Despite some hiccups along the way, Goldman Sachs' (GS +0.84%) stock has been on an absolute tear in recent years. The stock is up over 232% in the past five years and over 51% in the past year.

If you haven't heard of Goldman Sachs before, the big thing to know is that it's one of the oldest and most prominent investment banks, meaning it advises companies on mergers and acquisitions (M&As) and initial public offerings (IPOs). Goldman also helps companies raise debt, and has a strong fixed-income and equities trading desk.

Image source: Getty Images.

Market conditions can play a big role in dictating Goldman's performance. When interest rates are low and market conditions are favorable, there can be more M&As and IPOs, leading to higher fees for Goldman. Prior to 2025, the environment was less friendly, as a tougher regulatory regime slowed large-scale M&As and higher rates all but froze IPO activity.

But in 2025, whether due to the election of President Donald Trump, who ushered in a friendlier M&A environment, or lower interest rates, both IPOs and dealmaking activity picked back up significantly. Investors also have high hopes for 2026, especially amid rumors of major IPO candidates such as OpenAI and SpaceX.

Should investors buy, sell, or hold Goldman Sachs in 2026?

NYSE: GS

Key Data Points

The company trades at a high valuation

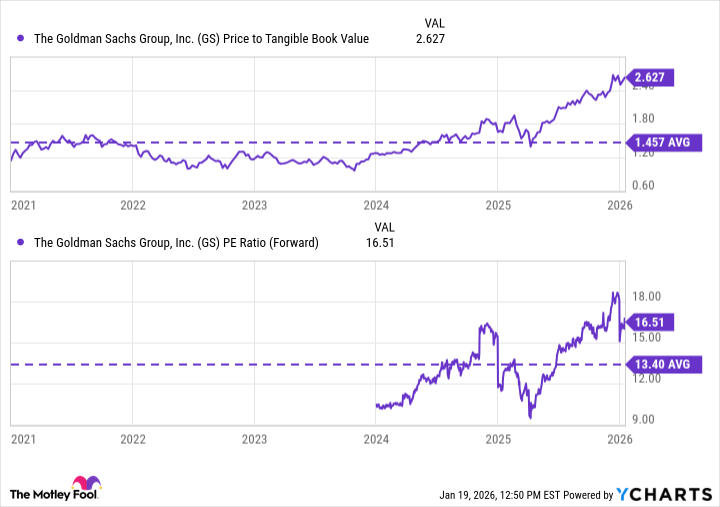

Whether on a price-to-tangible-book-value basis, which is a more common valuation metric for banks, or on a forward price-to-earnings basis, the big run in the stock has certainly led to higher valuations.

GS Price to Tangible Book Value data by YCharts

Now, Goldman has improved operationally in recent years as well. Not only did it abandon a big consumer lending push that was consuming capital and producing poor returns, but the company is also selling down its on-balance-sheet alternative investment holdings, such as private equity and real estate, that will make the company more capital efficient.

On Goldman's recent earnings call, CEO David Solomon said the company is also considering entering prediction markets. The company currently has a team studying these options and seeing where they might integrate well with Goldman's current businesses.

Overall, the stock's valuation is high, but deservedly so, given that this should be another big year of M&As and IPOs. I think current investors can hold the stock for now, though I'm not recommending a buy at this time due to valuation. However, investors should consider buying the stock on potential dips.