If you're concerned that market volatility could be looming, you're not alone. A whopping eight in 10 Americans are at least slightly worried about an impending recession, according to a December 2025 survey from financial association MDRT.

While nobody can predict exactly what the market will do in 2026, there are some warning signs. The Buffett indicator -- which is the ratio of the total value of U.S. stocks to U.S. GDP -- is currently at a record high of 223%. For context, Warren Buffett once warned that whenever the metric nears 200%, investors are "playing with fire."

Again, this doesn't necessarily mean that a recession or bear market is imminent. But it's wise to prepare your portfolio just in case, and history shows there's one fantastic move investors should make right now.

Image source: Getty Images.

Strong investments are critical right now

Many types of investments can thrive when the market is on fire -- including poor ones. Weak companies can sometimes hide their flaws behind a surging stock price, but if the market tumbles, those organizations may not have what it takes to pull through.

One of the most notable examples of this was the dot-com bubble burst of the early 2000s. Internet companies saw their stock prices soar in the late 1990s, but not all of them were strong stocks. Many struggled with nonviable business models or profitability concerns, for example, and crashed and burned during the following bear market.

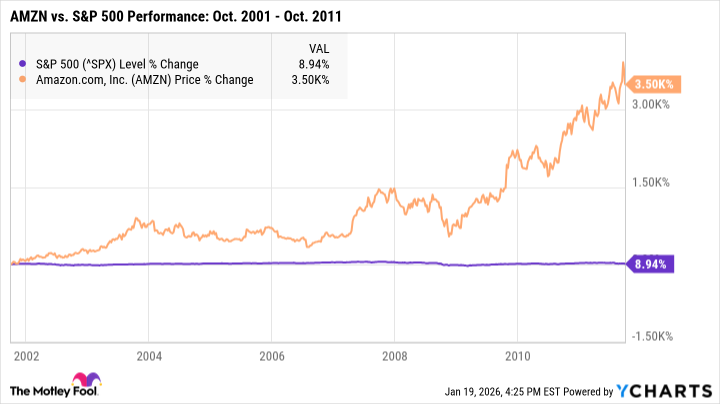

Not all companies failed during that period, of course, though many of them struggled in the near term. Amazon, for example, lost close to 95% of its value between 1999 and 2001. Yet in the 10 years following its lowest point, it soared by 3,500%.

No bear market is exactly the same, so there's no way to know whether the next downturn -- whenever it may arrive -- will be similar to those of the past. But if there's one thing we know for certain, it's that strong companies are far more likely to survive whatever the market throws at them.

What makes a strong investment?

The best stocks are those from healthy companies, and healthy companies are those with strong underlying business fundamentals.

Browsing a company's financial statements is a good way to gauge whether a business is on solid financial footing. Factors like the price-to-earnings (P/E) ratio and debt-to-EBITDA ratio, for example, can help determine whether a company is overvalued or taking on excessive debt.

In addition to financial metrics, it's equally important to consider less tangible factors. For example, does the company have an experienced leadership team at the helm that can be trusted to guide it through difficult times? What does the industry as a whole look like? Some sectors fare better than others during recessions, and in more volatile industries, a strong competitive advantage is especially important for a company to stand out.

History shows us that while market downturns are inevitable, it's possible to not only survive them, but thrive over time. The key, though, is to invest in strong stocks with long-term growth potential.