The U.S. stock market has been in bull territory for more than three years now. The S&P 500 index has gained an impressive 94% since the ongoing bull market started on Oct. 12, 2022, and the index is likely to head higher in 2026.

Deutsche Bank, for instance, sees the S&P 500 reaching 8,000 by year-end, a potential 15% jump from current levels. Meanwhile, Goldman Sachs is anticipating a 12% rally in the S&P 500 index this year. Investors can therefore consider putting their investible cash into the stock market now, as the impending rally could help them get richer in 2026 and beyond.

If you have $1,000 in investible cash after meeting your expenses, clearing high-interest debt, and saving enough money for tough times, consider allocating that money to the following stocks based on your risk profile. In my opinion, these names seem like solid bets to capitalize on the broader stock market rally this year and in the long run.

Image source: Micron Technology.

This growth stock can help investors benefit from a disruptive technology

Quantum computing is a nascent technology right now, but it is expected to grow by leaps and bounds in the long run, as it could outperform traditional computers exponentially. McKinsey predicts that the quantum computing market's revenue could jump from $4 billion in 2024 to a whopping $72 billion in 2035.

IonQ (IONQ +1.74%) is one way to tap this potentially lucrative opportunity. The company is in the business of designing and manufacturing quantum computers, and it also provides quantum computing services through major cloud service providers. Though it's very small right now, IonQ has been growing at an incredible pace.

NYSE: IONQ

Key Data Points

Its revenue in the first nine months of 2025 more than doubled year over year to $68 million, with Q3 revenue alone increasing by a whopping 222%. IonQ has been focused on enhancing the accuracy of its quantum computing systems. The company reported in October last year that it achieved a world record 99.99% two-qubit gate performance, a metric that measures the accuracy of a quantum computing system.

This achievement is impressive, as a 99.99% fidelity suggests that its quantum computing system is almost error-free, pushing the technology toward mainstream adoption. As a result, IonQ's quantum computers are likely to be more accurate and cost-effective. IonQ claims that its cost per system is 30x lower than that of rival offerings.

So, investors looking for a growth stock to add to their portfolios could consider allocating some of their $1,000 corpus toward IonQ. However, the stock is expensive right now, trading at 158 times sales, and is prone to volatility. But then, investing a small amount of money in this stock may pay off in the long run, given its remarkable growth and the prospects of the quantum computing market.

AI infrastructure spending makes these stocks a no-brainer buy

Artificial intelligence (AI) infrastructure stocks have been solid bets for investors in recent years, which isn't surprising given the huge spending in this sector. Gartner anticipates a 41% spike in AI infrastructure spend in 2026 to $1.4 trillion.

That's why it would be a good idea to buy shares of Celestica (CLS 6.39%), a company providing design, engineering, manufacturing, and supply chain management solutions to several industries. The connectivity and cloud solutions business is one of Celestica's key segments, which is benefiting from the enormous investments in AI infrastructure.

NYSE: CLS

Key Data Points

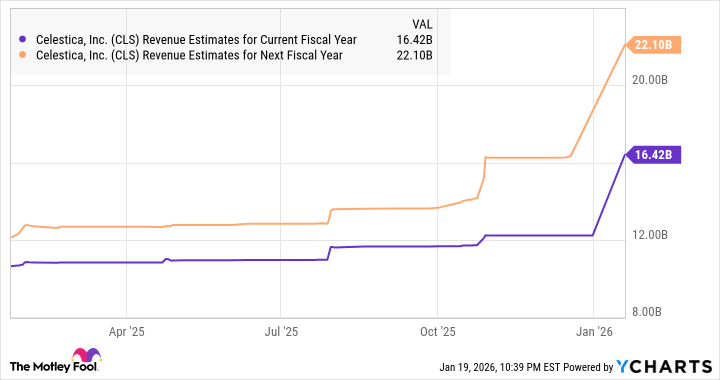

Specifically, Celestica is designing and manufacturing networking components that go into AI accelerator chips manufactured by companies like Broadcom, Marvell Technology, AMD, and Intel. Additionally, it develops and builds rack-scale networking solutions for hyperscalers deploying AI data centers. So, it is easy to see why Celestica's revenue jumped by an estimated 27% in 2025 to $12.2 billion. Importantly, the forecast for the next couple of years points toward an acceleration.

CLS Revenue Estimates for Current Fiscal Year data by YCharts

With the stock trading at just 3.2 times sales, buying Celestica is a no-brainer right now with your investible cash, as its accelerating growth could lead to significant gains on the stock market.

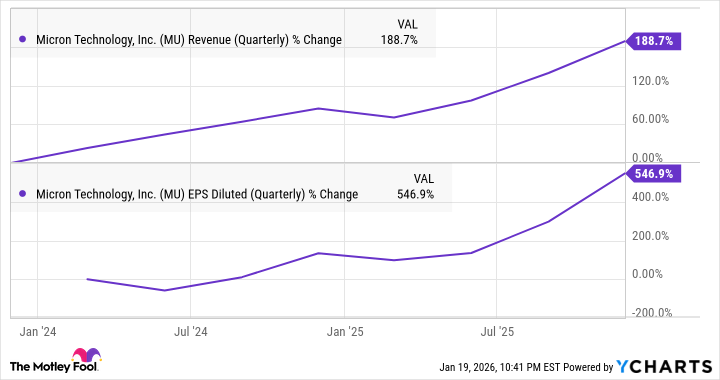

Meanwhile, Micron Technology (MU +2.12%) is another top AI stock that you can buy right now at attractive levels. It is trading at less than 10 times sales despite clocking stunning growth.

MU Revenue (Quarterly) data by YCharts

Even the forward earnings multiple of 11 is quite cheap. Consider that Micron's earnings could jump by nearly 4x in the ongoing fiscal year on the back of a 100% increase in sales. Importantly, the key factor driving Micron's red-hot growth is sustainable, as there is a shortage of memory chips used in AI data centers, smartphones, computers, and other applications.

Memory chip prices have taken off as demand has been outpacing supply, a trend that's likely to continue through 2028. Though Micron and other memory chipmakers are bringing online more capacity, adding new facilities takes time. This unavoidable delay could lead to persistently higher memory prices in the future, especially given the strong demand for high-bandwidth memory in AI data centers.

So, Micron looks like an unmissable value stock you may want to buy right now, as it can fly higher following its 243% gains over the past year, primarily driven by favorable memory market dynamics and its attractive valuation.