Pharmacy retailer CVS Health (CVS +1.75%) is coming off an impressive bounce-back year in 2025 when its share price soared by 77%. A year earlier, it looked as if it was in an endless tailspin, falling by 43%. The company has been generating some more encouraging results in recent quarters, which has given investors some hope that it's moving in the right direction under new CEO David Joyner, who took over in October 2024.

On Feb. 10, the company will hold a conference call to go over its latest results for the fourth quarter, which will be an early test for this year to see how the stock may perform later on. Is it a good idea to buy shares of CVS Health before those results come out, or are you better off waiting?

Image source: Getty Images.

How has CVS Health stock typically performed after earnings?

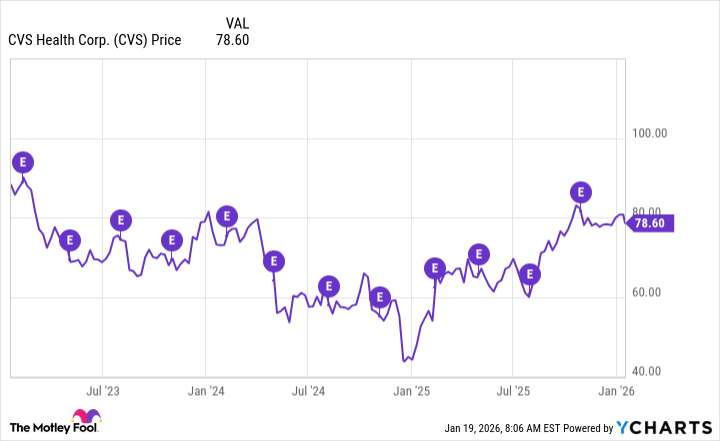

CVS Health doesn't typically experience large drops or surges in value after it releases its earnings numbers. As you can see from the chart below, it's usually between earnings when the healthcare stock experiences big rallies and declines. And unless there's some big surprise coming up in Q4, that's not likely to change this time around, either.

When CVS last reported earnings in October, it beat expectations and it also hiked its guidance. It was a solid showing for the business, as it looked committed to improving its financials by slowing the growth of clinics while shutting down underperforming ones, in an effort to strengthen overall profitability.

But despite the progress and encouraging outlook, shares of CVS didn't take off. Instead, they've been fairly steady since then. For a healthcare stock that isn't typically all that volatile, a big move on earnings day is the exception rather than the norm.

CVS stock still looks cheap

Anytime a company is heading into earnings season, it's important to consider its valuation. If it's trading at an inflated premium, that can set the bar high for the business and make it difficult to rise in value even if it's coming off a strong performance.

Currently, CVS Health is trading at a forward price-to-earnings (P/E) multiple of 11, which is based on analyst expectations of its future earnings. That's a modest multiple as the average stock on the S&P 500 trades at a forward P/E of more than 22. Despite a significant rally in the stock last year, its valuation hasn't become unsustainable. In fact, a case can be made that the stock may still have more room to run, especially if its financial performance remains strong this year.

And how it does in Q4, plus its outlook for the year ahead, could be great indicators of whether things are indeed looking better for CVS. With a fairly low earnings multiple, expectations still don't appear to be all that high for the stock heading into earnings, which is great news for investors looking to buy it before then.

NYSE: CVS

Key Data Points

Is CVS Health stock a buy today?

CVS has been doing well in recent quarters. The company's diverse operations span pharmacy benefits, health insurance, and of course, its pharmacy retail business. Overall, it makes for a well-balanced healthcare investment to buy and hold for the long haul.

But barring a big surprise on earnings day, it doesn't look likely that the healthcare stock will experience a big decline or spike in value after it reports its latest financial results next month. And thus, for that reason, there arguably isn't a reason to rush out and buy shares of CVS before then.

Although it's a good buy right now, there's no harm in waiting until after its Q4 results come out, particularly to see what management says about the year ahead, and any specific opportunities or challenges it expects in the future, which could impact your decision about investing in CVS.