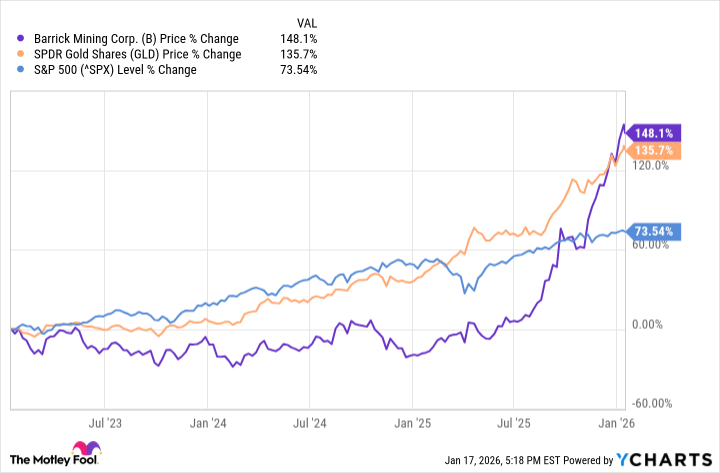

Investors who entered the commodities complex through precious metals over the past several years have been handsomely rewarded, thanks in large part to gold and silver. For the three years ended Jan. 16, SPDR Gold Shares ETF, the largest bullion-backed exchange-traded fund (ETF), returned 135.7%, leaving the S&P 500 in the dust.

Gold's bull market is also supporting upside for miners, including Barrick Mining (B 0.38%), which is the world's second-largest miner of the yellow metal as measured by output. That status, coupled with expectations that the company will extract 4.5 million ounces annually of the precious metal through 2029, confirms the stock is tethered to gold's price action.

This gold miner could shine if the metal's price continues soaring. Image source: Getty Images.

Barrick is also a major copper producer, and while that commodity is considered an essential macroeconomic indicator, the company's status as a top gold producer is the bedrock of the underlying investment thesis.

NYSE: B

Key Data Points

Barrick bets could be validated again in 2026

Gold mining stocks such as Barrick have a risk-reward proposition that investors need to acknowledge: The stocks can overshoot the commodity's price in either direction. Fortunately, the recent path for the yellow metal has been to the upside, paving the way for Barrick to outpace the aforementioned bellwether gold ETF.

The potentially good news is that, amid soaring global government debt and expectations, the Federal Reserve will likely continue cutting interest rates, and Wall Street banks see upside for gold this year. Some forecast prices as high as $4,900 to $5,000 an ounce, implying significant upside from the Jan. 13 closing price of $4,601.

Another possible gold-related catalyst that could generate upside for Barrick shares this year is confirmation that the company will spin off its North American gold assets. Last month, Barrick told investors that such a transaction is under consideration and that an update may be provided when it delivers fourth-quarter results next month.

If that value-unlocking transaction proceeds, it could benefit Barrick investors because the company would retain a significant stake in the newly formed entity, which would focus on prime assets in Nevada and the Dominican Republic.