If you're looking for some potential millionaire-making stocks to invest in, you can just settle for average performance. You're going to have to search out companies that are willing to take some big chances to generate life-changing returns.

Let's look at three stocks that could be worth the bet.

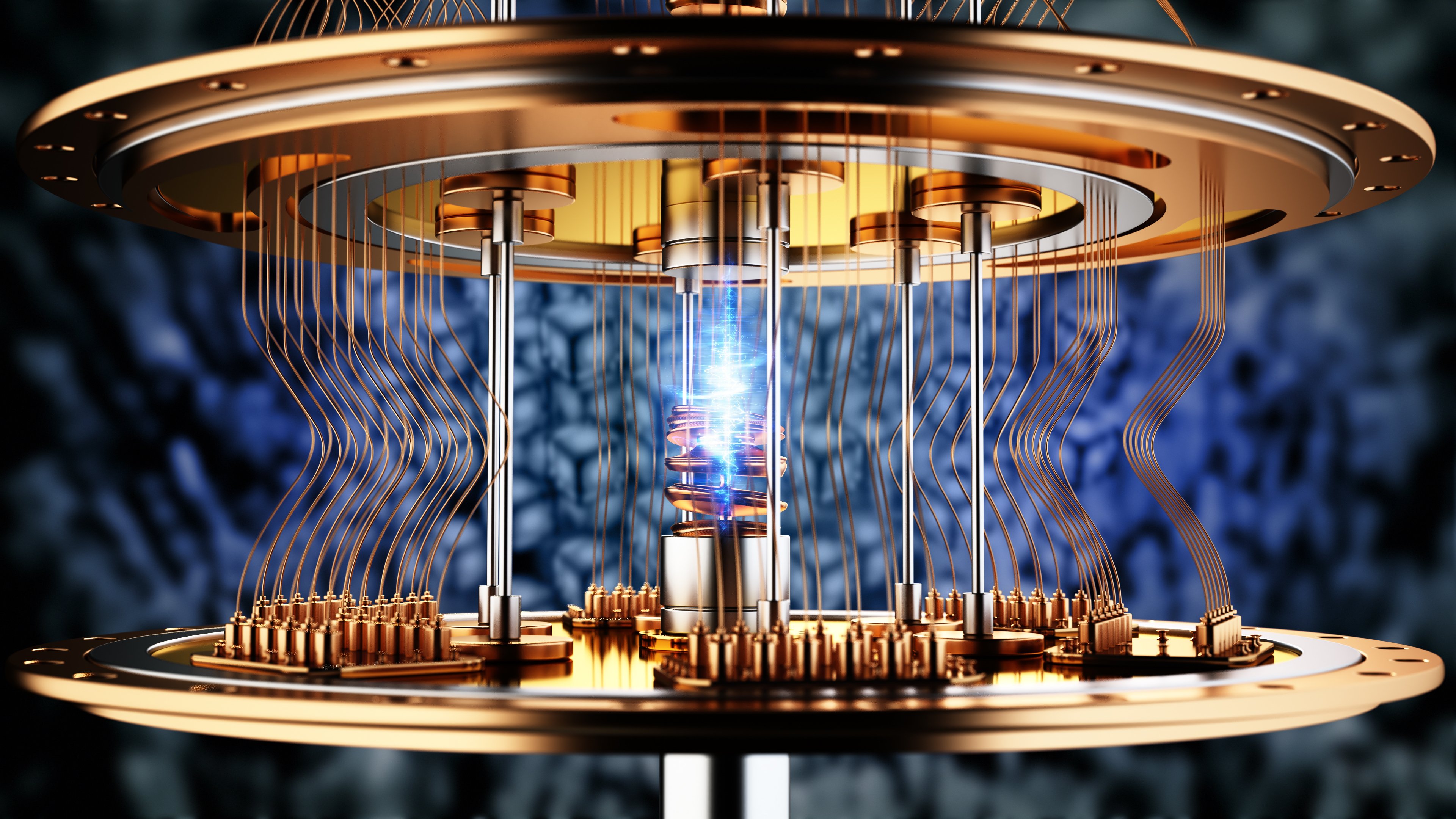

Image source: Getty Images.

IonQ: Looking to be a quantum leader

Quantum computing has the potential to be the next game-changing technology, and IonQ (IONQ +1.74%) looks like it could be the best pure play in the space. The reason for this is twofold. First, its systems have achieved some of the highest fidelity (accuracy) calculations of any company, which is one of the biggest obstacles facing the industry. Second, it is looking to control the entire quantum ecosystem, much like Nvidia does for artificial intelligence (AI) with its graphics processing units (GPUs), CUDA software platform, and networking portfolio.

IonQ has taken a different approach than most competitors, choosing to use actual atoms as the foundation for its trapped-ion technology. Because atoms are identical by nature, they are more stable than lab-made qubits. This helped the company recently achieve 99.99% two-qubit gate fidelity, which is one of the highest accuracy levels obtained in quantum computing.

NYSE: IONQ

Key Data Points

Meanwhile, the company has been aggressively making acquisitions to further its goal to build an entire quantum ecosystem. This includes technology to help shrink the size of its systems, as well as networking technology that will help its systems scale and transmit data more quickly.

While the commercialization of quantum computing may be many years away, if IonQ can become a leader in the field, the stock has the potential to be a massive winner.

UiPath: An agentic AI winner

Agentic AI is touted by some as the next evolution of AI, where AI agents will go out and perform tasks with little or no human intervention. It's both scary and filled with potential. Scary because AI still has flaws and is prone to what developers call hallucinations. For example, Wall Street Journal reporters were able to bully an AI tech product vending machine into giving them free items, including ordering more expensive items like video game consoles. At the same time, AI agents have the potential to become a virtual workforce, helping save organizations significant money.

NYSE: PATH

Key Data Points

Not surprisingly, many companies are chasing the potential of agentic AI. This is starting to lead to agent sprawl, as organizations now have to deal with AI agents coming from multiple vendors. This is where UiPath's (PATH +6.69%) big opportunity lies, as it has developed an AI agent orchestration platform to manage agents from multiple vendors.

As a leader in robotics processing automation (RPA), the company already had a compliance and governance framework in place that also helps keep humans in the loop. The platform can also help assign which tasks are best for AI agents, software bots, and humans, directing them to the best-suited job. This is a huge opportunity, and the stock has a ton of upside if it can establish itself as the leader in the space, especially given the low valuation of its stock, which trades at a forward price-to-sales (P/S) multiple of below 5.

GitLab: A misunderstood stock

Sometimes stocks get thrown into the bargain bin for all the wrong reasons, when what investors fear is actually more of an opportunity. That was seen with Alphabet in 2023 and 2024, where investors pegged it as an AI loser, only for the company to emerge last year as likely as one of the biggest AI winners.

I'd throw GitLab (GTLB +12.82%) into that same bucket, and the stock is very cheap now, trading at less than 5.5 times 2026 sales.

NASDAQ: GTLB

Key Data Points

There is a big narrative throughout the software-as-a-service (SaaS) space that AI is going to help replace a lot of SaaS functions, with organizations just creating their own software systems with the help of AI. However, if that were to actually happen, GitLab would likely be one of the biggest winners of so-called vibe coding, as this would still need to be managed and done in a secure platform like GitLab's.

Regardless, right now, AI in general is leading to more software development, which is helping drive GitLab's revenue. Throw in a pricing model change to a new hybrid seat-plus-usage-based pricing model, and GitLab should continue its strong revenue growth. This is a beaten-down stock with huge potential.