Anyone reading this probably already knows it's been a fantastic past three years for the stock market. The S&P 500 (^GSPC 2.06%) currently stands more than 80% above where it ended 2022.

Credit the mainstreaming of artificial intelligence (AI), mostly. A handful of the S&P 500's technology names in the AI space did the bulk of this heavy lifting. In fact, without the performance of the so-called "Magnificent Seven" during this stretch, the S&P 500's performance would only be about half of what it was.

And this dynamic has led to a situation that, from one perspective, is dangerous, but from another perspective, creates an opportunity. If you want to capitalize on this opportunity, you might want to make a point of holding a little less exposure to the large-cap segment of the market like you would with the Vanguard S&P 500 ETF (VOO 2.03%) or SPDR S&P 500 ETF Trust (SPY 2.11%), and instead own a little more small-cap exposure with a fund like the iShares Core S&P Small-Cap ETF (IJR 1.40%) or Vanguard's S&P Small-Cap 600 ETF (VIOO 1.47%) while both are priced at under $200 per share.

Here's the deal.

Image source: Getty Images.

A strangely wide performance disparity

No two indexes ever perfectly mirror each other's performance. By and large, though, all of the market's indexes -- regardless of their underlying style, sector, or company size -- more or less move in tandem.

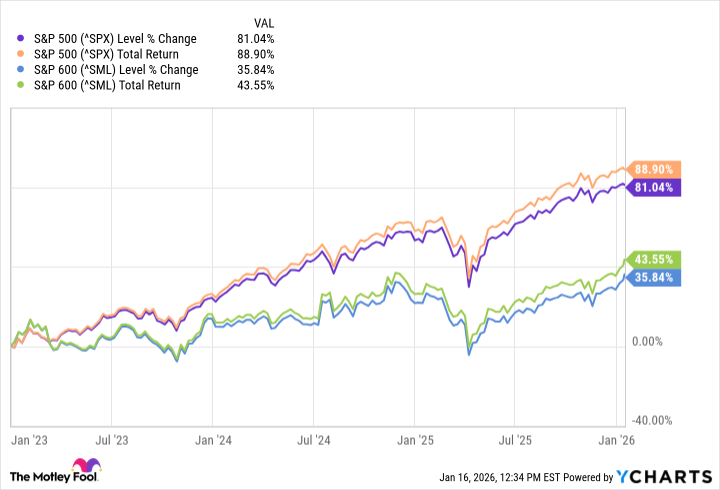

That's not been the case of late, however. The S&P 500 has performed remarkably well since the artificial intelligence revolution began in earnest in 2023, more than doubling the gains logged by the S&P 600 Small Cap Index.

Data by YCharts.

What gives? It would be naïve to pretend investors didn't get a little too excited about the advent of AI, foregoing their usual exposure to small-cap names to own more of the large-cap stocks that were seen as must-haves during this period.

And the evidence of this exuberance doesn't solely lie in the chart above. These two indexes' valuations tell the same tale, and perhaps more so.

Take a look at the graphic below. Although small-cap stocks have historically been more expensive than their large-cap counterparts, this changed during the COVID-19 pandemic, and remained that way ever since the AI revolution began shortly thereafter. As of the latest look, the S&P 500 is valued unusually high at more than 26 times its trailing per-share profits, while the S&P 600 is strangely cheap at only 22 times its trailing-12-month earnings.

Data source: Standard & Poor's. Chart by author.

This valuation disparity only widens on a forward-looking basis, too. Yardeni Research suggests the S&P 600's forward-looking price-to-earnings ratio (based on 2026's projected profits) is a little less than 16, versus the S&P 500's forward-looking P/E of a little over 22.

Connect the dots. Plenty of investors have "traded in" their small caps in order to own more AI-focused stocks, which have predominantly been large caps.

As the old adage goes, though, nothing lasts forever.

NYSEMKT: VIOO

Key Data Points

The inevitable may already be underway

While it certainly seems like the "once in a generation" investment opportunity that AI brings to the table isn't going fade anytime soon, experienced investors know better. At the risk of using an overused cliché, they know the time to expect such a shift is when you least expect it.

In this vein, take another look at the performance comparison chart above. Specifically, notice that the S&P 500's forward progress has been slowing down since the middle of last year, while the S&P 600's has actually accelerated since last month. We may already be seeing the beginning of this shift away from large caps and toward small caps.

NYSEMKT: IJR

Key Data Points

Now, to be clear, none of this is to suggest you should swap out the entirety of your exposure to the S&P 500 and instead own nothing but small-cap-focused funds like the aforementioned Vanguard S&P Small-Cap 600 ETF or iShares' Core S&P Small-Cap Fund.

Given the width of this performance disparity, though -- and the subsequent potential for gains once this gap closes -- this is one of those instances where it could pay off in a big way to make a point of being philosophically strategic.

And not just because of what we've seen over the course of the past three years, by the way. Small caps have lagged large caps for well over a decade now. But this ultimately sets the stage for a prolonged reversal of this trend. The more recent dynamic may simply end up serving as the catalyst for this bigger-picture shift.

Whatever the case, holding a little more exposure to the small-cap sliver of the market at this time certainly couldn't hurt you here.