.

Should AI investors be worried about a bubble?

Over the past few months, some analysts and pundits have drawn parallels between the current AI boom and the dot-com bubble of the late 1990s. Adding fuel to the fire, a recent MIT report concluded that 95% of organizations implementing generative AI tools are getting zero return on their investment.

As alarming as that sounds, there's at least one distinct difference between the dot-com bubble and the recent run-up in AI stocks. Unlike the fly-by-night companies that embodied the dot-com collapse, most of today's AI leaders have healthy businesses that generate massive revenue and profits. Nvidia (NVDA 4.38%), for example, reported third-quarter fiscal 2026 revenue of $57 billion -- a 62% year-over-year increase -- and net income of $31.9 billion, ending the quarter with a fortress of nearly $61 billion in cash and equivalents on its balance sheet. With its data center GPUs sold out and revenue at record levels, CEO Jensen Huang declared: "We've entered the virtuous circle of AI."

While I'm not convinced that we're in a bubble, the combination of stretched valuations and persistent fretting over a possible AI bubble could be a recipe for short-term volatility. We've certainly seen it in AI-adjacent names like Bloom Energy (BE +1.02%), an on-site power provider that's seeing strong demand from AI data centers. After a 495% moonshot in the first 10 months of 2025, Bloom Energy stock tumbled 34% during November and December. The stock has surged 72% in the first half of January, and currently trades at a price-to-earnings (P/E) ratio of 2,136.

NYSE: BE

Key Data Points

Asit Sharma, CPA, Senior Investment Analyst at The Motley Fool, recommends that investors looking to get into these inflated AI stocks now consider dollar-cost averaging into the high-quality AI stocks within the group and take a long-term view on AI investing.

"AI is a generational investment opportunity, and it's normal for even the best companies in this space to see frothy share prices and occasional premiums," Sharma said. "Consistent, rational buying will help most investors tap into the industry's long-term potential while maintaining the peace of mind that comes from a strategic or even opportunistic approach to volatility."